Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) If the nominal rate is 16%, what is the effective annual rate, if it's compounded monthly? Round your answer to 2 decimals (for example

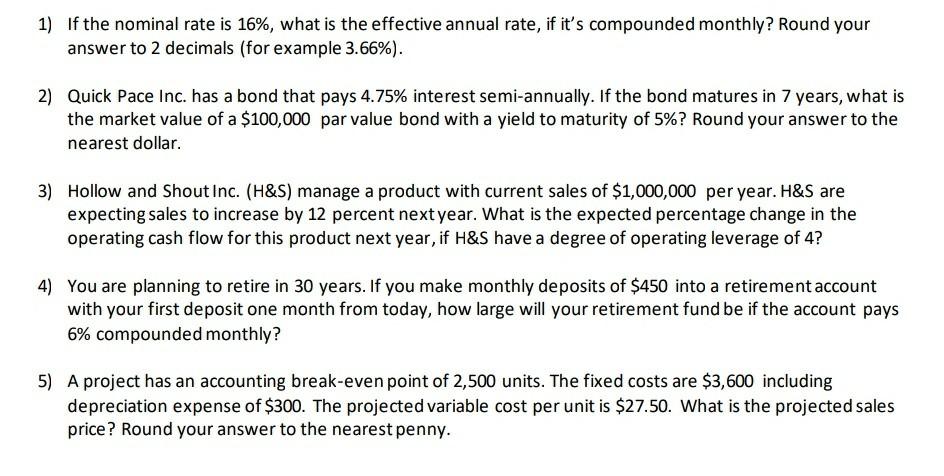

1) If the nominal rate is 16%, what is the effective annual rate, if it's compounded monthly? Round your answer to 2 decimals (for example 3.66%). 2) Quick Pace Inc. has a bond that pays 4.75% interest semi-annually. If the bond matures in 7 years, what is the market value of a $100,000 par value bond with a yield to maturity of 5%? Round your answer to the nearest dollar. 3) Hollow and Shout Inc. (H&S) manage a product with current sales of $1,000,000 per year. H&S are expecting sales to increase by 12 percent next year. What is the expected percentage change in the operating cash flow for this product next year, if H&S have a degree of operating leverage of 4? 4) You are planning to retire in 30 years. If you make monthly deposits of $450 into a retirement account with your first deposit one month from today, how large will your retirement fund be if the account pays 6% compounded monthly? 5) A project has an accounting break-even point of 2,500 units. The fixed costs are $3,600 including depreciation expense of $300. The projected variable cost per unit is $27.50. What is the projected sales price? Round your answer to the nearest penny

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started