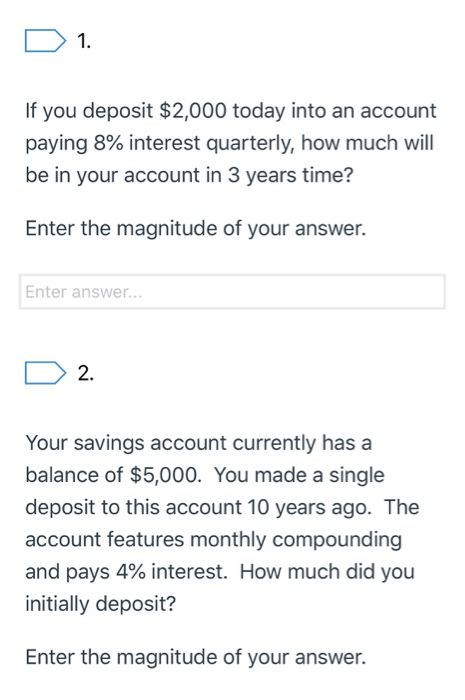

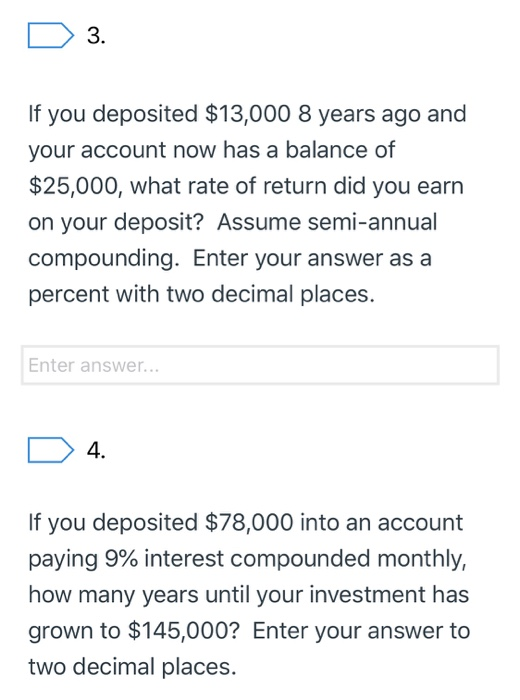

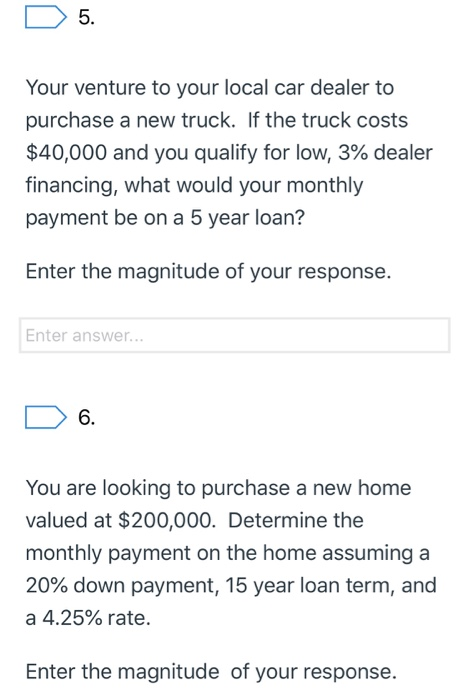

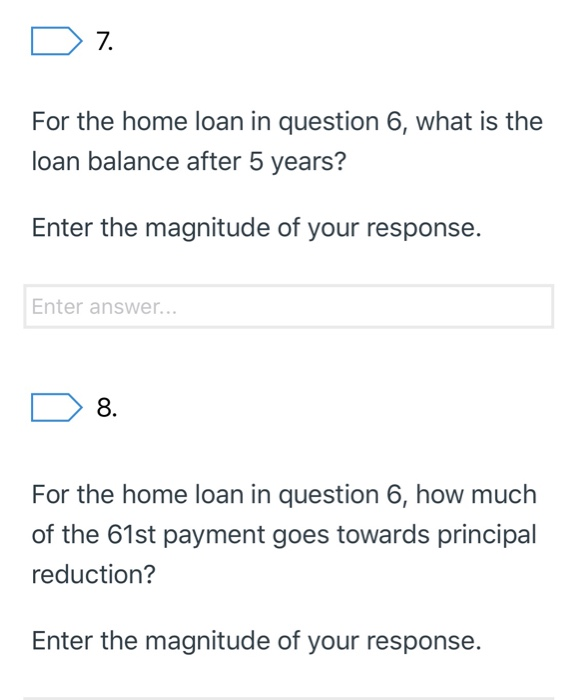

1. If you deposit $2,000 today into an account paying 8% interest quarterly, how much will be in your account in 3 years time? Enter the magnitude of your answer. Enter answer... 2. Your savings account currently has a balance of $5,000. You made a single deposit to this account 10 years ago. The account features monthly compounding and pays 4% interest. How much did you initially deposit? Enter the magnitude of your answer. 3. If you deposited $13,000 8 years ago and your account now has a balance of $25,000, what rate of return did you earn on your deposit? Assume semi-annual compounding. Enter your answer as a percent with two decimal places Enter answer... 4. If you deposited $78,000 into an account paying 9% interest compounded monthly, how many years until your investment has grown to $145,000? Enter your answer to two decimal places. 5. Your venture to your local car dealer to purchase a new truck. If the truck costs $40,000 and you qualify for low, 3% dealer financing, what would your monthly payment be on a 5 year loan? Enter the magnitude of your response. Enter answer... 6. You are looking to purchase a new home valued at $200,000. Determine the monthly payment on the home assuming a 20% down payment, 15 year loan term, and a 4.25% rate. Enter the magnitude of your response. LO 7. For the home loan in question 6, what is the loan balance after 5 years? Enter the magnitude of your response. Enter answer.. 8 For the home loan in question 6, how much of the 61st payment goes towards principal reduction? Enter the magnitude of your response. 9 Assume you plan to retire at age 65. On the day you retire, you will begin to make annual withdrawals in the amount of $75,000 from your retirement savings According to actuarial tables, you will likely live for 30 years in retirement. Assuming your retirement savings earns 5% interest during this time, how much will you need to have saved by the time you retire? Please enter the magnitude of your answer. Enter answer... 10. Building on question 9, assume you begin saving at age 25 by investing at the end of each month into an account paying 10% interest. How much do you need to save each month to meet your retirement goal? Enter the magnitude of your answer. 11. Assume you save $3,000 at the end of each year for 9 years. Following this, you cease making deposits until you retire 18 years later. If you are able to earn an 8% return, how much will you have at the time you retire? Enter the magnitude of your answer. Enter answer... 12. Assume you save $3,000 at the end of each year for 18 years. If you earn an 8% return on your investment, how much will you have saved at the end of the 18 years? Enter the magnitude of your answer. 13. You are considering purchasing a home here in Weatherford that you can rent to SWOSU students. Assume you can receive cash flows of 200 per month after expenses and sell the home for $125,000 in 10 years. If you require a 6% return, how much would you be willing to pay for the home? Make the somewhat unusual assumption that you allow your tenants to pay at the end of the month. Enter the magnitude of your answer. Enter answer... 14. Given a required return of 11%, what is the value of an investment that pays 10,000 in year 1, 15,000 in year two, and 20,000 for each of the next 8 years? Enter the magnitude of your answer. 15. Returning to the home loan in question 6. If you pay an additional $200 per month, how long (in years) will it take to repay the loan? Enter your answering using 2 decimal places 1. If you deposit $2,000 today into an account paying 8% interest quarterly, how much will be in your account in 3 years time? Enter the magnitude of your answer. Enter answer... 2. Your savings account currently has a balance of $5,000. You made a single deposit to this account 10 years ago. The account features monthly compounding and pays 4% interest. How much did you initially deposit? Enter the magnitude of your answer. 3. If you deposited $13,000 8 years ago and your account now has a balance of $25,000, what rate of return did you earn on your deposit? Assume semi-annual compounding. Enter your answer as a percent with two decimal places Enter answer... 4. If you deposited $78,000 into an account paying 9% interest compounded monthly, how many years until your investment has grown to $145,000? Enter your answer to two decimal places. 5. Your venture to your local car dealer to purchase a new truck. If the truck costs $40,000 and you qualify for low, 3% dealer financing, what would your monthly payment be on a 5 year loan? Enter the magnitude of your response. Enter answer... 6. You are looking to purchase a new home valued at $200,000. Determine the monthly payment on the home assuming a 20% down payment, 15 year loan term, and a 4.25% rate. Enter the magnitude of your response. LO 7. For the home loan in question 6, what is the loan balance after 5 years? Enter the magnitude of your response. Enter answer.. 8 For the home loan in question 6, how much of the 61st payment goes towards principal reduction? Enter the magnitude of your response. 9 Assume you plan to retire at age 65. On the day you retire, you will begin to make annual withdrawals in the amount of $75,000 from your retirement savings According to actuarial tables, you will likely live for 30 years in retirement. Assuming your retirement savings earns 5% interest during this time, how much will you need to have saved by the time you retire? Please enter the magnitude of your answer. Enter answer... 10. Building on question 9, assume you begin saving at age 25 by investing at the end of each month into an account paying 10% interest. How much do you need to save each month to meet your retirement goal? Enter the magnitude of your answer. 11. Assume you save $3,000 at the end of each year for 9 years. Following this, you cease making deposits until you retire 18 years later. If you are able to earn an 8% return, how much will you have at the time you retire? Enter the magnitude of your answer. Enter answer... 12. Assume you save $3,000 at the end of each year for 18 years. If you earn an 8% return on your investment, how much will you have saved at the end of the 18 years? Enter the magnitude of your answer. 13. You are considering purchasing a home here in Weatherford that you can rent to SWOSU students. Assume you can receive cash flows of 200 per month after expenses and sell the home for $125,000 in 10 years. If you require a 6% return, how much would you be willing to pay for the home? Make the somewhat unusual assumption that you allow your tenants to pay at the end of the month. Enter the magnitude of your answer. Enter answer... 14. Given a required return of 11%, what is the value of an investment that pays 10,000 in year 1, 15,000 in year two, and 20,000 for each of the next 8 years? Enter the magnitude of your answer. 15. Returning to the home loan in question 6. If you pay an additional $200 per month, how long (in years) will it take to repay the loan? Enter your answering using 2 decimal places