Answered step by step

Verified Expert Solution

Question

1 Approved Answer

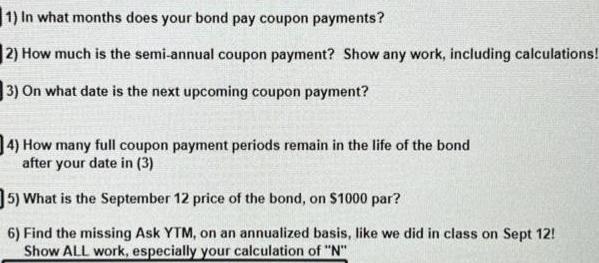

1) In what months does your bond pay coupon payments? 2) How much is the semi-annual coupon payment? Show any work, including calculations! 3)

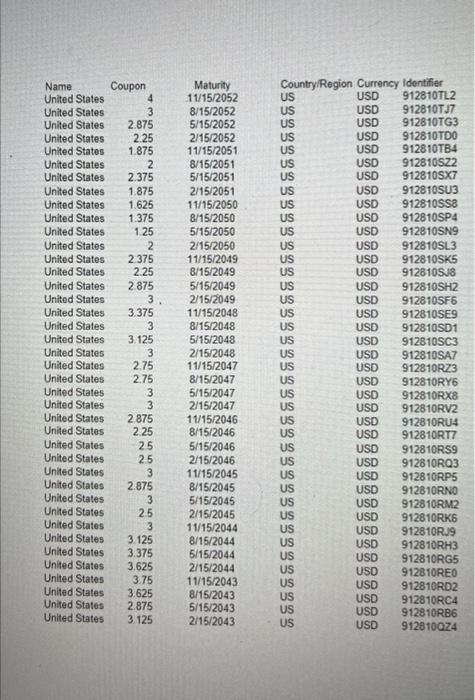

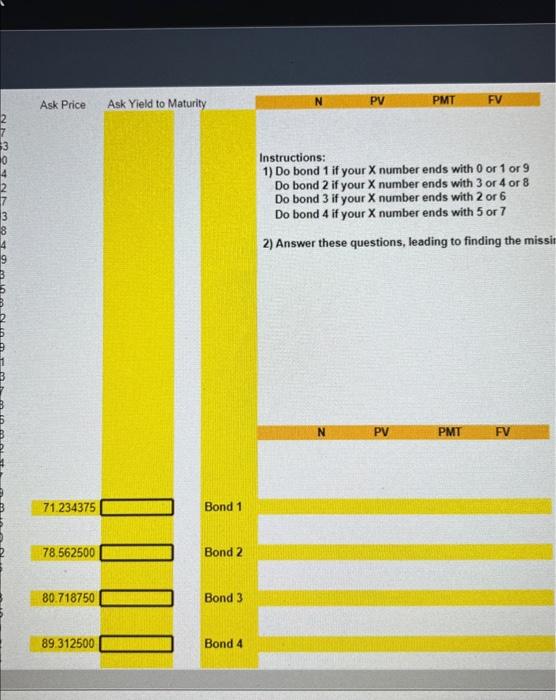

1) In what months does your bond pay coupon payments? 2) How much is the semi-annual coupon payment? Show any work, including calculations! 3) On what date is the next upcoming coupon payment? 4) How many full coupon payment periods remain in the life of the bond after your date in (3) 5) What is the September 12 price of the bond, on $1000 par? 6) Find the missing Ask YTM, on an annualized basis, like we did in class on Sept 12! Show ALL work, especially your calculation of "N" Name United States United States United States United States United States 2.875 United States 2.25 United States 1.875 2 2.375 United States 1.875 United States 1.625 1.375 1.25 2 United States United States United States United States United States United States United States United States United States United States United States United States United States United States United States United States United States United States United States United States United States United States Coupon United States United States United States United States United States 4 3 2.375 2.25 2.875 3. 3.375 3 3.125 3 2.75 2.75 3 3555536 2.875 2.25 25 25 2.875 3 25 3 3.125 3.375 3.625 United States 3.75 United States 3.625 United States 2.875 United States 3.125 Maturity 11/15/2052 8/15/2052 5/15/2052 2/15/2052 11/15/2051 8/15/2051 5/15/2051 2/15/2051 11/15/2050 8/15/2050 5/15/2050 2/15/2050 11/15/2049 8/15/2049 5/15/2049 2/15/2049 11/15/2048 8/15/2048 5/15/2048 2/15/2048 11/15/2047 8/15/2047 5/15/2047 2/15/2047 11/15/2046 8/15/2046 5/15/2046 2/15/2046 11/15/2045 8/15/2045 5/15/2045 2/15/2045 11/15/2044 8/15/2044 5/15/2044 2/15/2044 11/15/2043 8/15/2043 5/15/2043 2/15/2043 Country/Region Currency Identifier 912810TL2 89999999999999999999999999999999999999999 US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US US USD USD USD USD USD USD USD USD USD 912810TJ7 912810TG3 912810TD0 912810TB4 912810SU3 912810SS8 912810SP4 912810SN9 912810SL3 912810SK5 912810SJ8 USD 912810SH2 USD 912810SF6 USD 912810SE9 USD 912810SD1 USD 912810SC3 USD 912810SA7 USD 912810RZ3 USD 912810RY6 USD 912810RX8 USD USD USD USD USD USD USD USD USD 912810522 912810SX7 912810RV2 912810RU4 912810RT7 912810RS9 912810RQ3 USD USD 912810RP5 USD USD 912810RNO 912810RM2 912810RK6 912810RJ9 USD USD USD 912810RH3 USD USD USD USD USD 912810RG5 912810RE0 912810RD2 912810RC4 912810RB6 912810024 USD Ask Price 71.234375 78.562500 80.718750 89.312500 Ask Yield to Maturity Bond 1 Bond 2 Bond 3 Bond 4 PV N PMT Instructions: 1) Do bond 1 if your X number ends with 0 or 1 or 9 Do bond 2 if your X number ends with 3 or 4 or 8 Do bond 3 if your X number ends with 2 or 6 Do bond 4 if your X number ends with 5 or 7 2) Answer these questions, leading to finding the missin PV FV PMT FV

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer Current bond price 108931 YTM 37 Coupon rate 5 semiannual coupon payments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started