Answered step by step

Verified Expert Solution

Question

1 Approved Answer

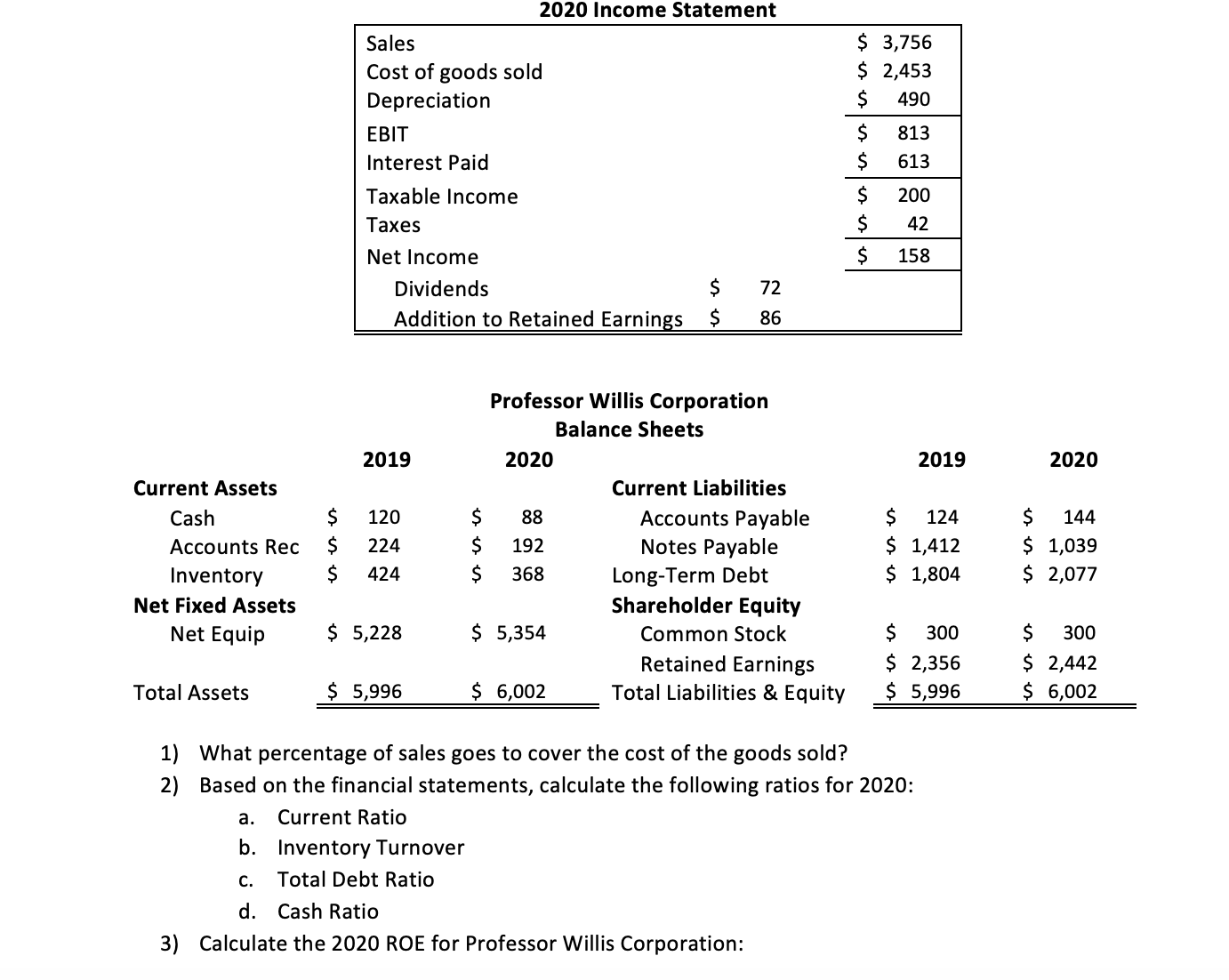

2020 Income Statement Sales $ 3,756 Cost of goods sold $ 2,453 Depreciation $ 490 EBIT Interest Paid Taxable Income Taxes Net Income $

2020 Income Statement Sales $ 3,756 Cost of goods sold $ 2,453 Depreciation $ 490 EBIT Interest Paid Taxable Income Taxes Net Income $ 813 $ 613 $ 200 $ 42 $ 158 Dividends Addition to Retained Earnings is st $ 72 $ 86 Professor Willis Corporation Balance Sheets 2019 2020 2019 2020 Current Assets Current Liabilities Cash $ 120 $ 88 Accounts Payable $ 124 Accounts Rec $ 224 $ 192 Notes Payable $ 1,412 es es $ 144 $ 1,039 Inventory $ 424 $ 368 Long-Term Debt $ 1,804 $ 2,077 Net Fixed Assets Shareholder Equity Net Equip $ 5,228 $ 5,354 Common Stock Retained Earnings $ 300 $ 300 $ 2,356 $ 2,442 Total Assets $ 5,996 $ 6,002 Total Liabilities & Equity $ 5,996 $ 6,002 1) What percentage of sales goes to cover the cost of the goods sold? 2) Based on the financial statements, calculate the following ratios for 2020: a. Current Ratio b. Inventory Turnover C. Total Debt Ratio d. Cash Ratio 3) Calculate the 2020 ROE for Professor Willis Corporation:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the percentage of sales that goes to cover the cost of goods sold COGS you can use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started