Answered step by step

Verified Expert Solution

Question

1 Approved Answer

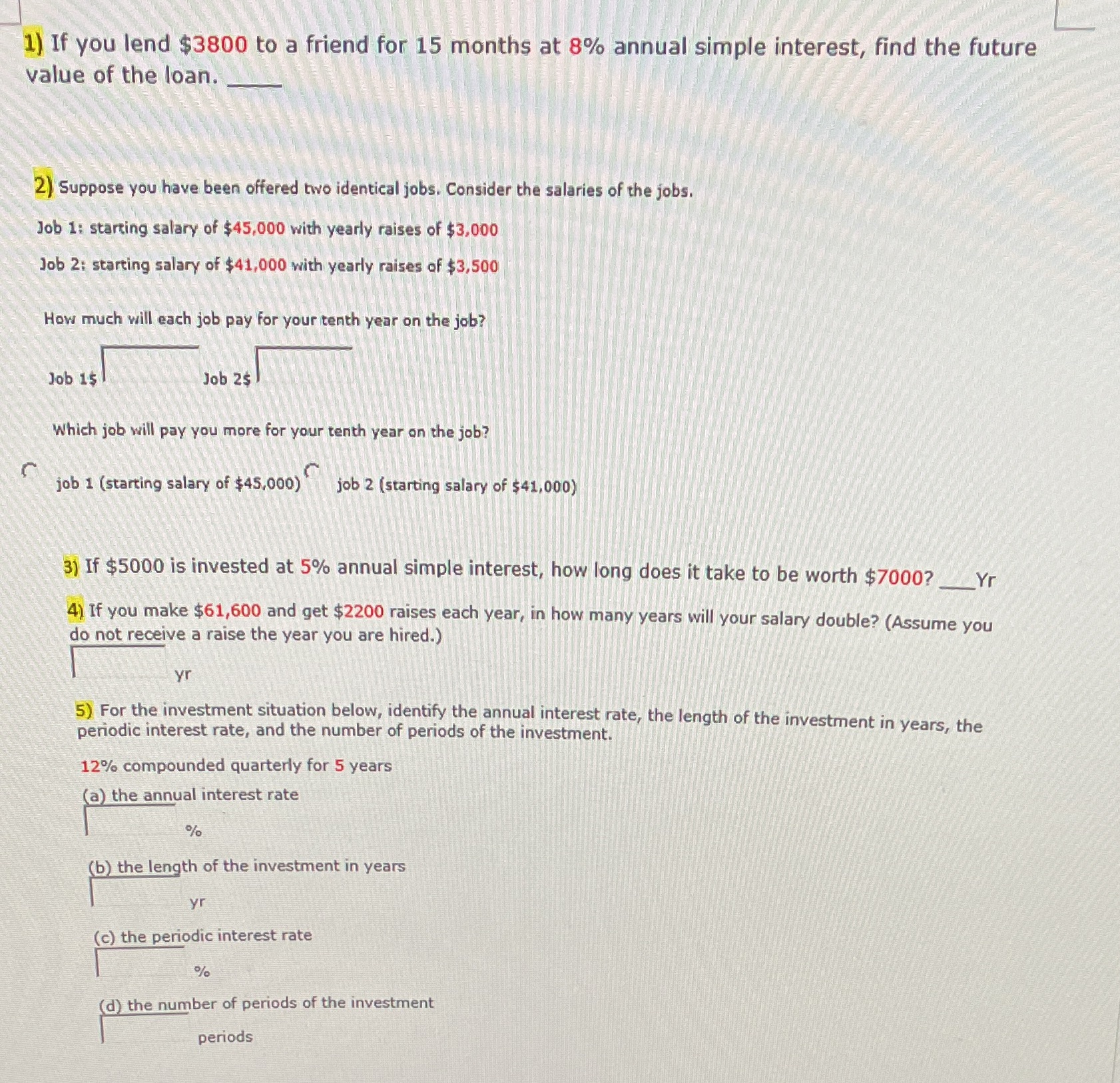

1) If you lend $3800 to a friend for 15 months at 8% annual simple interest, find the future value of the loan. 2)

1) If you lend $3800 to a friend for 15 months at 8% annual simple interest, find the future value of the loan. 2) Suppose you have been offered two identical jobs. Consider the salaries of the jobs. Job 1: starting salary of $45,000 with yearly raises of $3,000 Job 2: starting salary of $41,000 with yearly raises of $3,500 How much will each job pay for your tenth year on the job? Job 1$ Job 2$ Which job will pay you more for your tenth year on the job? job 1 (starting salary of $45,000) job 2 (starting salary of $41,000) 3) If $5000 is invested at 5% annual simple interest, how long does it take to be worth $7000? Yr 4) If you make $61,600 and get $2200 raises each year, in how many years will your salary double? (Assume you do not receive a raise the year you are hired.) yr 5) For the investment situation below, identify the annual interest rate, the length of the investment in years, the periodic interest rate, and the number of periods of the investment. 12% compounded quarterly for 5 years (a) the annual interest rate % the length of the investment in years yr (c) the periodic interest rate % (d) the number of periods of the investment periods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started