Answered step by step

Verified Expert Solution

Question

1 Approved Answer

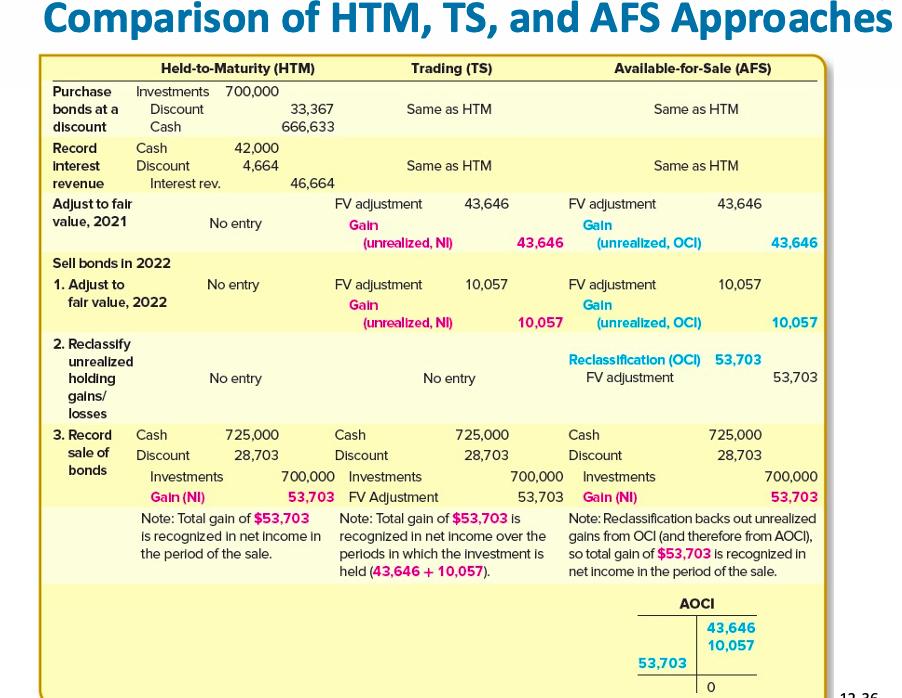

1. In what way is the treatment of HTM different from the other two (TS and AFS)? 2. A stock can obviously not be classified

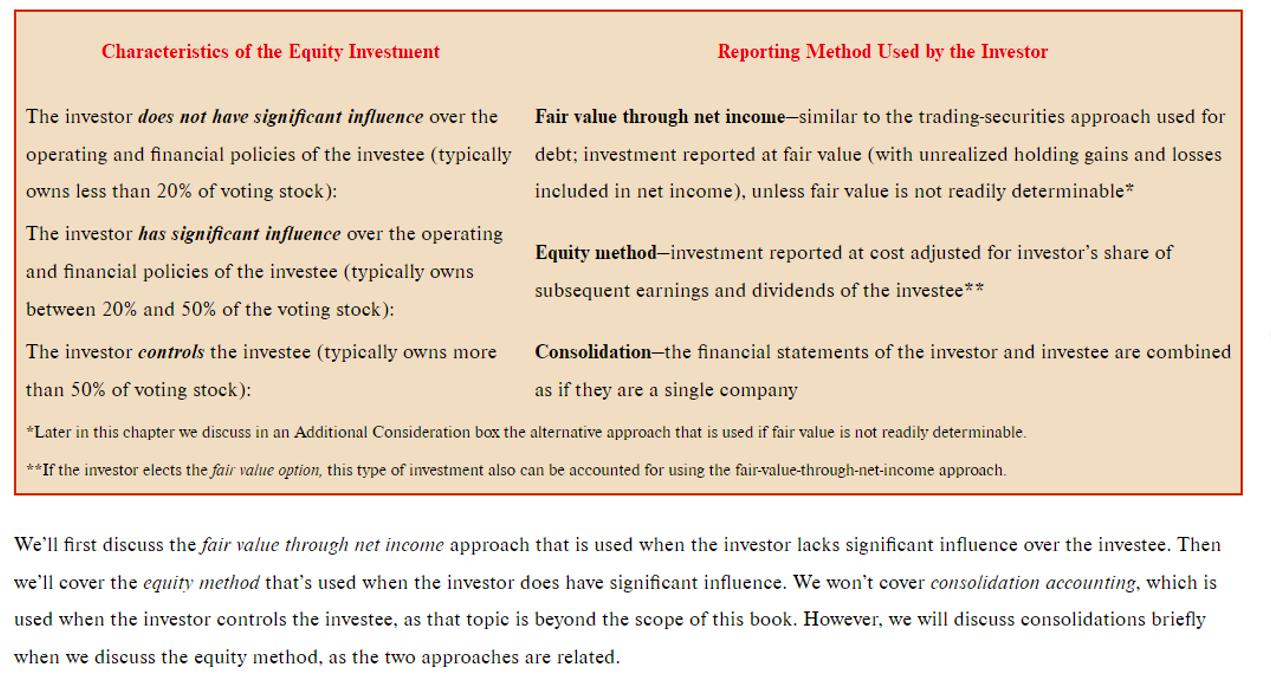

Characteristics of the Equity Investment The investor does not have significant influence over the operating and financial policies of the investee (typically owns less than 20% of voting stock): Reporting Method Used by the Investor Fair value through net income-similar to the trading-securities approach used for debt; investment reported at fair value (with unrealized holding gains and losses included in net income), unless fair value is not readily determinable* The investor has significant influence over the operating and financial policies of the investee (typically owns between 20% and 50% of the voting stock): The investor controls the investee (typically owns more than 50% of voting stock): *Later in this chapter we discuss in an Additional Consideration box the alternative approach that is used if fair value is not readily determinable. **If the investor elects the fair value option, this type of investment also can be accounted for using the fair-value-through-net-income approach. Equity method-investment reported at cost adjusted for investor's share of subsequent earnings and dividends of the investee** Consolidation-the financial statements of the investor and investee are combined as if they are a single company We'll first discuss the fair value through net income approach that is used when the investor lacks significant influence over the investee. Then we'll cover the equity method that's used when the investor does have significant influence. We won't cover consolidation accounting, which is used when the investor controls the investee, as that topic is beyond the scope of this book. However, we will discuss consolidations briefly when we discuss the equity method, as the two approaches are related.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Step 1 1 The treatment of HTM Held to Maturity is different from the other two Trading Securities and Available for Sale in that it is an acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started