Question

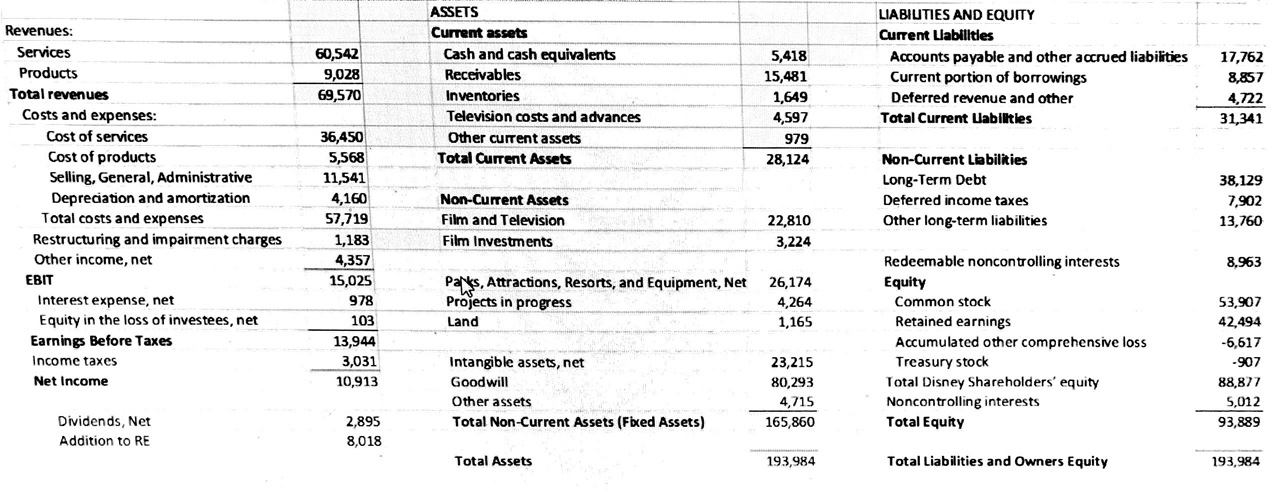

1. If year end sales are expected to drop by 2%, and costs and NWC vary with sales, what will be the change in accounts

1. If year end sales are expected to drop by 2%, and costs and NWC vary with sales, what will be the change in accounts receivable? Income statement numbers in millions

2. New Scenario: If revenues increase by 4,522,050,000 dollars in following year, what will be the projected retained earnings? Assume that rest. and imp, will grow at a rate 2x sales and other income grows at .5x sales. D/E, profit margin, and div payout are constant.

3. New scenario: If sales increase by 8%, what would the DFN be? Assume current liab. grow .5x sales and long-term liab. remain constant. D/E, prof. margin, and div. pay are constant.

Same as #3: If the company has 32 mil. shares outstanding and plans to sell 4 mil more at 85.98, the div pay ratio will grow by percent growth of shares outstanding. If this doesn't change current assets, how will DFN change from problem 3?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started