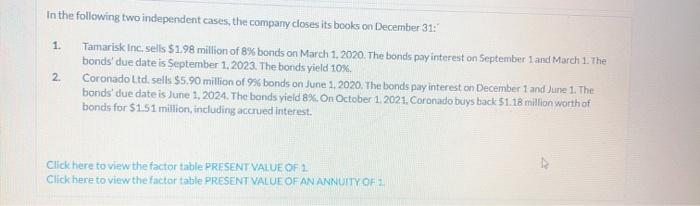

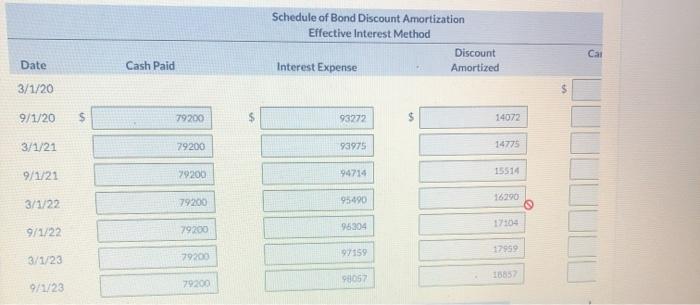

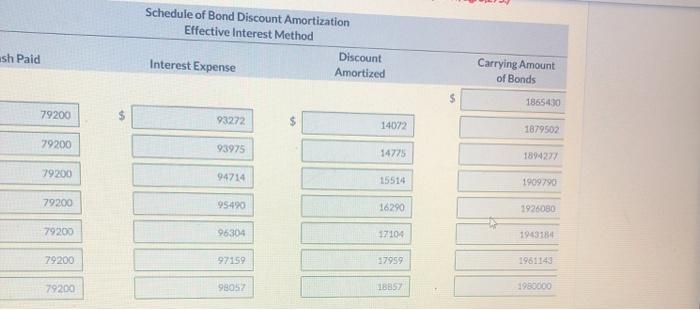

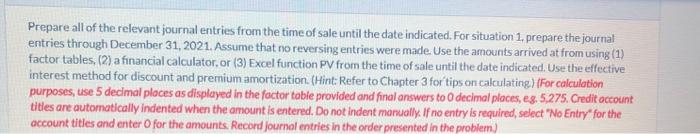

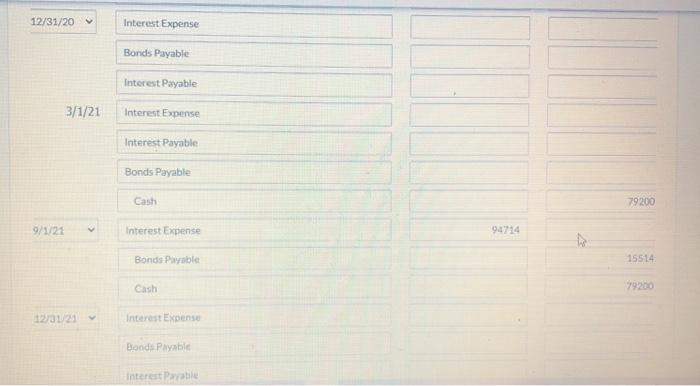

1. In the following two independent cases, the company closes its books on December 313 Tamarisk Inc.sells $1.98 million of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds due date is September 1, 2023. The bonds yield 10%. Coronado Ltd sells $5.90 million of 9% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The bonds' due date is June 1, 2024. The bonds yield 8%. On October 1, 2021. Coronado buys back $1.18 million worth of bonds for $1.5 1 million, including accrued interest. 2. Click here to view the factor table PRESENT VALUE OF 1 Click here to view the factor table PRESENT VALUE OF AN ANNUITY OFIZ Schedule of Bond Discount Amortization Effective Interest Method Discount Interest Expense Amortized Cal Date Cash Paid 3/1/20 $ 9/1/20 S 79200 $ 93272 14072 3/1/21 79200 93975 14775 9/1/21 15514 79200 94714 3/1/22 16290 95490 79200 17104 96304 9/1/22 79200 97159 17959 3/1/23 79200 9/1/23 79200 98057 Schedule of Bond Discount Amortization Effective Interest Method Discount Interest Expense Amortized ash Paid Carrying Amount of Bonds 1865430 79200 $ 93272 $ 14072 1879502 79200 93975 14775 1894277 79200 94714 15514 1909790 79200 95490 16290 1926080 79200 96304 17100 1943184 79200 97159 17959 1961143 79200 98057 48857 1980000 Prepare all of the relevant journal entries from the time of sale until the date indicated. For situation 1. prepare the journal entries through December 31, 2021. Assume that no reversing entries were made. Use the amounts arrived at from using (1) factor tables, (2) a financial calculator, or (3) Excel function PV from the time of sale until the date indicated. Use the effective interest method for discount and premium amortization. (Hint: Refer to Chapter 3 for tips on calculating) (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to decimal places, es, 5275. Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) 12/31/20 Interest Expense Bonds Payable Interest Payable 3/1/21 Interest Expense Interest Payable Bonds Payable Cash 79200 9/1/21