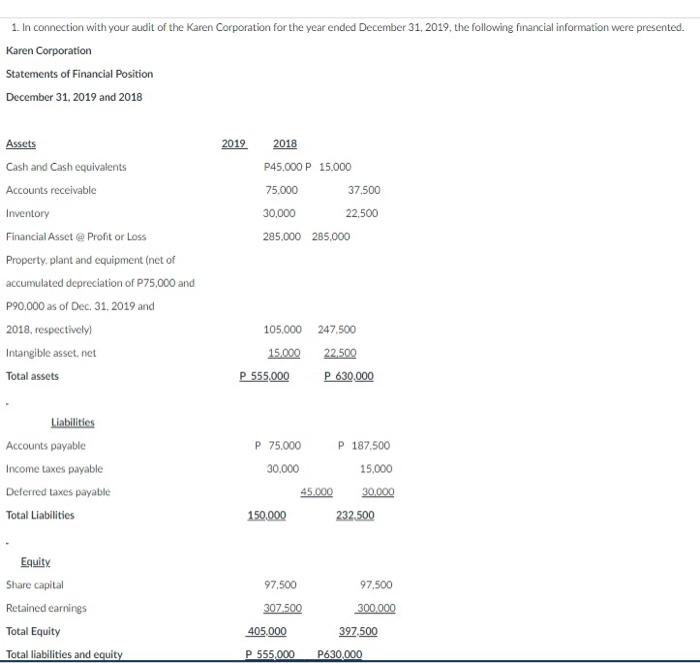

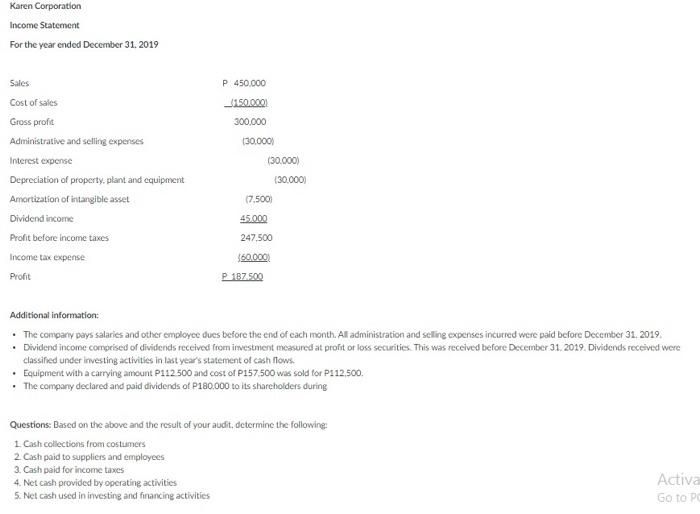

1. In connection with your audit of the Karen Corporation for the year ended December 31, 2019, the following financial information were presented. Karen Corporation Statements of Financial Position December 31, 2019 and 2018 2019 2018 P45,000 P 15.000 75,000 37.500 30,000 22,500 285.000 285.000 Assets Cash and Cash equivalents Accounts receivable Inventory Financial Asset @ Profit or Loss Property, plant and equipment (net of accumulated depreciation of P75,000 and P90,000 as of Dec. 31, 2019 and 2018, respectively Intangible asset.net Total assets 105.000 247.500 15.000 22.500 P 555.000 P 630.000 Liabilities Accounts payable Income taxes payable Deferred taxes payable Total Liabilities P 75.000 P 187.500 30,000 15,000 45.000 30,000 150.000 232.500 Equity Share capital Retained earnings Total Equity Total liabilities and equity 97,500 97,500 307.500 300.000 397.500 P 555,000 P630,000 405.000 Karen Corporation Income Statement For the year ended December 31, 2019 Sales P 450.000 _150.0001 300,000 130.000) Cost of sales Gross profit Administrative and selling expenses Interest expense Depreciation of property, plant and equipment Amortization of intangible asset Dividend income Profit before income taxes Income tax expense Profit (30.000) (30.000 (7.500 45.000 247.500 $60.000 P 167.500 Additional information: The company pays salaries and other employee dues before the end of each month. Al administration and stilling expenses incurred were paid before December 31, 2019, Dividend income comprised of dividends received from irvestment measured at profit or loss securities. This was received before December 31, 2019. Dividends received were classified under investing activities in last year's statement of cash flows Equipment with a carrying amount P112 500 and cost of P157.500 was sold for P112.500. The company declared and paid dividends of P180,000 to its shareholders during Questions: Based on the above and the result of your audit, determine the following 1. Cash collections from costumers 2 Cash paid to suppliers and employees 3. Cash paid for income taxes 4. Net cash provided by operating activities 5. Net cash used in investing and financing activities Activa Go to PC