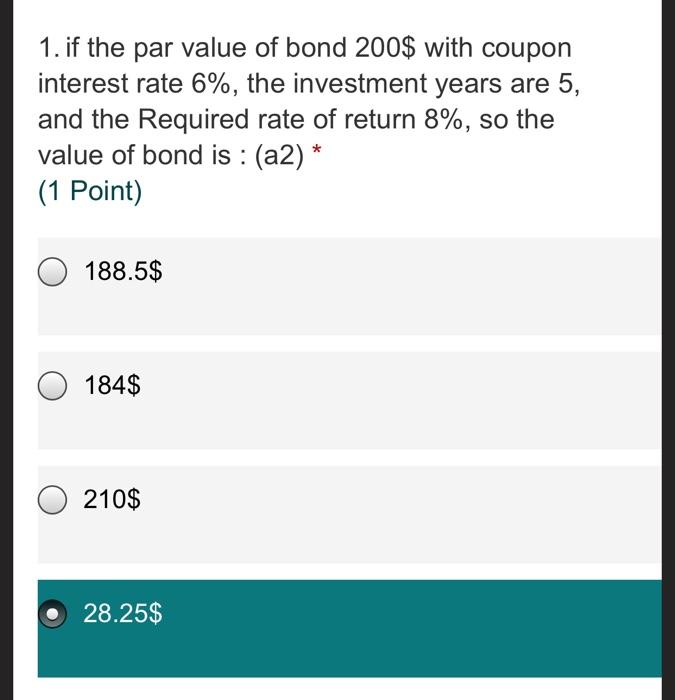

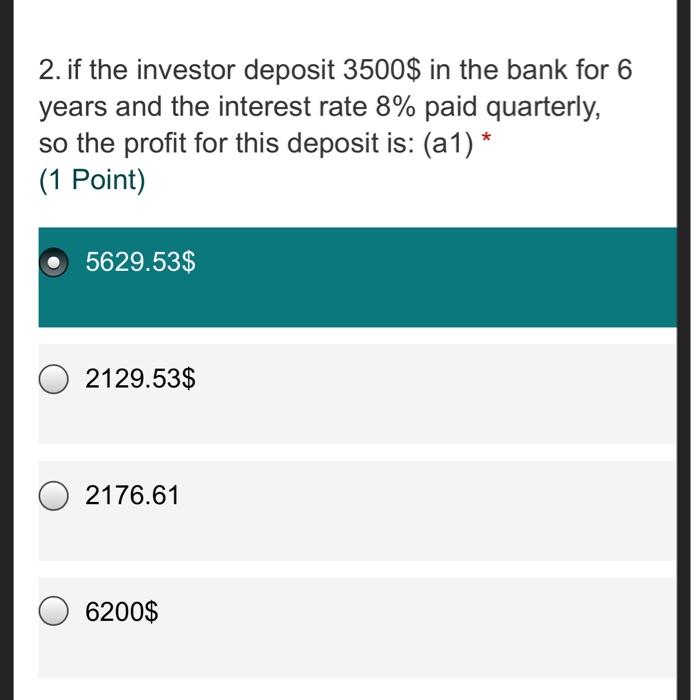

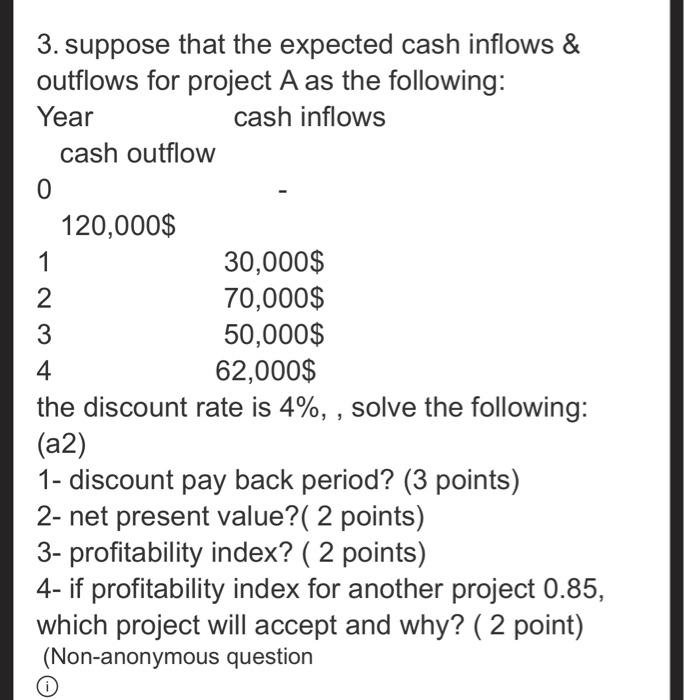

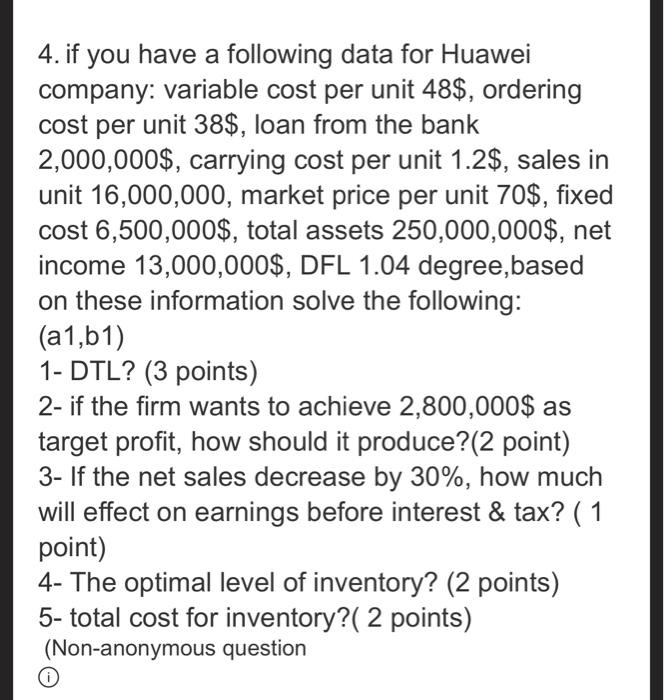

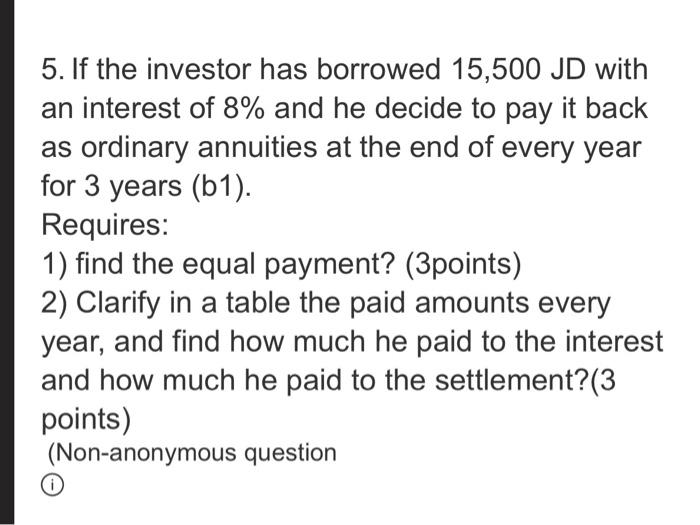

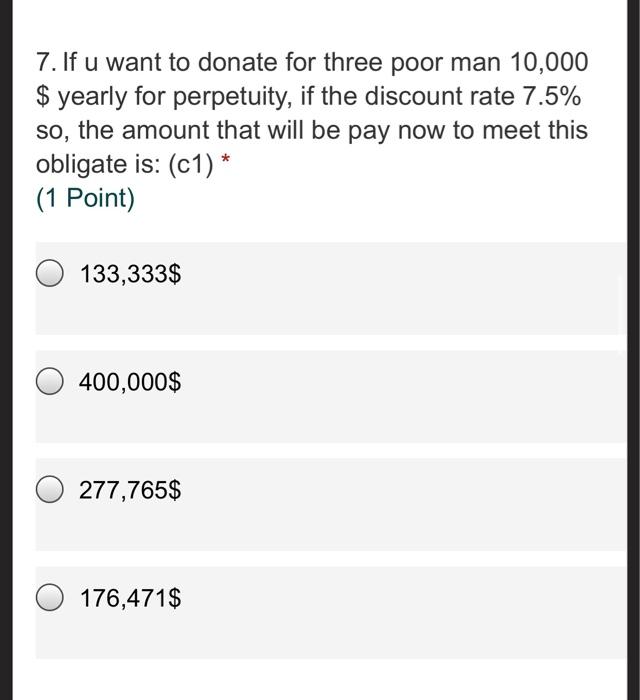

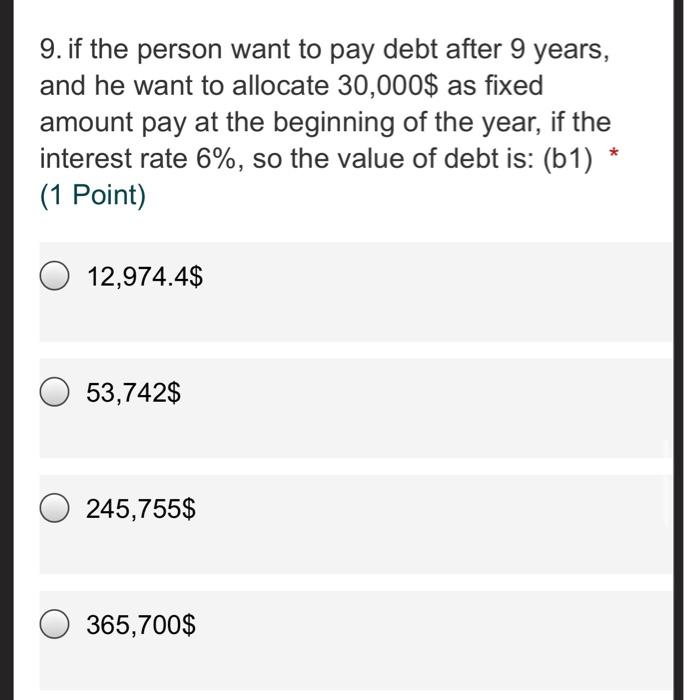

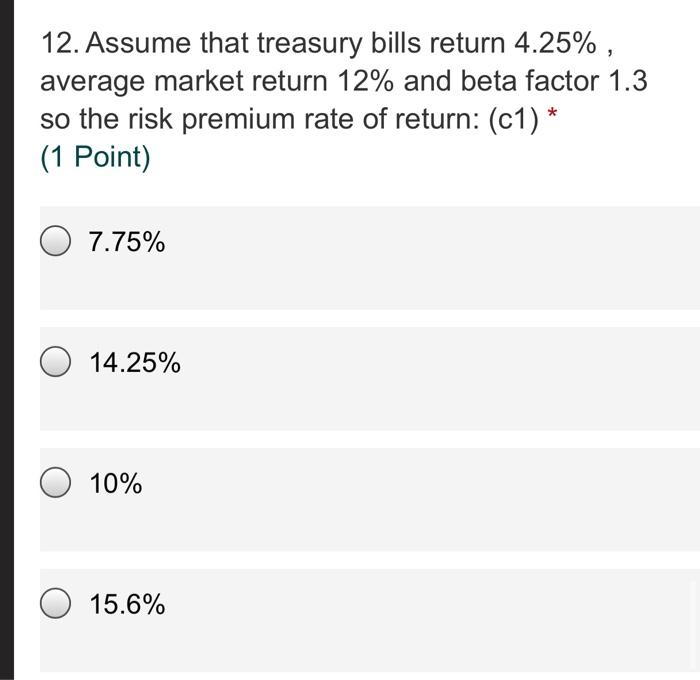

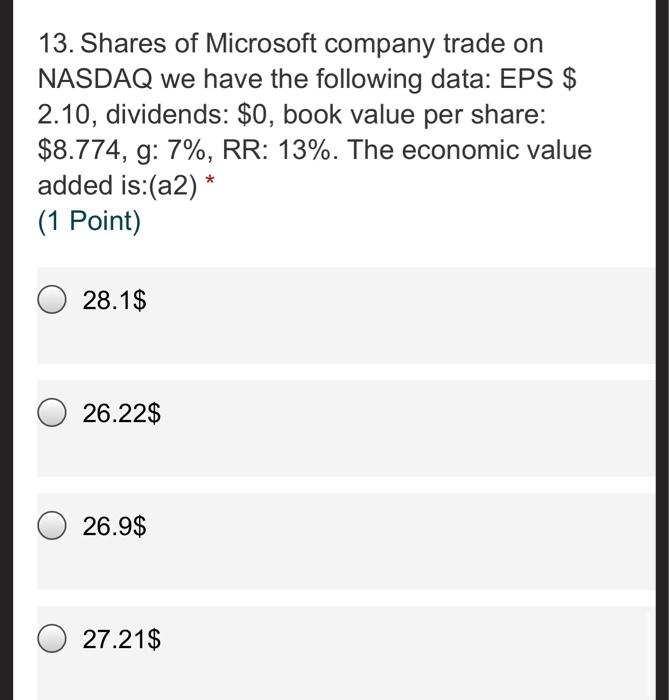

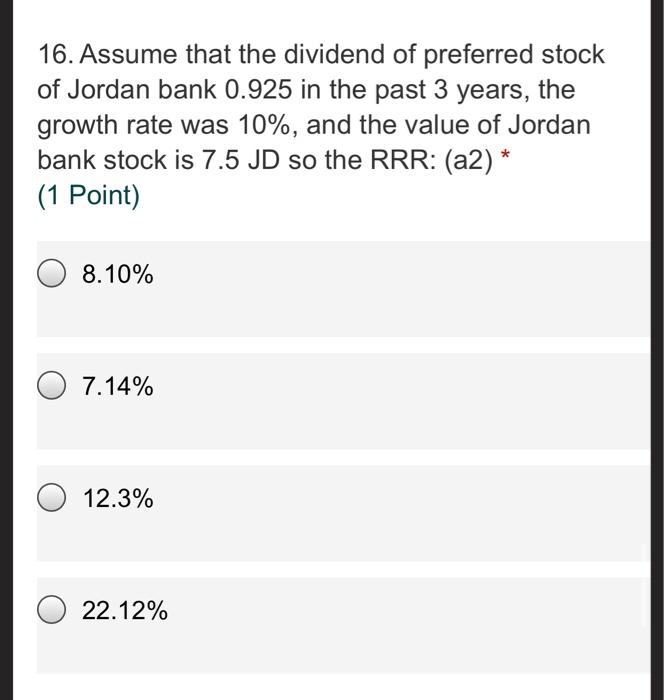

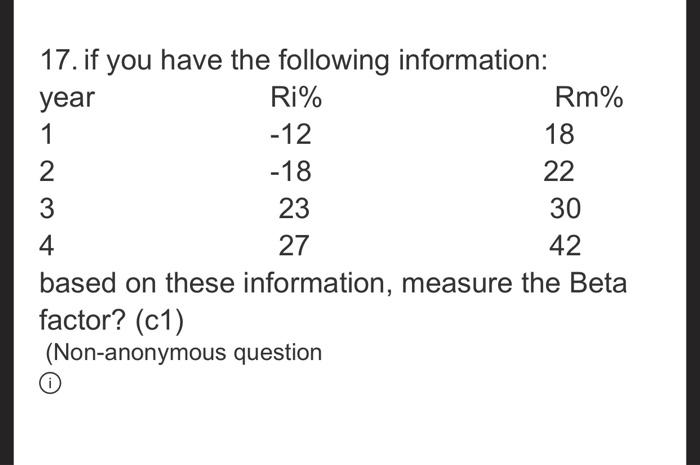

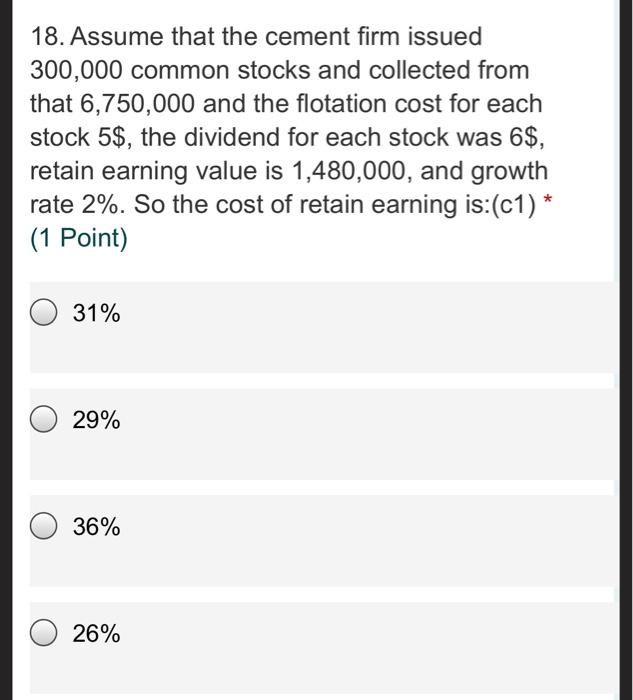

1. if the par value of bond 200$ with coupon interest rate 6%, the investment years are 5, and the Required rate of return 8%, so the value of bond is : (a2) * (1 Point) 188.5$ 184$ 210$ 28.25$ 2. if the investor deposit 3500$ in the bank for 6 years and the interest rate 8% paid quarterly, so the profit for this deposit is: (a1) * (1 Point) 5629.53$ 2129.53$ 2176.61 6200$ 3. suppose that the expected cash inflows & outflows for project A as the following: Year cash inflows cash outflow 0 120,000$ 1 30,000$ 2 70,000$ 3 50,000$ 4 62,000$ the discount rate is 4%, , solve the following: (a2) 1- discount pay back period? (3 points) 2- net present value?( 2 points) 3- profitability index? ( 2 points) 4- if profitability index for another project 0.85, which project will accept and why? ( 2 point) (Non-anonymous question 0 4. if you have a following data for Huawei company: variable cost per unit 48$, ordering cost per unit 38$, loan from the bank 2,000,000$, carrying cost per unit 1.2$, sales in unit 16,000,000, market price per unit 70$, fixed cost 6,500,000$, total assets 250,000,000$, net income 13,000,000$, DFL 1.04 degree, based on these information solve the following: (a1,b1) 1- DTL? (3 points) 2- if the firm wants to achieve 2,800,000$ as target profit, how should it produce?(2 point) 3- If the net sales decrease by 30%, how much will effect on earnings before interest & tax? ( 1 point) 4- The optimal level of inventory? (2 points) 5- total cost for inventory?( 2 points) (Non-anonymous question 0 5. If the investor has borrowed 15,500 JD with an interest of 8% and he decide to pay it back as ordinary annuities at the end of every year for 3 years (61). Requires: 1) find the equal payment? (3points) 2) Clarify in a table the paid amounts every year, and find how much he paid to the interest and how much he paid to the settlement?(3 points) (Non-anonymous question 0 7. If u want to donate for three poor man 10,000 $ yearly for perpetuity, if the discount rate 7.5% so, the amount that will be pay now to meet this obligate is: (c1) * (1 Point) 133,333$ 400,000$ 277,765$ 176,471$ 9. if the person want to pay debt after 9 years, and he want to allocate 30,000$ as fixed amount pay at the beginning of the year, if the interest rate 6%, so the value of debt is: (61) (1 Point) 12,974.4$ 53,742$ 245,755$ 365,700$ 12. Assume that treasury bills return 4.25% , average market return 12% and beta factor 1.3 so the risk premium rate of return: (01) * (1 Point) 0 7.75% 14.25% O 10% 15.6% 13. Shares of Microsoft company trade on NASDAQ we have the following data: EPS $ 2.10, dividends: $0, book value per share: $8.774, g: 7%, RR: 13%. The economic value added is:(a2) * (1 Point) 28.1$ 26.22$ 26.9$ 27.21$ 16. Assume that the dividend of preferred stock of Jordan bank 0.925 in the past 3 years, the growth rate was 10%, and the value of Jordan bank stock is 7.5 JD so the RRR: (a2) * (1 Point) 8.10% 7.14% 12.3% 0 22.12% 17. if you have the following information: year Ri% Rm% 1 -12 18 2 -18 22 3 23 30 4 27 42 based on these information, measure the Beta factor? (c1) (Non-anonymous question 18. Assume that the cement firm issued 300,000 common stocks and collected from that 6,750,000 and the flotation cost for each stock 5$, the dividend for each stock was 6$, retain earning value is 1,480,000, and growth rate 2%. So the cost of retain earning is:(c1) * (1 Point) 31% 29% 36% 26%