Question

1. If the Company uses activity-based costing, the amount of overhead cost allocated to the tiffany lamps is $16,800. $12,500. $3,600. $10,080. 2. Which of

1.  If the Company uses activity-based costing, the amount of overhead cost allocated to the tiffany lamps is

If the Company uses activity-based costing, the amount of overhead cost allocated to the tiffany lamps is

$16,800.

$12,500.

$3,600.

$10,080.

2.

Which of the following statement(s) regarding total quality management is(are) true? I. Voluntary costs are costs managers voluntarily incur in order to reduce failure costs. II. Prevention costs are voluntary cost. III. Warranty costs that are incurred due to product defects are prevention cost.

I and III

III only

II and III

I and II

3.

Benitez Company makes wicker and wooden slat picnic baskets. It requires approximately 1 hour of labor to make one basket of either type. Wicker baskets are produced in batches of 100 units and require 0.5 machine hours per basket. Wooden slat baskets are produced in batches of 50 units and require 0.75 machine hours per basket. Setup is required for each batch. During the most recent accounting period, the company made 8,000 wicker baskets and 2,000 wooden slat baskets. Setup costs amounted to $24,000 for the baskets produced during the period. If activity-based costing is used to allocate overhead costs to the two products, the amount of setup cost assigned to the wicker baskets will be:

$16,000.

$12,000.

$17,455.

$19,200.

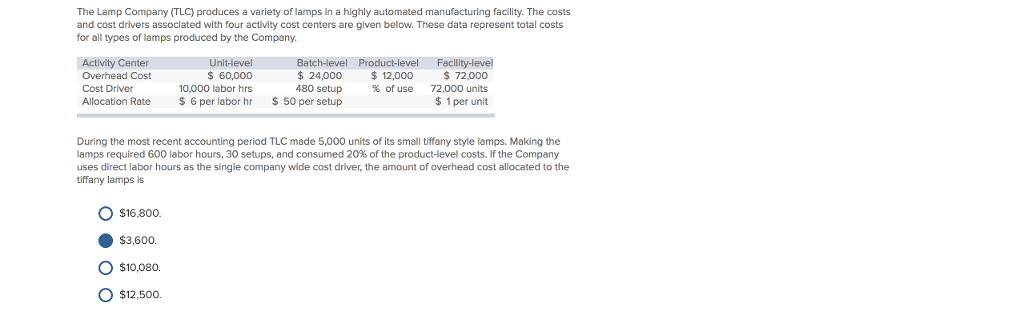

and cost drivers associated with four activity cost centers are given below. These data represent total costs for all types of lamps produced by the Company. Batch-level Product-level Facility level tivity Center Unit-level Overhead Cost 60,000 24,000 12,000 72,000 Cost Driver 0,000 labor hrs 480 setup of use 72,000 units Allocation Rate 6 per labor hr 50 per setup per unit During the most recent accounting period TLC made 5,000 units of its small tiffany style lamps. Making the lamps required 600 labor hours, 30 setups, and consumed 20% of the product-level costs. If the Company uses direct labor hours as the single company wide cost driver, the amount of overhead cost allocated to the tiffany lamps is O $16.800 $3,600 O $10,080 O $12,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started