Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. In Question 7.2, 95.09 is placed in 5% position, right? How was this 95.09 derived? 2. In Question 7.3, likewise, how was 99.93 derived?

1. In Question 7.2, 95.09 is placed in 5% position, right? How was this 95.09 derived?

2. In Question 7.3, likewise, how was 99.93 derived?

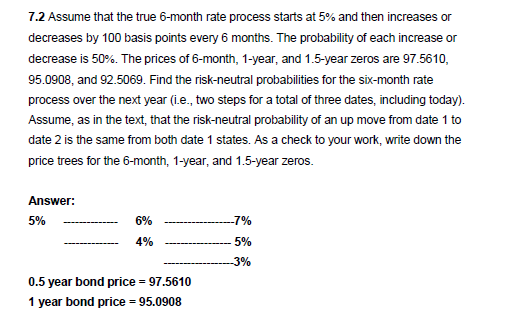

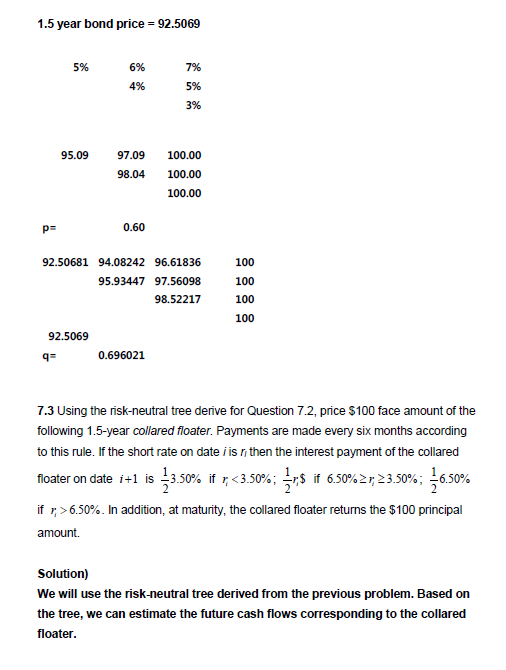

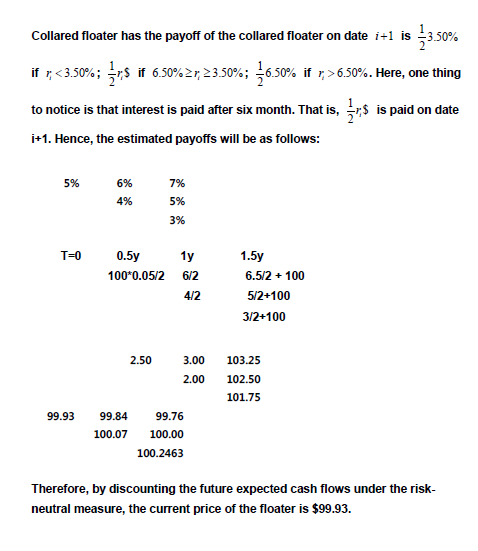

7.2 Assume that the true 6-month rate process starts at 5% and then increases or decreases by 100 basis points every 6 months. The probability of each increase or decrease is 50%. The prices of 6-month, 1-year, and 1.5-year zeros are 97.5610, 95.0908, and 92.5069. Find the risk-neutral probabilities for the six-month rate process over the next year (i.e., two steps for a total of three dates, including today). Assume, as in the text, that the risk-neutral probability of an up move from date 1 to date 2 is the same from both date 1 states. As a check to your work, write down the price trees for the 6-month, 1-year, and 1.5-year zeros. Answer: 5% 6% -7% 4% 5% 3% 0.5 year bond price - 97.5610 1 year bond price = 95.0908 = 1.5 year bond price = 92.5069 5% 6% 4% 7% 5% 3% 95.09 97.09 100.00 98.04 100.00 100.00 p= 0.60 92.50681 94.08242 96.61836 95.93447 97.56098 98.52217 100 100 100 100 92.5069 q 0.696021 7.3 Using the risk-neutral tree derive for Question 7.2 price $100 face amount of the following 1.5-year collared floater. Payments are made every six months according to this rule. If the short rate on date i is n then the interest payment of the collared floater on date i+1 is $3.50% if r6.50%. In addition, at maturity, the collared floater returns the $100 principal amount. Solution) We will use the risk-neutral tree derived from the previous problem. Based on the tree, we can estimate the future cash flows corresponding to the collared floater. Collared floater has the payoff of the collared floater on date i+1 is 3.50% if r6.50%. Here, one thing to notice is that interest is paid after six month. That is, 3rs is paid on date i+1. Hence, the estimated payoffs will be as follows: 5% 6% 4% 7% 5% 3% T=0 0.5y 100*0.05/2 1y 6/2 4/2 1.5y 6.5/2 + 100 5/2+100 3/2+100 2.50 3.00 2.00 103.25 102.50 101.75 99.93 99.84 100.07 99.76 100.00 100.2463 Therefore, by discounting the future expected cash flows under the risk- neutral measure, the current price of the floater is $99.93Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started