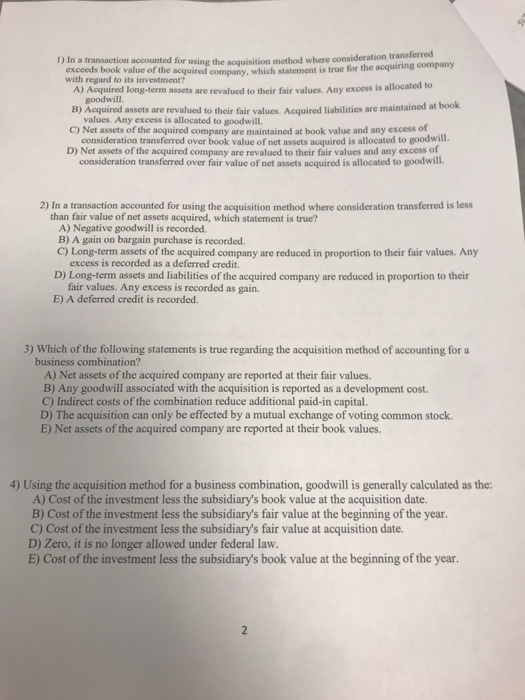

1) In a transaction accounted for using the acquisition method where consideration transferred exceeds book value of the acquired with regard to its investment? company, which statement is true for the acquiring company A) Acquired long-term assets are revalued to their fair values. Any excess is allocated to B) Acquired assets are revalued to their fair values. Acquired liabilities are maintained at book C) Net assets of the acquired company are maintained at book value and any excess of D) Net assets of the acquired company are revalued to their fair values and any excess of goodwill values. Any excess is allocated to goodwill. consideration transferred over book value of net assets acquired is allocated to goodwl. consideration transferred over fair value of net assets acquired is allocated to goodwill. 2) In a transaction accounted for using the acquisition method where consideration transferred is less than fair value of net assets acquired, which statement is true? A) Negative goodwill is recorded. B) A gain on bargain purchase is recorded C) Long-term assets of the acquired company are reduced in proportion to their fair values. Any excess is recorded as a deferred credit. D) Long-term assets and liabilities of the acquired company are reduced in proportion to their fair values. Any excess is recorded as gain. E) A deferred credit is recorded. 3) Which of the following statements is true regarding the acquisition method of accounting for a business combination? A) Net assets of the acquired company are reported at their fair values. B) Any goodwill associated with the acquisition is reported as a development cost. C) Indirect costs of the combination reduce additional paid-in capital. D) The acquisition can only be effected by a mutual exchange of voting common stock. E) Net assets of the acquired company are reported at their book values. 4) Using the acquisition method for a business combination, goodwill is generally calculated as the: A) Cost of the investment less the subsidiary's book value at the acquisition date. B) Cost of the investment less the subsidiary's fair value at the beginning of the year C) Cost of the investment less the subsidiary's fair value at acquisition date. D) Zero, it is no longer allowed under federal law. E) Cost of the investment less the subsidiary's book value at the beginning of the year