Answered step by step

Verified Expert Solution

Question

1 Approved Answer

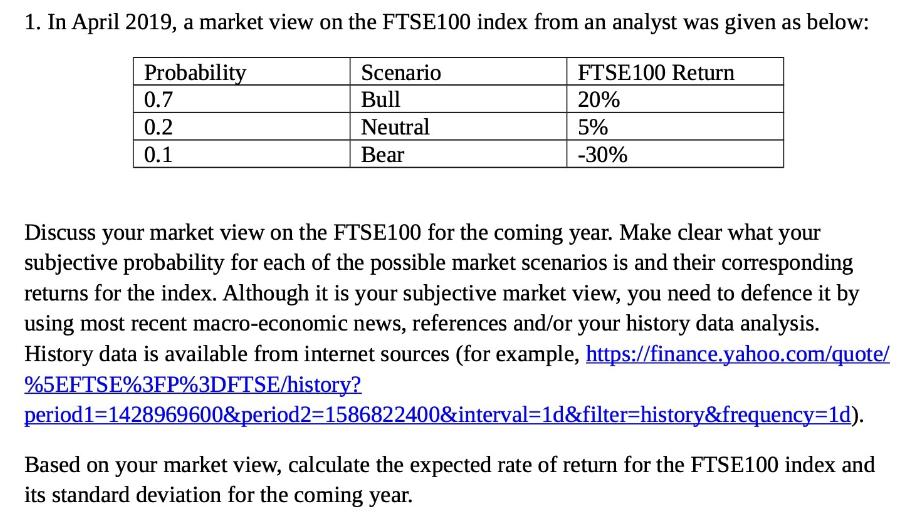

1. In April 2019, a market view on the FTSE100 index from an analyst was given as below: Probability FTSE100 Return 20% 0.7 0.2

1. In April 2019, a market view on the FTSE100 index from an analyst was given as below: Probability FTSE100 Return 20% 0.7 0.2 5% 0.1 -30% Scenario Bull Neutral Bear Discuss your market view on the FTSE100 for the coming year. Make clear what your subjective probability for each of the possible market scenarios is and their corresponding returns for the index. Although it is your subjective market view, you need to defence it by using most recent macro-economic news, references and/or your history data analysis. History data is available from internet sources (for example, https://finance.yahoo.com/quote/ %5EFTSE%3FP%3DFTSE/history? period1=1428969600&period2=1586822400&interval=1d&filter=history&frequency=1d). Based on your market view, calculate the expected rate of return for the FTSE100 index and its standard deviation for the coming year.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

In order to calculate the expected rate of return for the FTSE100 index based on the given market vi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started