Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. If the company uses the direct method of service department cost distribution, how much will the Machinery Department apply as factory overhead if

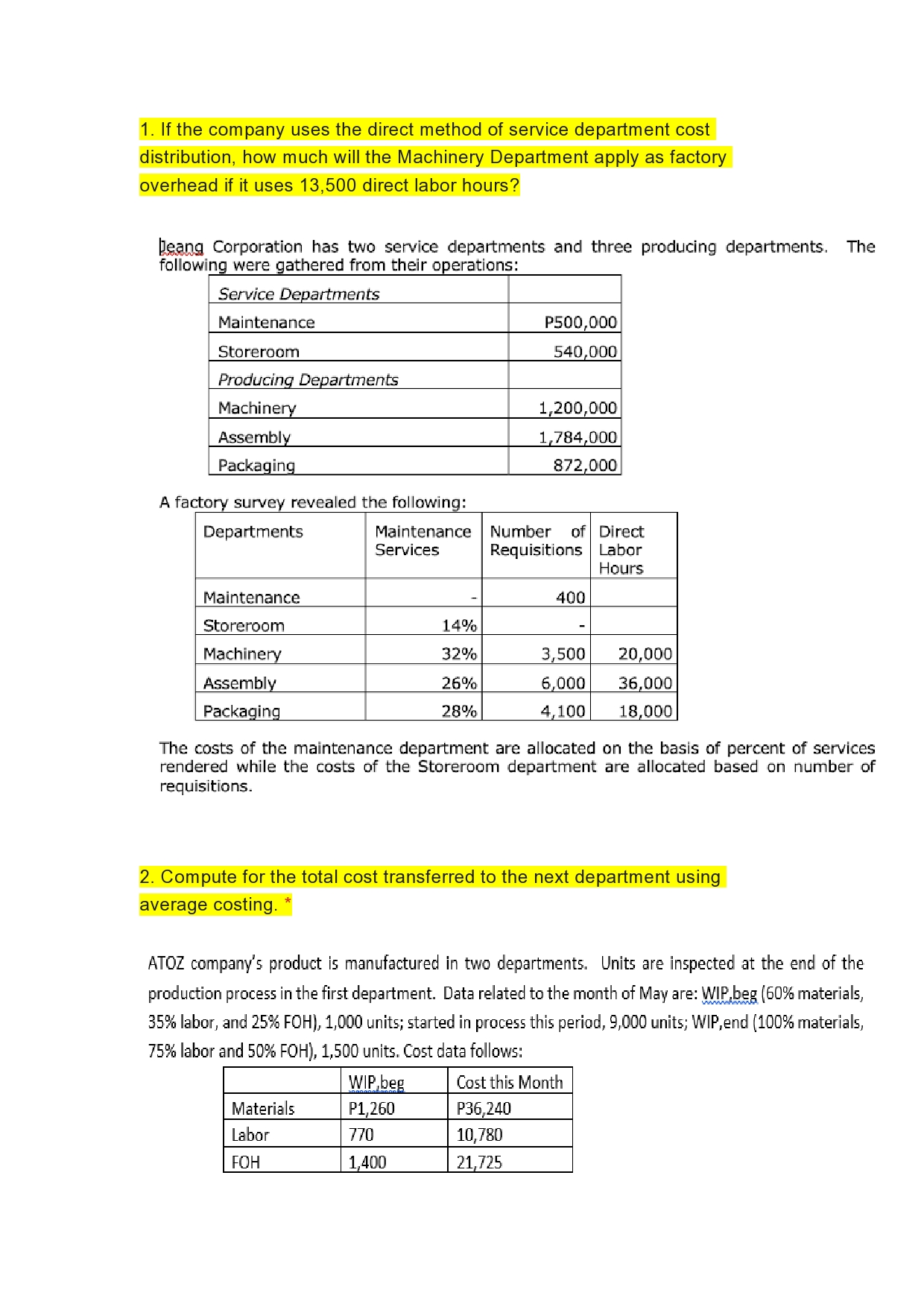

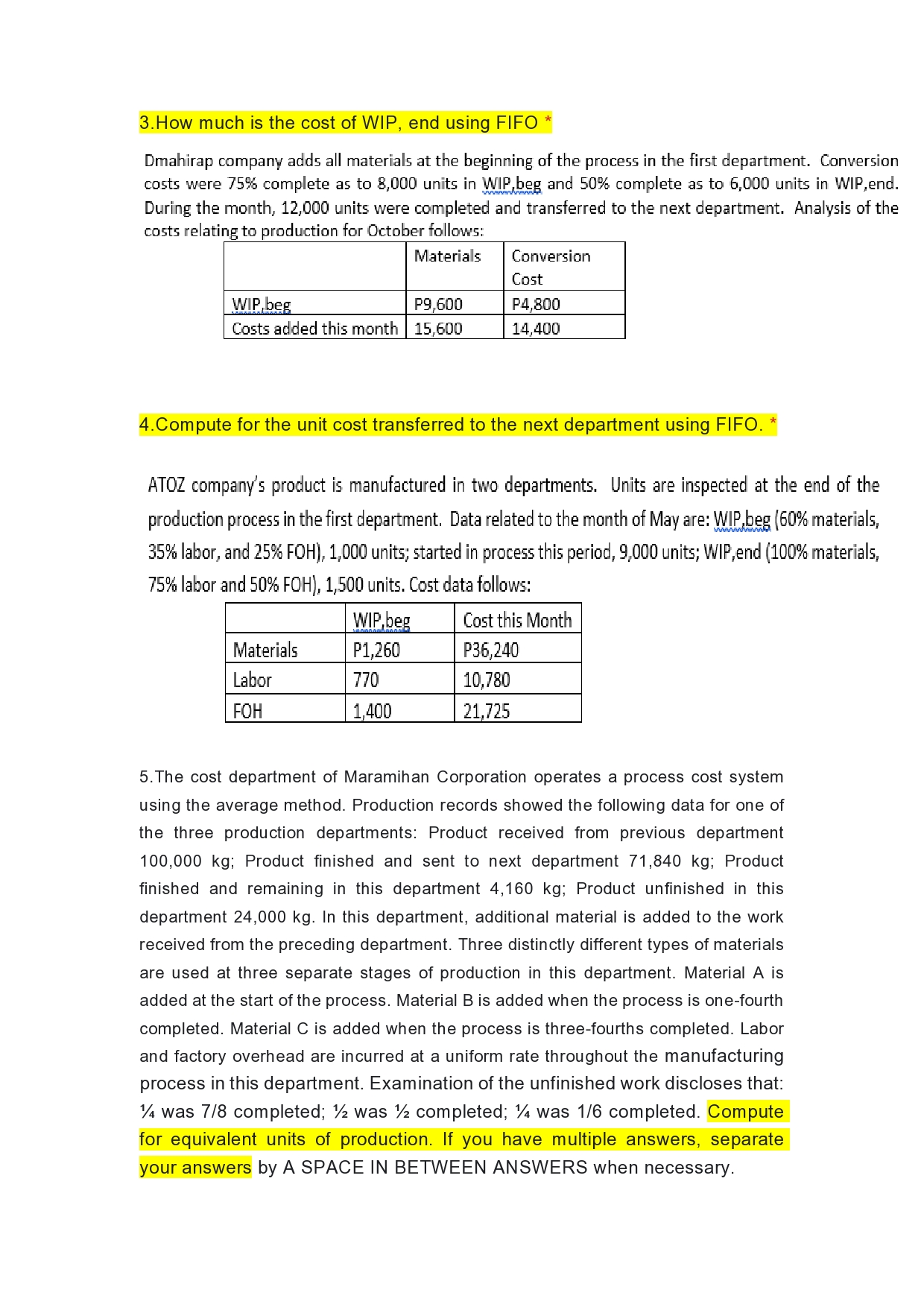

1. If the company uses the direct method of service department cost distribution, how much will the Machinery Department apply as factory overhead if it uses 13,500 direct labor hours? Jeang Corporation has two service departments and three producing departments. The following were gathered from their operations: Service Departments Maintenance Storeroom Producing Departments Machinery Assembly Packaging P500,000 540,000 1,200,000 1,784,000 872,000 A factory survey revealed the following: Departments Maintenance Services Number of Direct Requisitions Labor Maintenance Storeroom Machinery Assembly Packaging Hours 400 14% 32% 3,500 20,000 26% 6,000 36,000 28% 4,100 18,000 The costs of the maintenance department are allocated on the basis of percent of services rendered while the costs of the Storeroom department are allocated based on number of requisitions. 2. Compute for the total cost transferred to the next department using average costing. wwwwww ATOZ company's product is manufactured in two departments. Units are inspected at the end of the production process in the first department. Data related to the month of May are: WIP,beg (60% materials, 35% labor, and 25% FOH), 1,000 units; started in process this period, 9,000 units; WIP,end (100% materials, 75% labor and 50% FOH), 1,500 units. Cost data follows: WIP,beg Materials Labor P1,260 Cost this Month P36,240 770 10,780 FOH 1,400 21,725 3. How much is the cost of WIP, end using FIFO Dmahirap company adds all materials at the beginning of the process in the first department. Conversion costs were 75% complete as to 8,000 units in WIP beg and 50% complete as to 6,000 units in WIP,end. During the month, 12,000 units were completed and transferred to the next department. Analysis of the costs relating to production for October follows: Conversion Materials Cost WIP,beg P9,600 P4,800 Costs added this month 15,600 14,400 4. Compute for the unit cost transferred to the next department using FIFO. ATOZ company's product is manufactured in two departments. Units are inspected at the end of the production process in the first department. Data related to the month of May are: WIP,beg (60% materials, 35% labor, and 25% FOH), 1,000 units; started in process this period, 9,000 units; WIP,end (100% materials, 75% labor and 50% FOH), 1,500 units. Cost data follows: Cost this Month WIP,beg Materials Labor P1,260 P36,240 770 10,780 FOH 1,400 21,725 5. The cost department of Maramihan Corporation operates a process cost system using the average method. Production records showed the following data for one of the three production departments: Product received from previous department 100,000 kg; Product finished and sent to next department 71,840 kg; Product finished and remaining in this department 4,160 kg; Product unfinished in this department 24,000 kg. In this department, additional material is added to the work received from the preceding department. Three distinctly different types of materials are used at three separate stages of production in this department. Material A is added at the start of the process. Material B is added when the process is one-fourth completed. Material C is added when the process is three-fourths completed. Labor and factory overhead are incurred at a uniform rate throughout the manufacturing process in this department. Examination of the unfinished work discloses that: 1/4 was 7/8 completed; was completed; was 1/6 completed. Compute for equivalent units of production. If you have multiple answers, separate your answers by A SPACE IN BETWEEN ANSWERS when necessary.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Deang Corporation Service Department Cost Allocation Since Deang Corporation uses the direct method of service department cost distribution...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started