Answered step by step

Verified Expert Solution

Question

1 Approved Answer

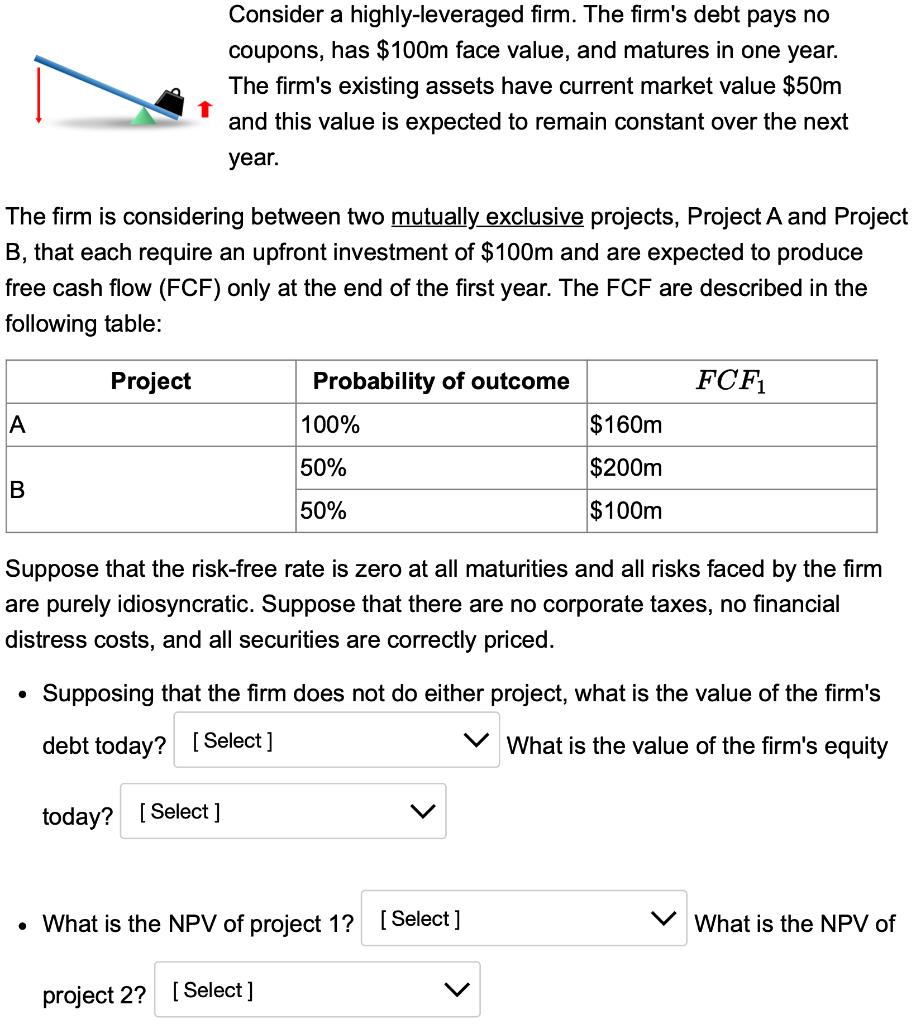

The firm is considering between two mutually exclusive projects, Project A and Project B, that each require an upfront investment of $100m and are

The firm is considering between two mutually exclusive projects, Project A and Project B, that each require an upfront investment of $100m and are expected to produce free cash flow (FCF) only at the end of the first year. The FCF are described in the following table: Project A B Consider a highly-leveraged firm. The firm's debt pays no coupons, has $100m face value, and matures in one year. The firm's existing assets have current market value $50m and this value is expected to remain constant over the next year. . Probability of outcome Suppose that the risk-free rate is zero at all maturities and all risks faced by the firm are purely idiosyncratic. Suppose that there are no corporate taxes, no financial distress costs, and all securities are correctly priced. project 2? 100% 50% 50% What is the NPV of project 1? [Select] [Select] $160m $200m $100m Supposing that the firm does not do either project, what is the value of the firm's debt today? [Select] What is the value of the firm's equity today? [Select ] FCF What is the NPV of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the value of the firms debt and equity if the firm does not undertake either project we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started