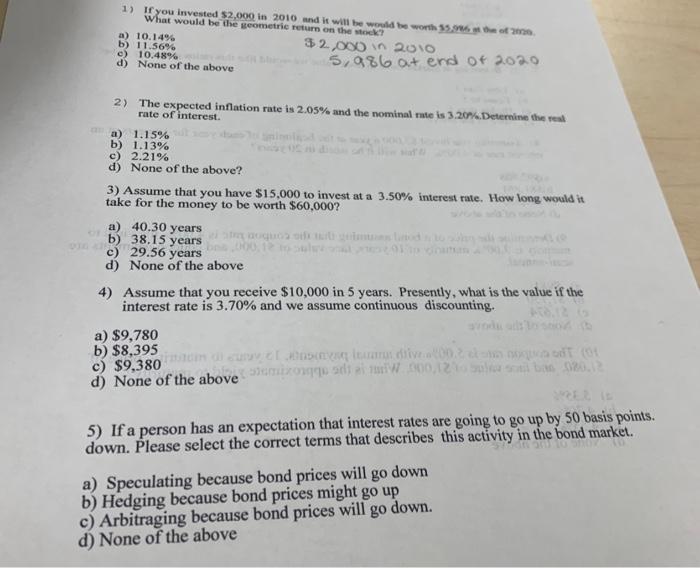

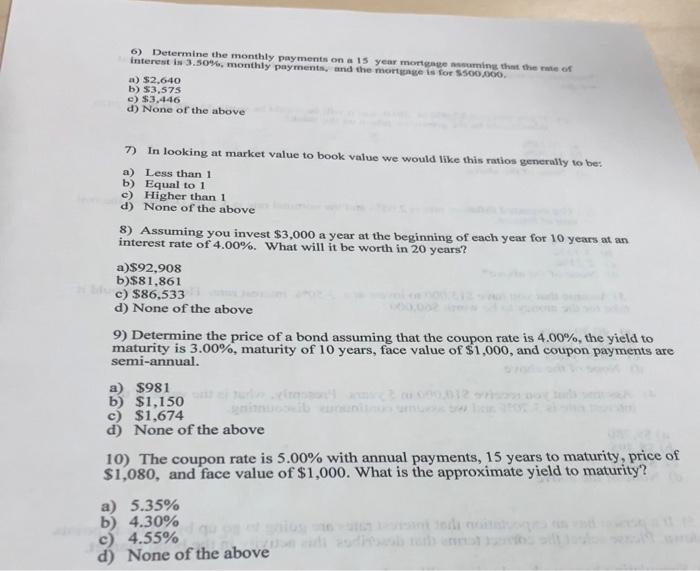

1) If you invested $2,000 in 2010 and it will be would be worth 55.94 of What would be the geometric return on the stock? a) 10.1496 32,000 in 2010 b) 11.56% e) 10.4896 5,986 at end of 2020 d) None of the above 2) The expected inflation rate is 2.05% and the nominal mute is 3.207.Determine the real rate of interest a) 1.15% b) 1.13% c) 2.21% d) None of the above? 3) Assume that you have $15,000 to invest at a 3.50% interest rate. How long would it take for the money to be worth $60,000? a) 40.30 years b) 38.15 years c) 29.56 years d) None of the above 4) Assume that you receive $10,000 in 5 years. Presently, what is the value if the interest rate is 3.70% and we assume continuous discounting. DE 53 a) $9,780 b) $8,395 c) $9,380 De divino d) None of the above song to edit al .600.12.2012 5) If a person has an expectation that interest rates are going to go up by 50 basis points. down. Please select the correct terms that describe this activity in the bond market. a) Speculating because bond prices will go down b) Hedging because bond prices might go up c) Arbitraging because bond prices will go down. d) None of the above 6) Determine the monthly payments on a 15 year morming that theme of interest is 3.50%, monthly payments, and the mortgage is for S500 200. a) $2.640 b) 53.575 e) $3.446 d) None of the above 7) In looking at market value to book value we would like this ratios generally to be: a) Less than 1 b) Equal to 1 c) Higher than 1 d) None of the above 8) Assuming you invest $3,000 a year at the beginning of each year for 10 years at an interest rate of 4.00%. What will it be worth in 20 years? a)$92,908 b)$81.861 c) $86,533 d) None of the above 9) Determine the price of a bond assuming that the coupon rate is 4.00%, the yield to maturity is 3.00%, maturity of 10 years, face value of $1,000, and coupon payments are semi-annual. a) $981 b) $1,150 c) $1,674 d) None of the above 10) The coupon rate is 5.00% with annual payments, 15 years to maturity, price of $1,080, and face value of $1,000. What is the approximate yield to maturity? a) 5.35% b) 4.30% c) 4.55% d) None of the above