Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1- If the total present value of cash inflow equal to 19750 and the initial investment is equal to 10000, so what is the Profitability

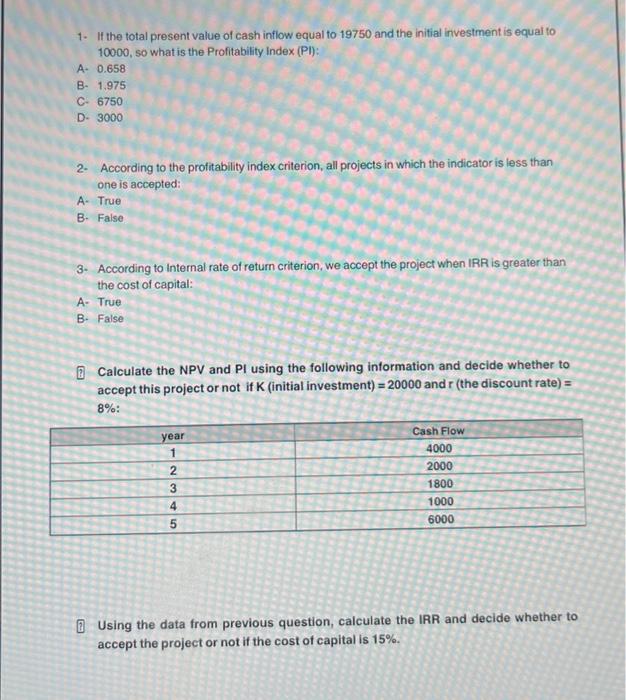

1- If the total present value of cash inflow equal to 19750 and the initial investment is equal to 10000, so what is the Profitability Index (PI): A- 0.658 B- 1.975 C- 6750 D- 3000 2- According to the profitability index criterion, all projects in which the indicator is less than one is accepted: A- True B- False 3- According to Internal rate of return criterion, we accept the project when IRR is greater than the cost of capital: A- True B- False Calculate the NPV and PI using the following information and decide whether to accept this project or not if K (initial investment) = 20000 and r (the discount rate) = 8%: year 1 2 3 4 5 Cash Flow 4000 2000 1800 1000 6000 Using the data from previous question, calculate the IRR and decide whether to accept the project or not if the cost of capital is 15%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started