Answered step by step

Verified Expert Solution

Question

1 Approved Answer

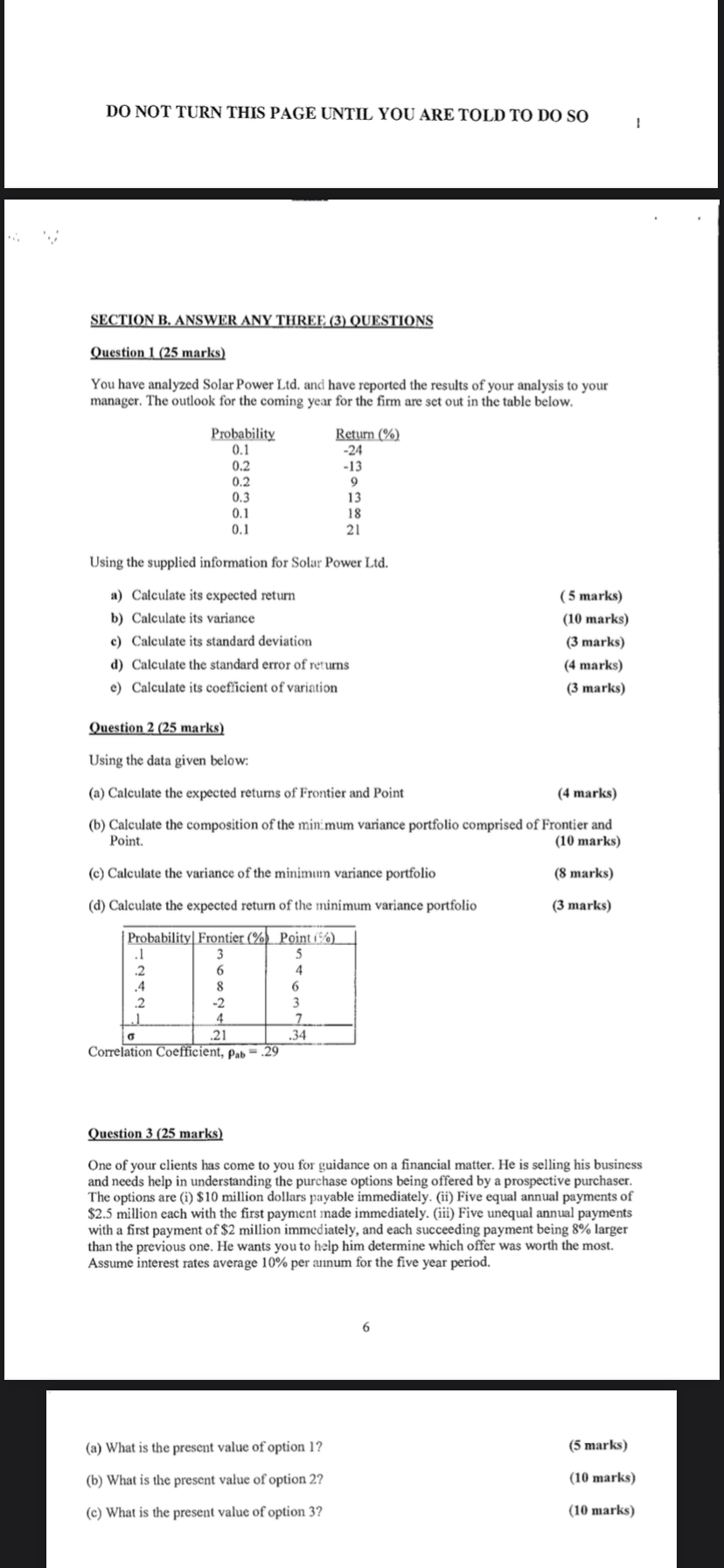

M DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO SECTION B. ANSWER ANY THREE (3) QUESTIONS Question 1 (25 marks)

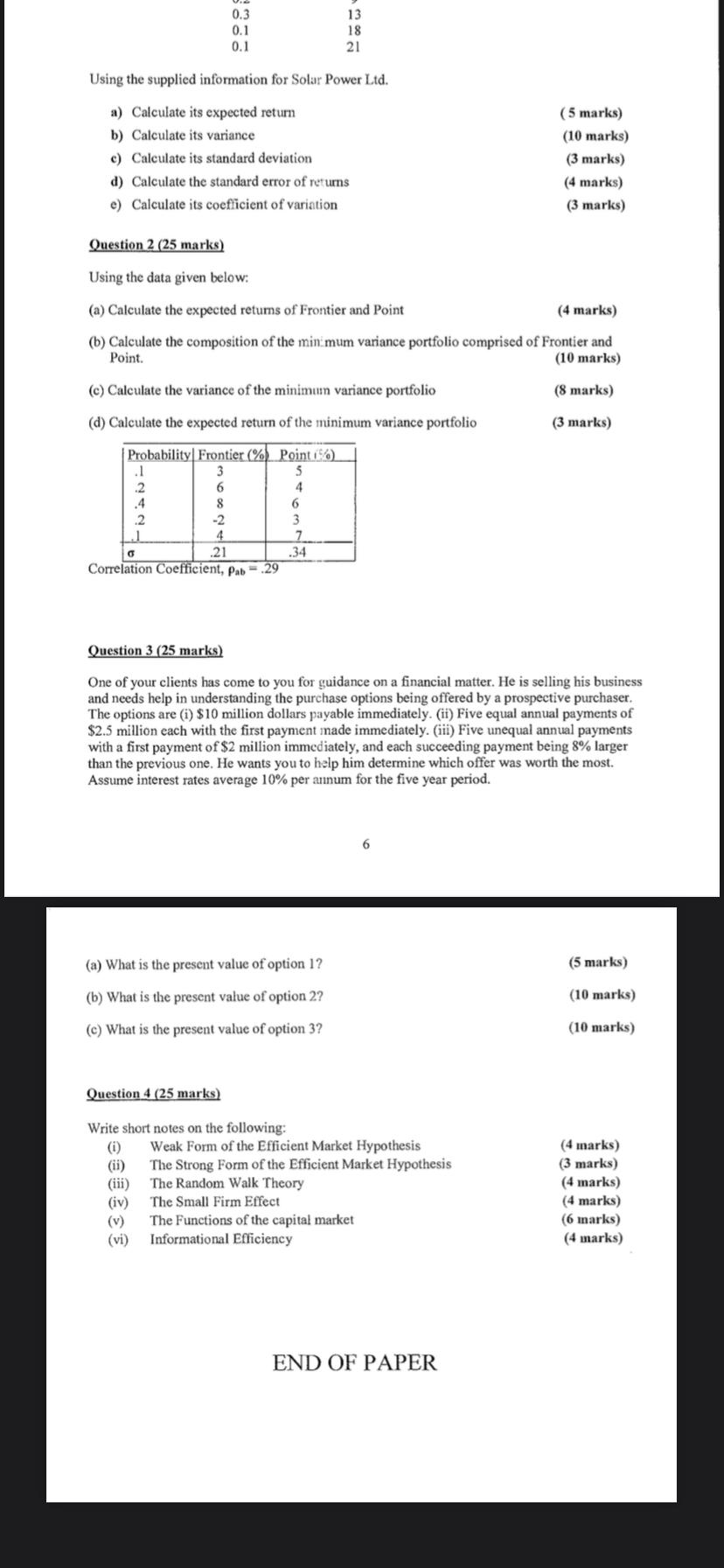

M DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO SECTION B. ANSWER ANY THREE (3) QUESTIONS Question 1 (25 marks) You have analyzed Solar Power Ltd. and have reported the results of your analysis to your manager. The outlook for the coming year for the firm are set out in the table below. Probability 0.1 0.2 0.2 0.3 0.1 0.1 .1 .2 .4 .2 Using the supplied information for Solar Power Ltd. a) Calculate its expected return b) Calculate its variance c) Calculate its standard deviation d) Calculate the standard error of returns. e) Calculate its coefficient of variation -2 4 21 Question 2 (25 marks) Using the data given below: (a) Calculate the expected returns of Frontier and Point (4 marks) (b) Calculate the composition of the minimum variance portfolio comprised of Frontier and Point. (10 marks) (8 marks) (3 marks) (c) Calculate the variance of the minimum variance portfolio (d) Calculate the expected return of the minimum variance portfolio Probability Frontier (%) Point (5) 3 6 8 G Correlation Coefficient, Pab= .29 Return (%) -24 -13 9 5 4 13 18 21 6 3 7 .34 (a) What is the present value of option 1? (b) What is the present value of option 2? (c) What is the present value of option 3? (5 marks) (10 marks) (3 marks) (4 marks) (3 marks) 1 Question 3 (25 marks) One of your clients has come to you for guidance on a financial matter. He is selling his business and needs help in understanding the purchase options being offered by a prospective purchaser. The options are (i) $10 million dollars payable immediately. (ii) Five equal annual payments of $2.5 million each with the first payment made immediately. (iii) Five unequal annual payments with a first payment of $2 million immediately, and each succeeding payment being 8% larger than the previous one. He wants you to help him determine which offer was worth the most. Assume interest rates average 10% per annum for the five year period. (5 marks) (10 marks) (10 marks) Using the supplied information for Solar Power Ltd. a) Calculate its expected return b) Calculate its variance c) Calculate its standard deviation d) Calculate the standard error of returns e) Calculate its coefficient of variation 0.3 0.1 0.1 Question 2 (25 marks) Using the data given below: (a) Calculate the expected returns of Frontier and Point (4 marks) (b) Calculate the composition of the minimum variance portfolio comprised of Frontier and Point. (10 marks) (8 marks) (3 marks) (c) Calculate the variance of the minimum variance portfolio (d) Calculate the expected return of the minimum variance portfolio Probability Frontier (% Point (6) .1 5 4 .4 3 6 8 -2 4 21 G Correlation Coefficient, Pab.29 (1) (ii) (iii) (iv) 6 Question 4 (25 marks) Write short notes on the following: 3 13 18 21 7 34 (a) What is the present value of option 1? (b) What is the present value of option 2? (c) What is the present value of option 3? Question 3 (25 marks) One of your clients has come to you for guidance on a financial matter. He is selling his business and needs help in understanding the purchase options being offered by a prospective purchaser. The options are (i) $10 million dollars payable immediately. (ii) Five equal annual payments of $2.5 million each with the first payment made immediately. (iii) Five unequal annual payments with a first payment of $2 million immediately, and each succeeding payment being 8% larger than the previous one. He wants you to help him determine which offer was worth the most. Assume interest rates average 10% per annum for the five year period. Weak Form of the Efficient Market Hypothesis The Strong Form of the Efficient Market Hypothesis The Random Walk Theory The Small Firm Effect The Functions of the capital market (vi) Informational Efficiency 6 (5 marks) (10 marks) (3 marks) (4 marks) (3 marks) END OF PAPER (5 marks) (10 marks) (10 marks) (4 marks) (3 marks) (4 marks) (4 marks) (6 marks) (4 marks)

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 a Expected return 02401 01302 00902 01303 01801 02101 004 b Variance 010...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started