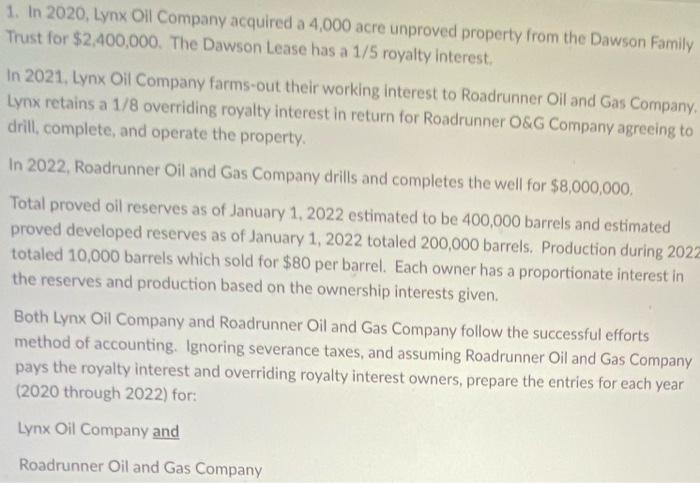

1. In 2020, Lynx Oil Company acquired a 4,000 acre unproved property from the Dawson Family Trust for $2.400,000. The Dawson Lease has a 1/5 royalty interest In 2021, Lynx Oil Company farms out their working interest to Roadrunner Oil and Gas Company, Lynx retains a 1/8 overriding royalty interest in return for Roadrunner O&G Company agreeing to drill, complete, and operate the property. In 2022, Roadrunner Oil and Gas Company drills and completes the well for $8,000,000, Total proved oil reserves as of January 1, 2022 estimated to be 400,000 barrels and estimated proved developed reserves as of January 1, 2022 totaled 200,000 barrels. Production during 2022 totaled 10,000 barrels which sold for $80 per barrel. Each owner has a proportionate interest in the reserves and production based on the ownership interests given Both Lynx Oil Company and Roadrunner Oil and Gas Company follow the successful efforts method of accounting. Ignoring severance taxes, and assuming Roadrunner Oil and Gas Company pays the royalty interest and overriding royalty interest owners, prepare the entries for each year (2020 through 2022) for: Lynx Oil Company and Roadrunner Oil and Gas Company 1. In 2020, Lynx Oil Company acquired a 4,000 acre unproved property from the Dawson Family Trust for $2.400,000. The Dawson Lease has a 1/5 royalty interest In 2021, Lynx Oil Company farms out their working interest to Roadrunner Oil and Gas Company, Lynx retains a 1/8 overriding royalty interest in return for Roadrunner O&G Company agreeing to drill, complete, and operate the property. In 2022, Roadrunner Oil and Gas Company drills and completes the well for $8,000,000, Total proved oil reserves as of January 1, 2022 estimated to be 400,000 barrels and estimated proved developed reserves as of January 1, 2022 totaled 200,000 barrels. Production during 2022 totaled 10,000 barrels which sold for $80 per barrel. Each owner has a proportionate interest in the reserves and production based on the ownership interests given Both Lynx Oil Company and Roadrunner Oil and Gas Company follow the successful efforts method of accounting. Ignoring severance taxes, and assuming Roadrunner Oil and Gas Company pays the royalty interest and overriding royalty interest owners, prepare the entries for each year (2020 through 2022) for: Lynx Oil Company and Roadrunner Oil and Gas Company