Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. If you invest $1,000 today in a security paying 8 percent compounded quarterly, how much will the investment be worth seven years from today?

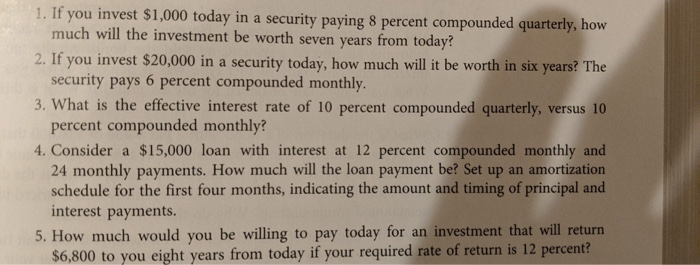

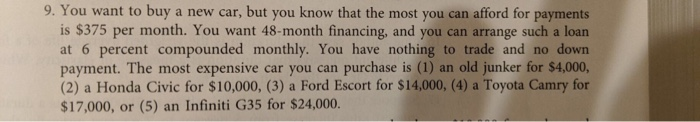

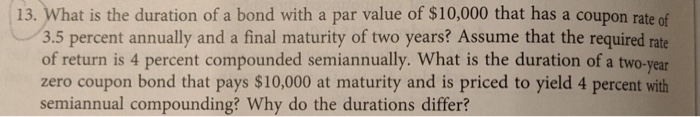

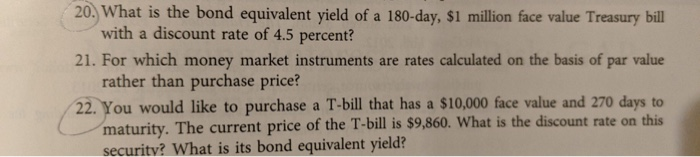

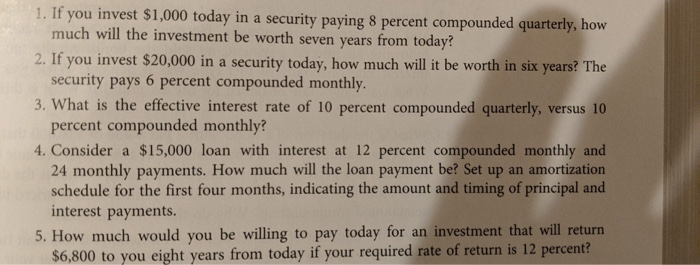

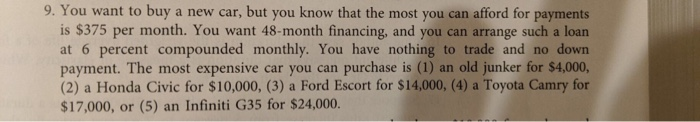

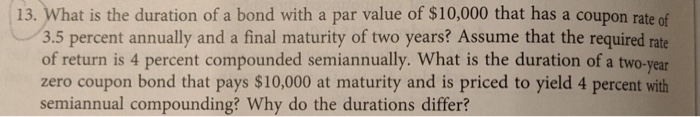

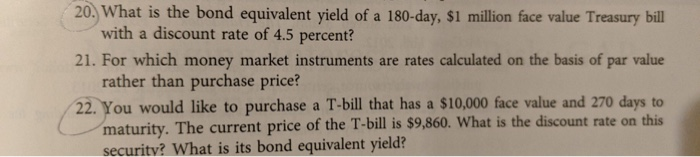

1. If you invest $1,000 today in a security paying 8 percent compounded quarterly, how much will the investment be worth seven years from today? 2. If you invest $20,000 in a security today, how much will it be worth in six years? The security pays 6 percent compounded monthly. 3. What is the effective interest rate of 10 percent compounded quarterly, versus 10 percent compounded monthly? 4. Consider a $15,000 loan with interest at 12 percent compounded monthly and 24 monthly payments. How much will the loan payment be? Set up an amortization schedule for the first four months, indicating the amount and timing of principal and interest payments. 5. How much would you be willing to pay today for an investment that will return $6,800 to you eight years from today if your required rate of return is 12 percent? 9. You want to buy a new car, but you know that the most you can afford for payments is $375 per month. You want 48-month financing, and you can arrange such a loan at 6 percent compounded monthly. You have nothing to trade and no down payment. The most expensive car you can purchase is (1) an old junker for $4,000, (2) a Honda Civic for $10,000, (3) a Ford Escort for $14,000, (4) a Toyota Camry for $17,000, or (5) an Infiniti G35 for $24,000. 13. What is the duration of a bond with a par value of $10,000 that has a coupon rate of 3.5 percent annually and a final maturity of two years? Assume that the required rate of return is 4 percent compounded semiannually. What is the duration of a two-year zero coupon bond that pays $10,000 at maturity and is priced to yield 4 percent with semiannual compounding? Why do the durations differ? 20. What is the bond equivalent yield of a 180-day, $1 million face value Treasury bill with a discount rate of 4.5 percent? 21. For which money market instruments are rates calculated on the basis of par value rather than purchase price? 22. You would like to purchase a T-bill that has a $10,000 face value and 270 days to maturity. The current price of the T-bill is $9,860. What is the discount rate on this security? What is its bond equivalent yield

1. If you invest $1,000 today in a security paying 8 percent compounded quarterly, how much will the investment be worth seven years from today? 2. If you invest $20,000 in a security today, how much will it be worth in six years? The security pays 6 percent compounded monthly. 3. What is the effective interest rate of 10 percent compounded quarterly, versus 10 percent compounded monthly? 4. Consider a $15,000 loan with interest at 12 percent compounded monthly and 24 monthly payments. How much will the loan payment be? Set up an amortization schedule for the first four months, indicating the amount and timing of principal and interest payments. 5. How much would you be willing to pay today for an investment that will return $6,800 to you eight years from today if your required rate of return is 12 percent? 9. You want to buy a new car, but you know that the most you can afford for payments is $375 per month. You want 48-month financing, and you can arrange such a loan at 6 percent compounded monthly. You have nothing to trade and no down payment. The most expensive car you can purchase is (1) an old junker for $4,000, (2) a Honda Civic for $10,000, (3) a Ford Escort for $14,000, (4) a Toyota Camry for $17,000, or (5) an Infiniti G35 for $24,000. 13. What is the duration of a bond with a par value of $10,000 that has a coupon rate of 3.5 percent annually and a final maturity of two years? Assume that the required rate of return is 4 percent compounded semiannually. What is the duration of a two-year zero coupon bond that pays $10,000 at maturity and is priced to yield 4 percent with semiannual compounding? Why do the durations differ? 20. What is the bond equivalent yield of a 180-day, $1 million face value Treasury bill with a discount rate of 4.5 percent? 21. For which money market instruments are rates calculated on the basis of par value rather than purchase price? 22. You would like to purchase a T-bill that has a $10,000 face value and 270 days to maturity. The current price of the T-bill is $9,860. What is the discount rate on this security? What is its bond equivalent yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started