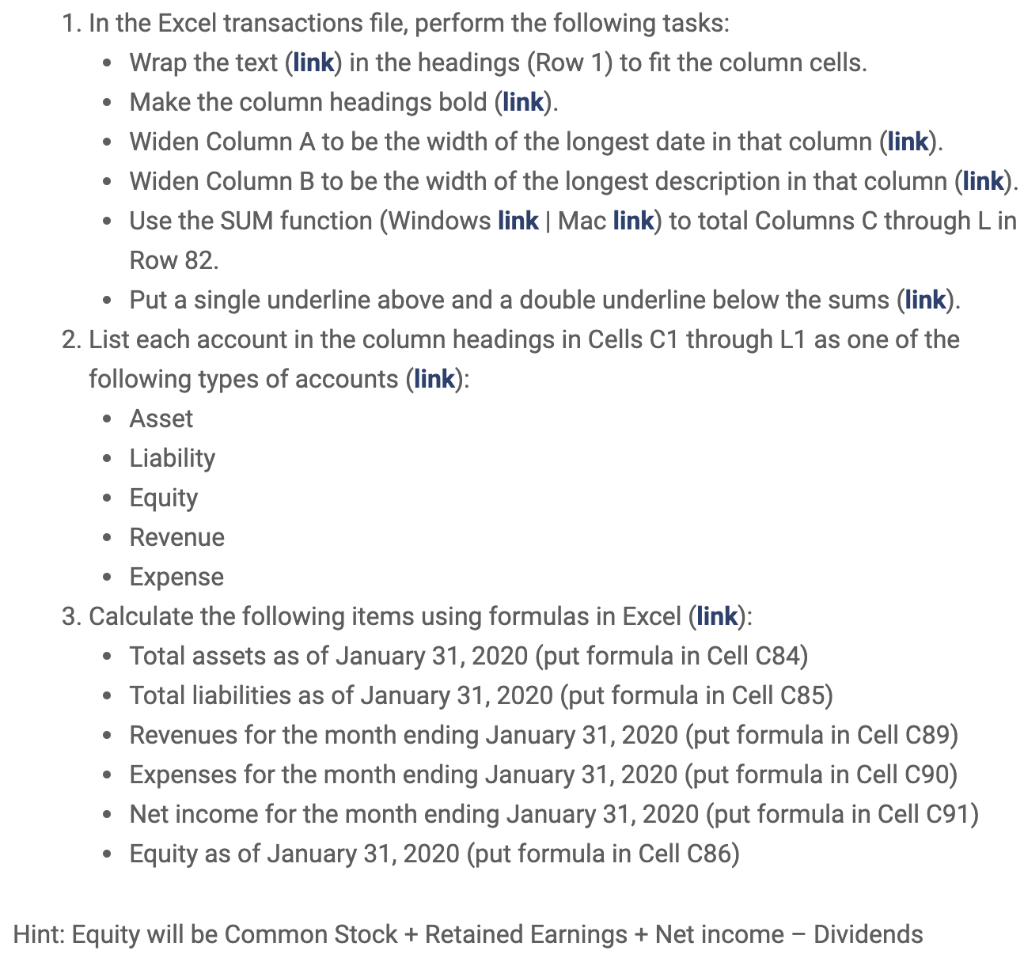

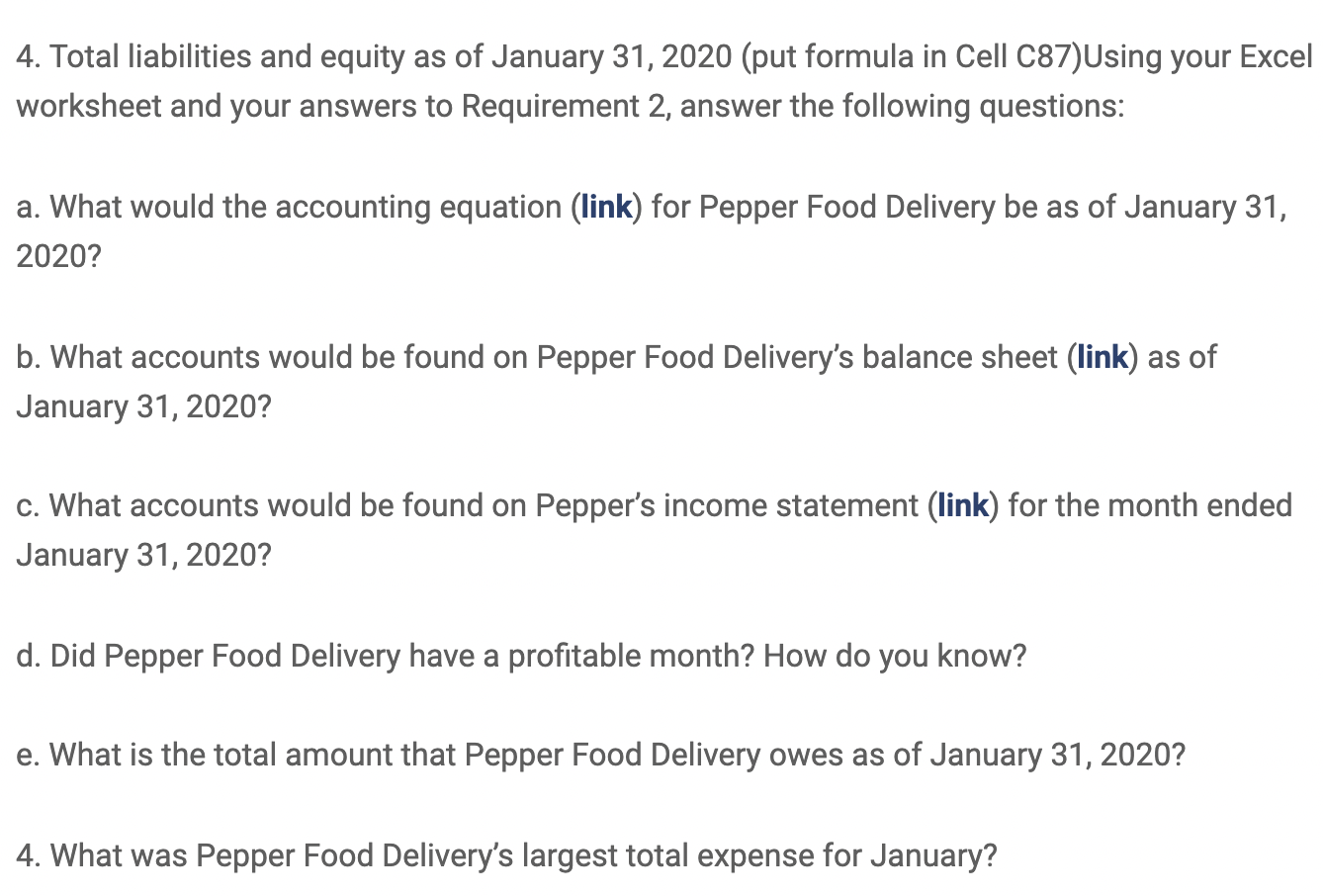

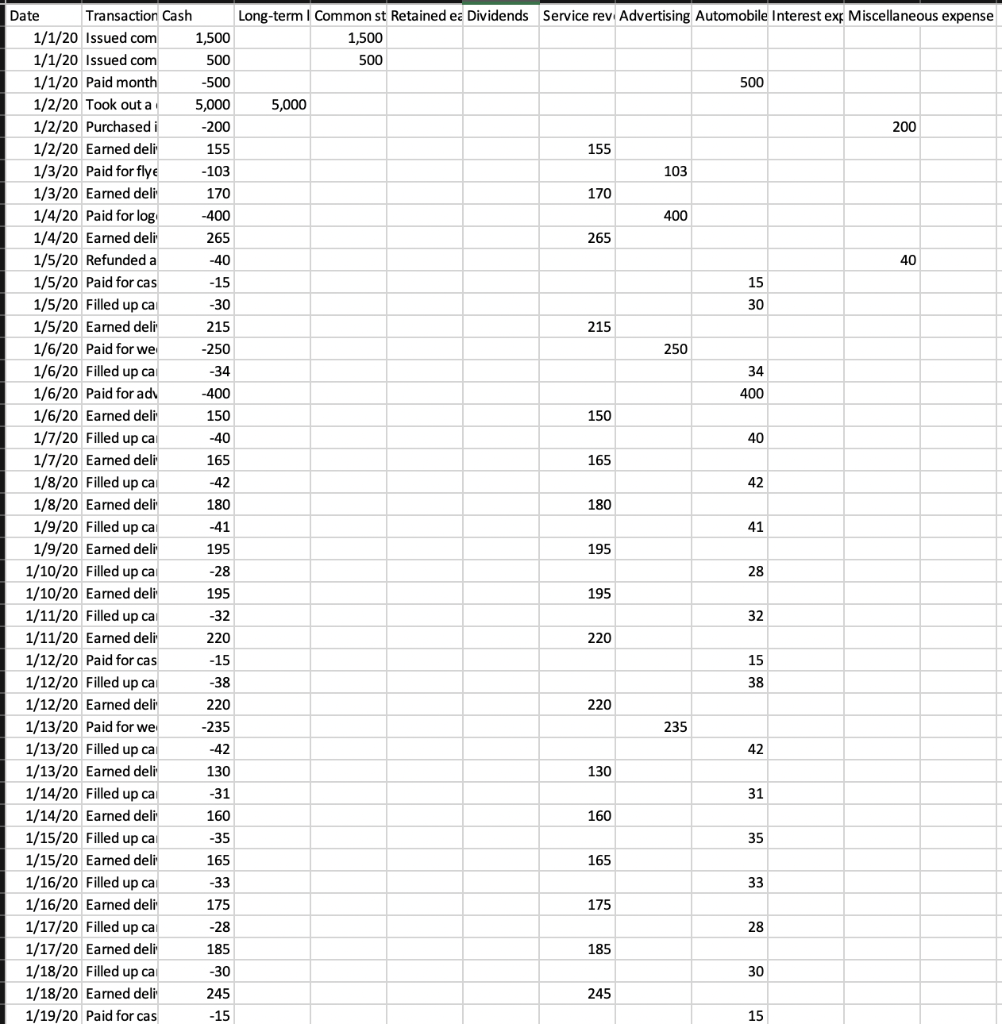

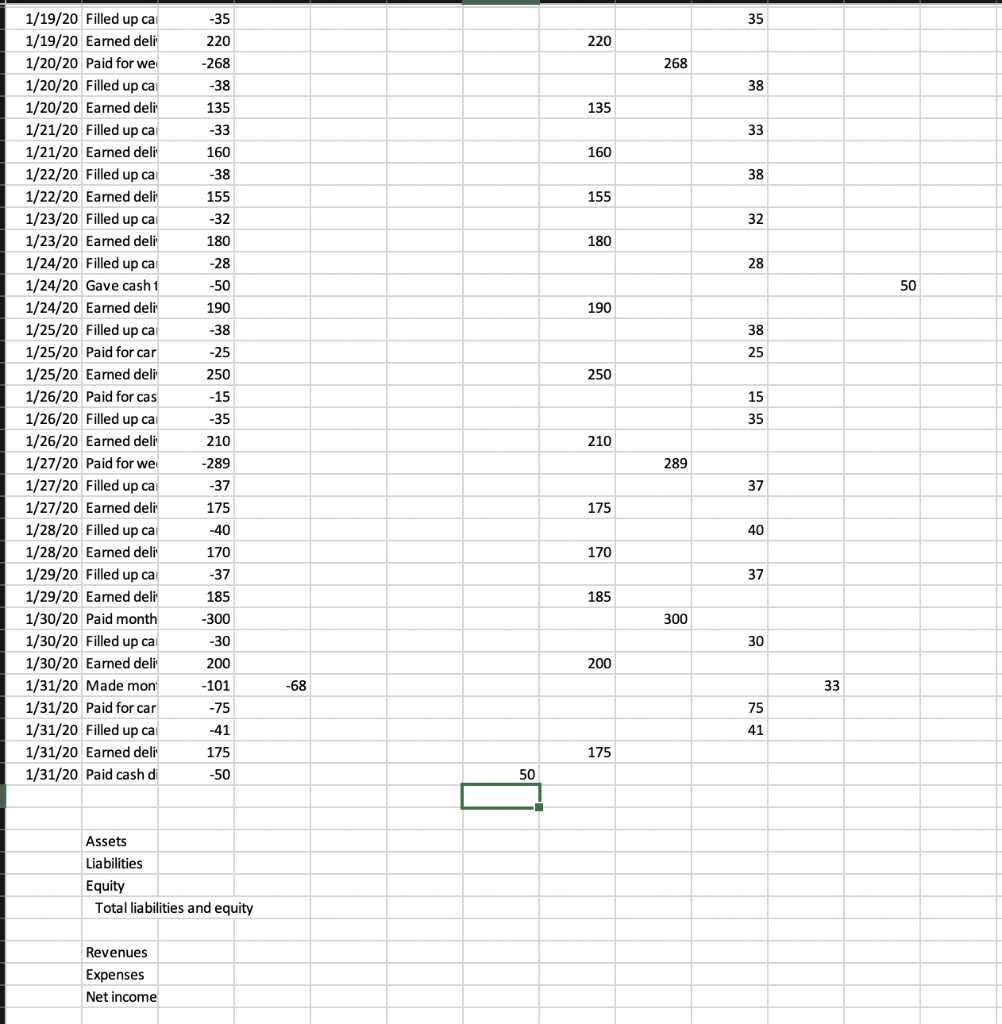

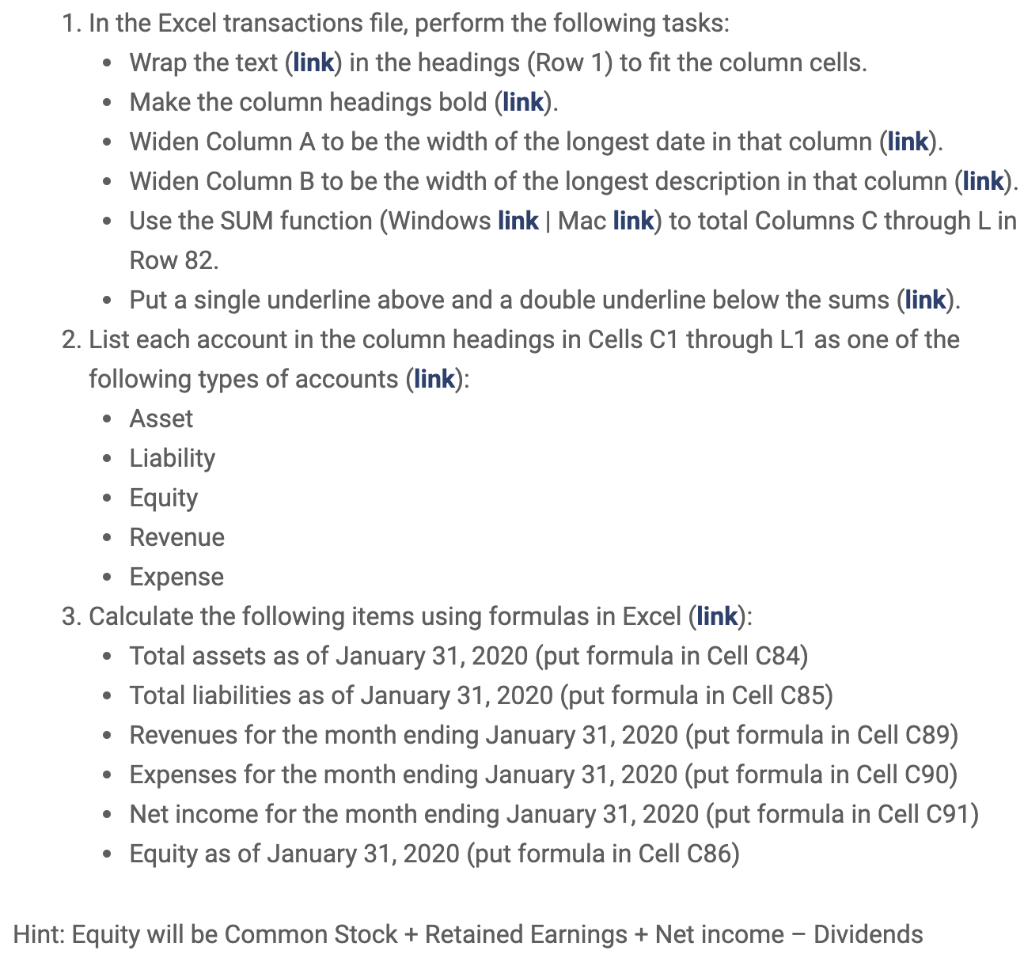

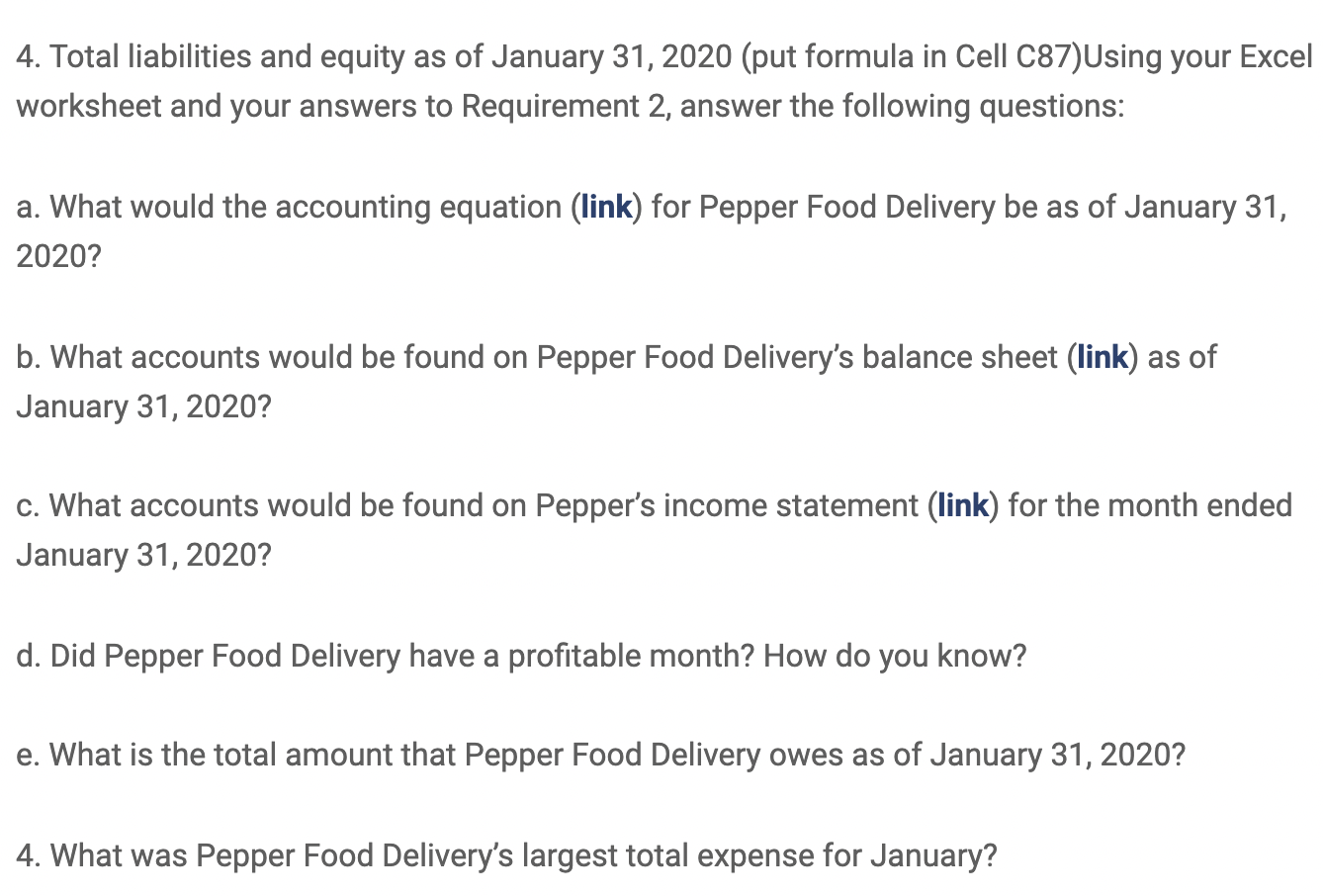

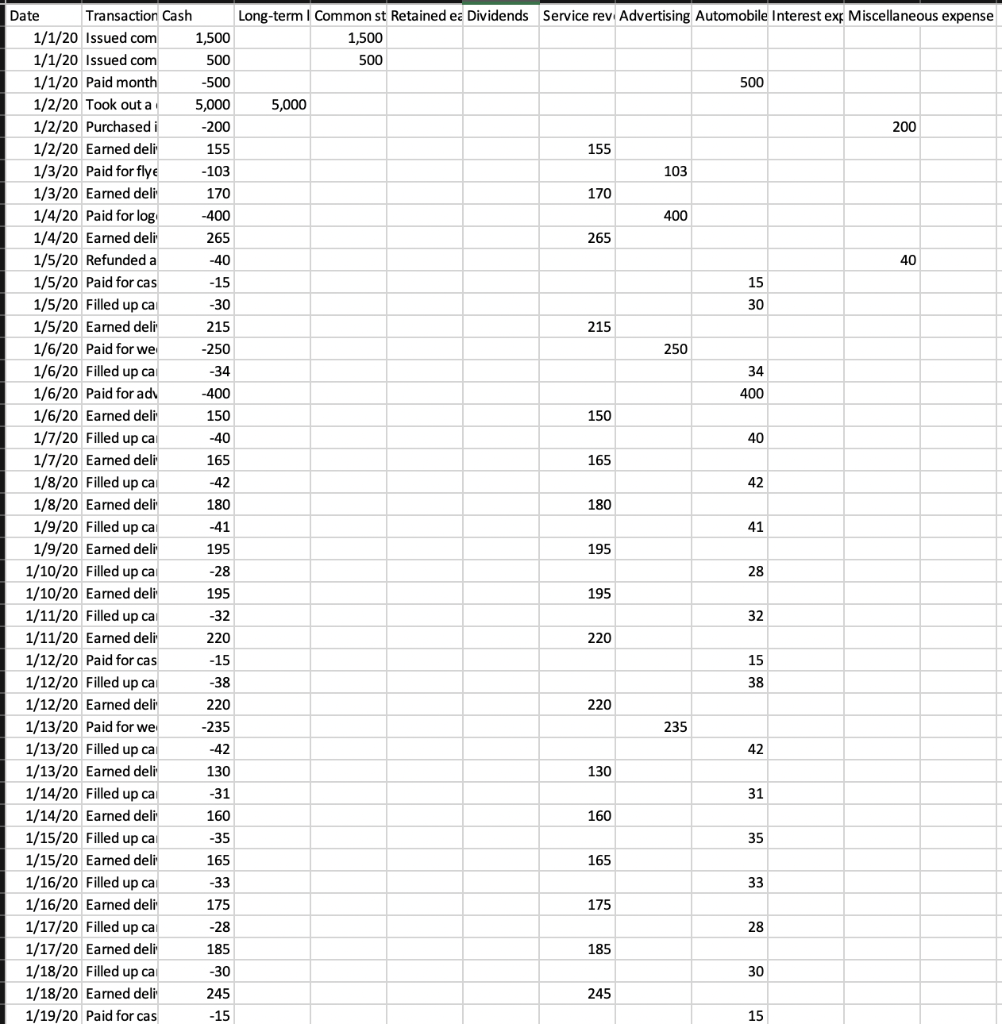

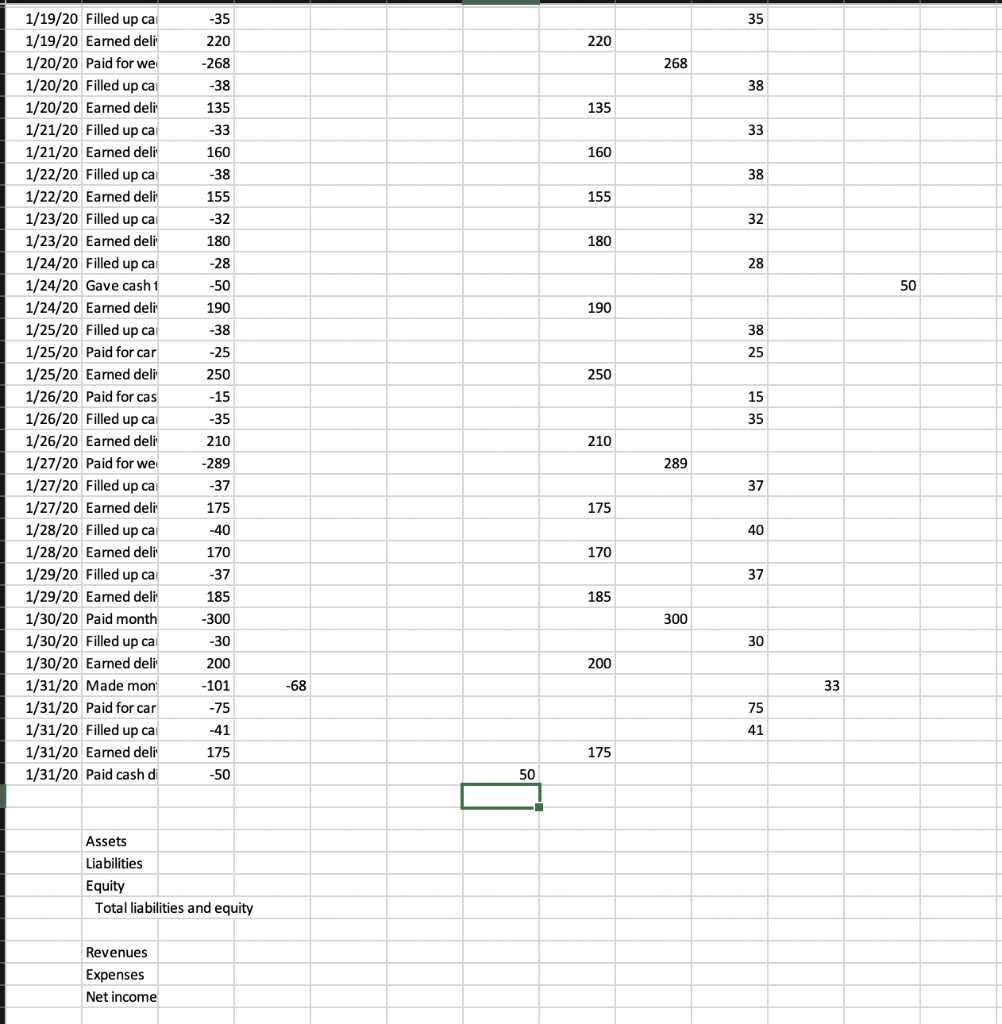

. . 1. In the Excel transactions file, perform the following tasks: Wrap the text (link) in the headings (Row 1) to fit the column cells. Make the column headings bold (link). Widen Column A to be the width of the longest date in that column (link). Widen Column B to be the width of the longest description in that column (link). Use the SUM function (Windows link | Mac link) to total Columns C through Lin Row 82. Put a single underline above and a double underline below the sums (link). 2. List each account in the column headings in Cells C1 through L1 as one of the following types of accounts (link): Asset Liability Equity Revenue Expense 3. Calculate the following items using formulas in Excel (link): Total assets as of January 31, 2020 (put formula in Cell C84) Total liabilities as of January 31, 2020 (put formula in Cell C85) Revenues for the month ending January 31, 2020 (put formula in Cell C89) Expenses for the month ending January 31, 2020 (put formula in Cell 090) Net income for the month ending January 31, 2020 (put formula in Cell C91) Equity as of January 31, 2020 (put formula in Cell C86) . . . Hint: Equity will be Common Stock + Retained Earnings + Net income Dividends 4. Total liabilities and equity as of January 31, 2020 (put formula in Cell C87)Using your Excel worksheet and your answers to Requirement 2, answer the following questions: a. What would the accounting equation (link) for Pepper Food Delivery be as of January 31, 2020? b. What accounts would be found on Pepper Food Delivery's balance sheet (link) as of January 31, 2020? c. What accounts would be found on Pepper's income statement (link) for the month ended January 31, 2020? d. Did Pepper Food Delivery have a profitable month? How do you know? e. What is the total amount that Pepper Food Delivery owes as of January 31, 2020? 4. What was Pepper Food Delivery's largest total expense for January? Long-term I Common st Retained ea Dividends Service rev Advertising Automobile Interest exp Miscellaneous expense 1,500 500 500 5,000 200 155 103 170 400 265 40 15 30 215 250 34 400 150 40 165 42 180 Date Transaction Cash 1/1/20 Issued com 1,500 1/1/20 Issued com 500 1/1/20 Paid month -500 1/2/20 Took out a 5,000 1/2/20 Purchased i -200 1/2/20 Earned deli 155 1/3/20 Paid for flye -103 1/3/20 Earned deli 170 1/4/20 Paid for log -400 1/4/20 Earned deli 265 1/5/20 Refunded a -40 1/5/20 Paid for cas -15 1/5/20 Filled up ca -30 1/5/20 Earned deli 215 1/6/20 Paid for we -250 1/6/20 Filled up ca -34 1/6/20 Paid for ad -400 1/6/20 Earned deli 150 1/7/20 Filled up ca -40 1/7/20 Earned deli 165 1/8/20 Filled up ca -42 1/8/20 Earned deli 180 1/9/20 Filled up ca -41 1/9/20 Earned deli 195 1/10/20 Filled up ca -28 1/10/20 Earned deli 195 1/11/20 Filled up cal -32 1/11/20 Earned deli 220 1/12/20 Paid for cas -15 1/12/20 Filled up ca -38 1/12/20 Earned deli 220 1/13/20 Paid for we -235 1/13/20 Filled up ca -42 1/13/20 Earned deli 130 1/14/20 Filled up ca -31 1/14/20 Earned deli 160 1/15/20 Filled up ca -35 1/15/20 Earned deli 165 1/16/20 Filled up ca -33 1/16/20 Earned deli 175 1/17/20 Filled up ca -28 1/17/20 Earned deli 185 1/18/20 Filled up ca -30 1/18/20 Earned deli 245 1/19/20 Paid for cas -15 41 195 28 195 32 220 15 38 220 235 42 130 31 160 35 165 33 175 28 185 30 245 15 35 -35 220 -268 220 268 -38 38 135 135 -33 160 33 160 38 -38 155 155 32 -32 180 180 -28 28 -50 50 190 190 -38 38 25 250 1/19/20 Filled up ca 1/19/20 Earned deli 1/20/20 Paid for we 1/20/20 Filled up ca 1/20/20 Earned deli 1/21/20 Filled up ca 1/21/20 Earned deli 1/22/20 Filled up ca 1/22/20 Earned deli 1/23/20 Filled up ca 1/23/20 Earned deli 1/24/20 Filled up ca 1/24/20 Gave cash 1/24/20 Earned deli 1/25/20 Filled up ca 1/25/20 Paid for car 1/25/20 Earned deli 1/26/20 Paid for cas 1/26/20 Filled up ca 1/26/20 Earned deli 1/27/20 Paid for we 1/27/20 Filled up ca 1/27/20 Earned deli 1/28/20 Filled up ca 1/28/20 Earned deli 1/29/20 Filled up ca 1/29/20 Earned deli 1/30/20 Paid month 1/30/20 Filled up ca 1/30/20 Earned deli 1/31/20 Made mon 1/31/20 Paid for car 1/31/20 Filled up ca 1/31/20 Earned deli 1/31/20 Paid cash di 15 35 -25 250 -15 -35 210 -289 -37 175 210 37 175 -40 40 170 170 37 -37 185 -300 185 300 -30 30 200 200 -101 -68 33 -75 75 -41 41 175 175 -50 . 50 Assets Liabilities Equity Total liabilities and equity Revenues Expenses Net income . . 1. In the Excel transactions file, perform the following tasks: Wrap the text (link) in the headings (Row 1) to fit the column cells. Make the column headings bold (link). Widen Column A to be the width of the longest date in that column (link). Widen Column B to be the width of the longest description in that column (link). Use the SUM function (Windows link | Mac link) to total Columns C through Lin Row 82. Put a single underline above and a double underline below the sums (link). 2. List each account in the column headings in Cells C1 through L1 as one of the following types of accounts (link): Asset Liability Equity Revenue Expense 3. Calculate the following items using formulas in Excel (link): Total assets as of January 31, 2020 (put formula in Cell C84) Total liabilities as of January 31, 2020 (put formula in Cell C85) Revenues for the month ending January 31, 2020 (put formula in Cell C89) Expenses for the month ending January 31, 2020 (put formula in Cell 090) Net income for the month ending January 31, 2020 (put formula in Cell C91) Equity as of January 31, 2020 (put formula in Cell C86) . . . Hint: Equity will be Common Stock + Retained Earnings + Net income Dividends 4. Total liabilities and equity as of January 31, 2020 (put formula in Cell C87)Using your Excel worksheet and your answers to Requirement 2, answer the following questions: a. What would the accounting equation (link) for Pepper Food Delivery be as of January 31, 2020? b. What accounts would be found on Pepper Food Delivery's balance sheet (link) as of January 31, 2020? c. What accounts would be found on Pepper's income statement (link) for the month ended January 31, 2020? d. Did Pepper Food Delivery have a profitable month? How do you know? e. What is the total amount that Pepper Food Delivery owes as of January 31, 2020? 4. What was Pepper Food Delivery's largest total expense for January? Long-term I Common st Retained ea Dividends Service rev Advertising Automobile Interest exp Miscellaneous expense 1,500 500 500 5,000 200 155 103 170 400 265 40 15 30 215 250 34 400 150 40 165 42 180 Date Transaction Cash 1/1/20 Issued com 1,500 1/1/20 Issued com 500 1/1/20 Paid month -500 1/2/20 Took out a 5,000 1/2/20 Purchased i -200 1/2/20 Earned deli 155 1/3/20 Paid for flye -103 1/3/20 Earned deli 170 1/4/20 Paid for log -400 1/4/20 Earned deli 265 1/5/20 Refunded a -40 1/5/20 Paid for cas -15 1/5/20 Filled up ca -30 1/5/20 Earned deli 215 1/6/20 Paid for we -250 1/6/20 Filled up ca -34 1/6/20 Paid for ad -400 1/6/20 Earned deli 150 1/7/20 Filled up ca -40 1/7/20 Earned deli 165 1/8/20 Filled up ca -42 1/8/20 Earned deli 180 1/9/20 Filled up ca -41 1/9/20 Earned deli 195 1/10/20 Filled up ca -28 1/10/20 Earned deli 195 1/11/20 Filled up cal -32 1/11/20 Earned deli 220 1/12/20 Paid for cas -15 1/12/20 Filled up ca -38 1/12/20 Earned deli 220 1/13/20 Paid for we -235 1/13/20 Filled up ca -42 1/13/20 Earned deli 130 1/14/20 Filled up ca -31 1/14/20 Earned deli 160 1/15/20 Filled up ca -35 1/15/20 Earned deli 165 1/16/20 Filled up ca -33 1/16/20 Earned deli 175 1/17/20 Filled up ca -28 1/17/20 Earned deli 185 1/18/20 Filled up ca -30 1/18/20 Earned deli 245 1/19/20 Paid for cas -15 41 195 28 195 32 220 15 38 220 235 42 130 31 160 35 165 33 175 28 185 30 245 15 35 -35 220 -268 220 268 -38 38 135 135 -33 160 33 160 38 -38 155 155 32 -32 180 180 -28 28 -50 50 190 190 -38 38 25 250 1/19/20 Filled up ca 1/19/20 Earned deli 1/20/20 Paid for we 1/20/20 Filled up ca 1/20/20 Earned deli 1/21/20 Filled up ca 1/21/20 Earned deli 1/22/20 Filled up ca 1/22/20 Earned deli 1/23/20 Filled up ca 1/23/20 Earned deli 1/24/20 Filled up ca 1/24/20 Gave cash 1/24/20 Earned deli 1/25/20 Filled up ca 1/25/20 Paid for car 1/25/20 Earned deli 1/26/20 Paid for cas 1/26/20 Filled up ca 1/26/20 Earned deli 1/27/20 Paid for we 1/27/20 Filled up ca 1/27/20 Earned deli 1/28/20 Filled up ca 1/28/20 Earned deli 1/29/20 Filled up ca 1/29/20 Earned deli 1/30/20 Paid month 1/30/20 Filled up ca 1/30/20 Earned deli 1/31/20 Made mon 1/31/20 Paid for car 1/31/20 Filled up ca 1/31/20 Earned deli 1/31/20 Paid cash di 15 35 -25 250 -15 -35 210 -289 -37 175 210 37 175 -40 40 170 170 37 -37 185 -300 185 300 -30 30 200 200 -101 -68 33 -75 75 -41 41 175 175 -50 . 50 Assets Liabilities Equity Total liabilities and equity Revenues Expenses Net income