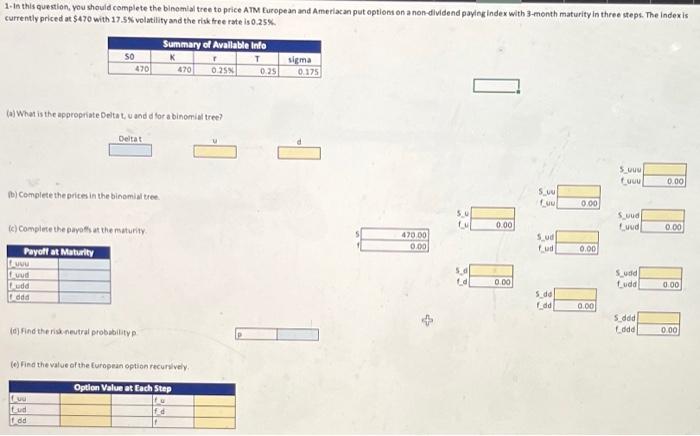

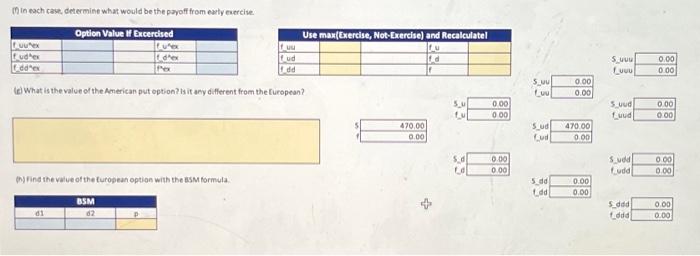

1. In this question. You should complete the binomial tree to price ATM European and American put options on a non dividend paying Index with 3-month maturity in three steps. The Index is currently priced at $470 with 17.5% volatility and the risk free rate is 0.25% Summary of Avaliable info 50 sigma 470 K 470 0.25% T 0.25 0.175 (a) What is the appropriate Deltat and for a binomial tree? Deltat -1 5. Luu 0.00 (b) Complete the prices in the binomial tree. S. fu 0.00 5.4 (c) Complete the profil at the maturity 0.00 Suud uud 0.00 470.00 0.00 Sud tud 0.00 Payoff at Maturity tu uud udd ddd 5. La 0.00 Sudd tudd 0.00 5 do Edd 0.00 (0) Find the risk neutral probability 5 ddd Edda 0.00 to) Find the value of the European option recursively Option Value at Each Step uu Itud dd d m in each cam, determine what would be the payoff from early exercise Option Value If Excercised tex Tudter It done Use max(Exercise, Not-Exercise) and Recalculatel LU Id It dhe ud dd 5 www Uuu 0.00 0.00 te What is the value of the American put option? Is it any different from the l'uropean? SUU uu 0.00 0.00 5. 0.00 0 00 5 uud Luud 0.00 0 00 470.00 0.00 Sud Cu 470.00 0.00 5d 0.00 0.00 Suod Eudal 0.00 0.00 o find the value of the European option with the formula, 5 dd dal 0.00 0.00 BSM d2 ded ddd 0.00 0.00 1. In this question. You should complete the binomial tree to price ATM European and American put options on a non dividend paying Index with 3-month maturity in three steps. The Index is currently priced at $470 with 17.5% volatility and the risk free rate is 0.25% Summary of Avaliable info 50 sigma 470 K 470 0.25% T 0.25 0.175 (a) What is the appropriate Deltat and for a binomial tree? Deltat -1 5. Luu 0.00 (b) Complete the prices in the binomial tree. S. fu 0.00 5.4 (c) Complete the profil at the maturity 0.00 Suud uud 0.00 470.00 0.00 Sud tud 0.00 Payoff at Maturity tu uud udd ddd 5. La 0.00 Sudd tudd 0.00 5 do Edd 0.00 (0) Find the risk neutral probability 5 ddd Edda 0.00 to) Find the value of the European option recursively Option Value at Each Step uu Itud dd d m in each cam, determine what would be the payoff from early exercise Option Value If Excercised tex Tudter It done Use max(Exercise, Not-Exercise) and Recalculatel LU Id It dhe ud dd 5 www Uuu 0.00 0.00 te What is the value of the American put option? Is it any different from the l'uropean? SUU uu 0.00 0.00 5. 0.00 0 00 5 uud Luud 0.00 0 00 470.00 0.00 Sud Cu 470.00 0.00 5d 0.00 0.00 Suod Eudal 0.00 0.00 o find the value of the European option with the formula, 5 dd dal 0.00 0.00 BSM d2 ded ddd 0.00 0.00