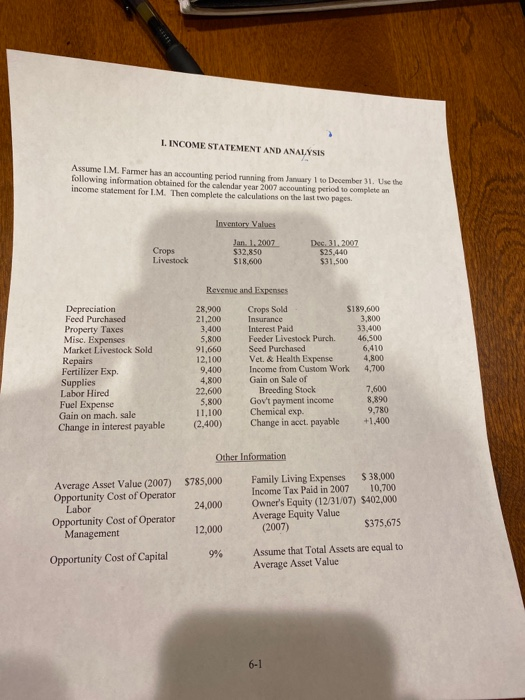

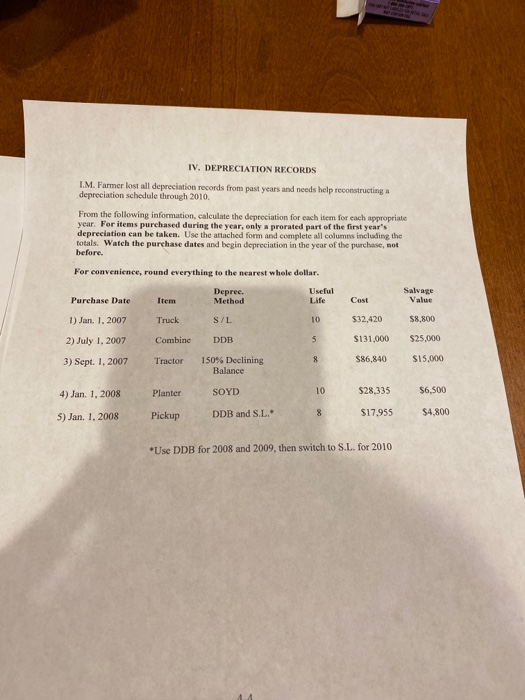

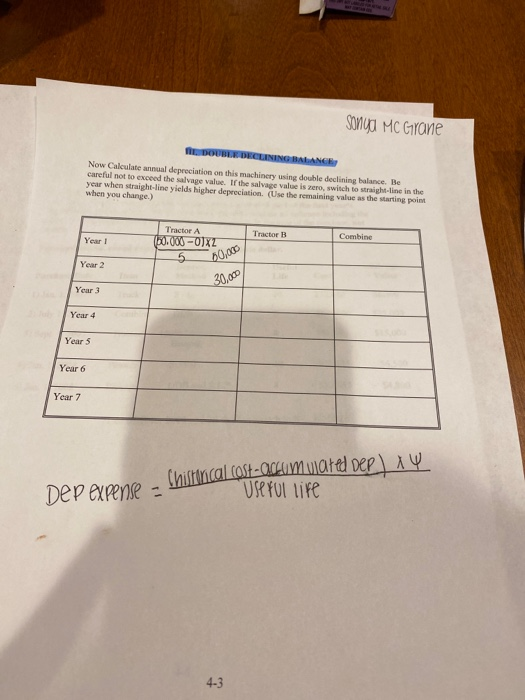

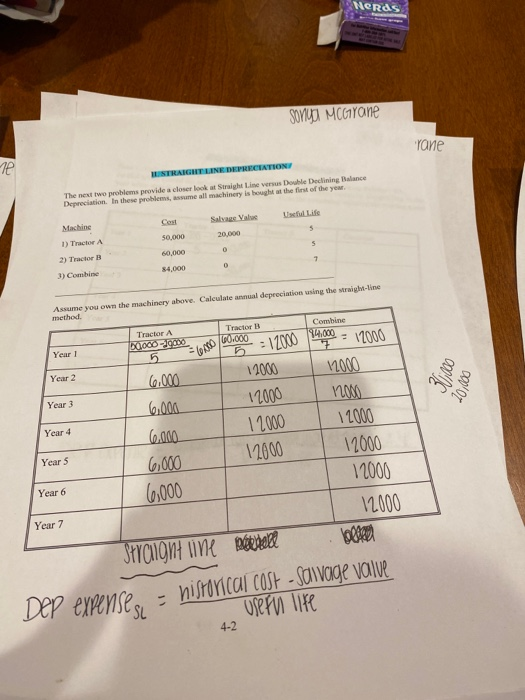

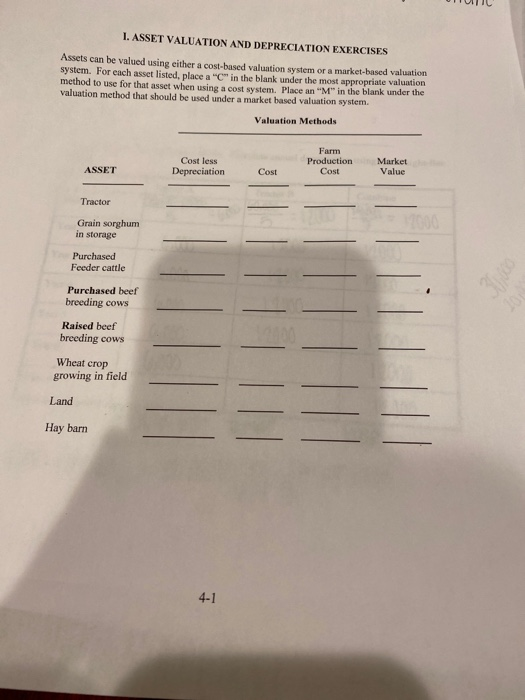

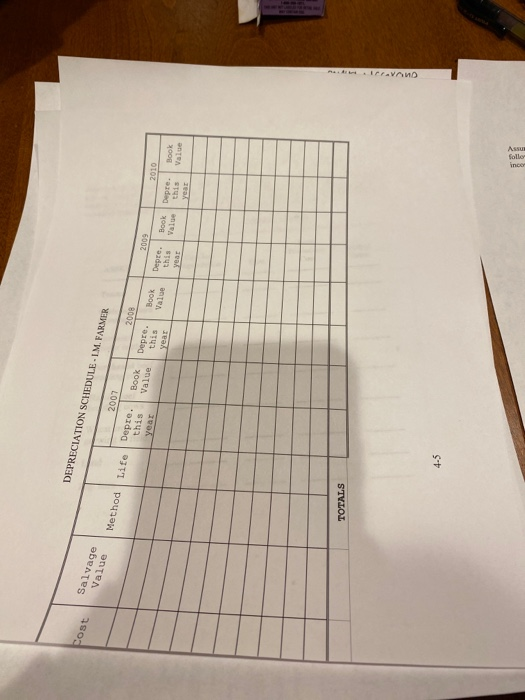

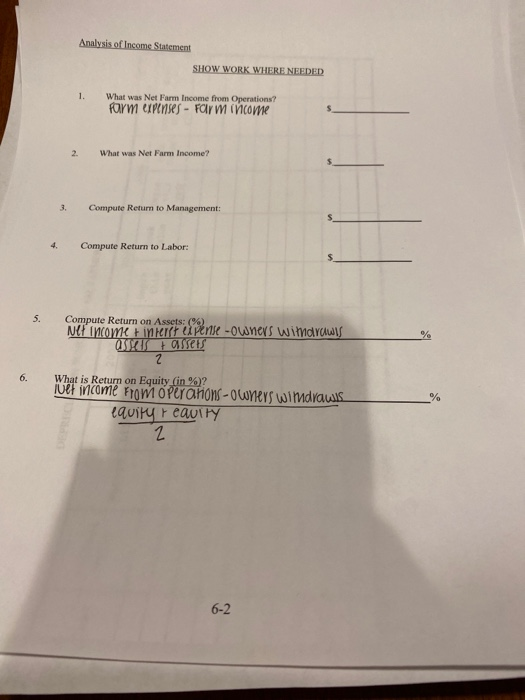

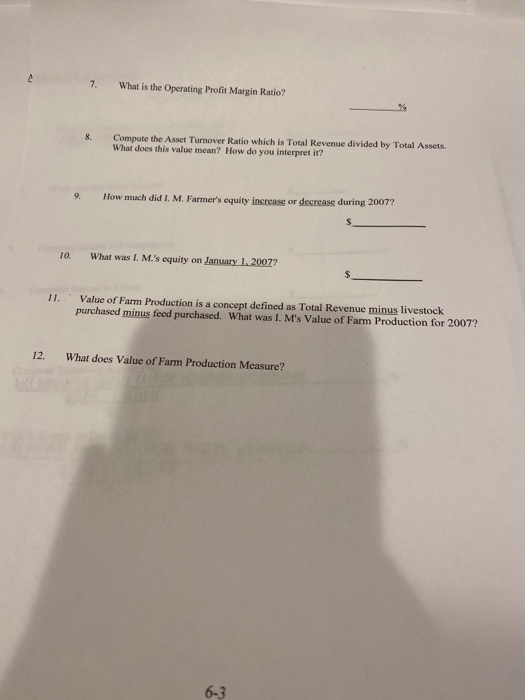

1. INCOME STATEMENT AND ANALYSIS Assume LM Farmer has an accounting period running from way to December 31. Use the following information obtained for the calendar year 2007 counting period to complete an income statement for LM. Then complete the calculations on the last two pages Inventory Values Crops Livestock Jan. 1.2007 $32.850 $18.600 Dec 31, 2007 $25.440 $31.500 Revenue and Expenses 28 900 21.200 3.400 Depreciation Feed Purchased Property Taxes Misc. Expenses Market Livestock Sold Repairs Fertilizer Exp. Supplies Labor Hired Fuel Expense Gain on mach. sale Change in interest payable 5,800 91.660 12.100 9.400 4,800 22,600 5,800 11,100 (2,400) Crops Sold S189,600 Insurance 3,800 Interest Paid 33.400 Feeder Livestock Purch. 46,500 Seed Purchased 6,410 Vet. & Health Expense 4,800 Income from Custom Work 4,700 Gain on Sale of Breeding Stock 7,600 Gov't payment income 8,890 Chemical exp. 9,780 Change in acct. payable +1.400 Other Information $785,000 Average Asset Value (2007) Opportunity Cost of Operator Labor Opportunity Cost of Operator Management 24,000 Family Living Expenses $38,000 Income Tax Paid in 2007 10,700 Owner's Equity (12/31/07) S402,000 Average Equity Value (2007) $375,675 12,000 9% Opportunity Cost of Capital Assume that Total Assets are equal to Average Asset Value 6-1 IV. DEPRECIATION RECORDS I.M. Farmer lost all depreciation records from past years and needs help reconstructing a depreciation schedule through 2010. From the following information, calculate the depreciation for each item for each appropriate year. For items purchased during the year, only a prorated part of the first year's depreciation ean be taken. Use the attached form and complete all columns including the totals. Watch the purchase dates and begin depreciation in the year of the purchase, not before. For convenience, round everything to the nearest whole dollar. Purchase Date Item Depree. Method Useful Life Salvage Value Cost 1) Jan. 1. 2007 Truck S/L $32,420 $8,800 Combine DDB $131,000 $25.000 2) July 1, 2007 3) Sept. 1, 2007 Tractor $86,840 $15.000 150% Declining Balance 4) Jan 1, 2008 Planter SOYD $28,335 $6,500 5) Jan. 1. 2008 Pickup DDB and S.L. $17.955 $4,800 *Use DDB for 2008 and 2009, then switch to S.L. for 2010 Sonyai MC Crane ME DOUBLE DECLININOBA Now Calculate annual depreciation on this machinery using double declining balance. Be careful not to exceed the salvage value. If the salvage value is er wicht i ght line is the year when straight-line yields higher depreciation. (Use the remaining value as the starting point when you change.) Tractor 10.000 -OXZ Tractor B Combine Year C00.000 Year 2 Year 3 Year 4 Year 5 Year 6 Useful life Dep expene - Chistical cost-Qum valed Deplay Meras Sony Mccrane Tane TRAIGHT LINE DEPRECIATION The next two problems provide a closer look Sigher Depreciation in these problem a chinery is bought De D a the list of the year nce Machine 1) Tractor A Sabunge Value 20,000 Life 50,000 0.000 3) Combine 84.000 Assume you own the machinery above. Calculate anual depreciation using the right-line method Tractor A Conf Tractor .ca Combine Your Year 2 Year 3 V1000 20,000 Year 4 Year 5 -Go 60000 = 12000 14:00 - 12000 6.000 12000 12.000 6.000 12000 12000 6.000 12000 12000 6,000 12000 12000 6,000 12000 12000 Straight line marbelle Dep expenses historical cost - Sai vaige valve useful life 4-2 Year 6 Year 7 UUTIC 1. ASSET VALUATION AND DEPRECIATION EXERCISES Assets can be valued using either a cost-based valuation system or a market-based valuation system. For each asset listed, plase a " in the blank under the most appropriate valuation method to use for that asset when using a cost system. Place an "M" in the blank under the valuation method that should be used under a market based valuation system Valuation Methods Farm eduction ASSET Cost less Depreciation Market Value Cost Cost Tractor Grain sorghum in storage Purchased Feeder cattle Purchased beef breeding cows Raised beef breeding cows Wheat crop growing in field Land Hay barn 4-1 Cost Salvage Value DEPRECIATION SCHEDULE - LM. FARMER 2007 Method Life Depre. Book Value year 2008 Depre. this Book Value Depre. Book Depre. Value TOTALS 4-5 Analysis of Income Statement SHOW WORK WHERE NEEDED 1. What was Net Farm Income from Operations? farm eirenses - Farm income 2. What was Net Farm Income? 3. Compute Return to Management 4. Compute Return to Labor: 5. Compute Return on Assets: (%) NU COM + irrerit opens -owners window DIXUS + assets What is Return on Equity (in %)? Ivet income from operations-owners wirdraws equity requiry 7. What is the Operating Profit Margin Ratio? Compute the Asset Turnover Ratio which is Total Revenue divided by Total Assets. What does this value mean? How do you interpret it? 9. How much did I. M. Farmer's equity increase or decrease during 2007? 10. What was I. M.'s equity on January 1. 2007? II. Value of Farm Production is a concept defined as Total Revenue minus livestock purchased minus feed purchased. What was I M's Value of Farm Production for 2007? 12. What does Value of Farm Production Measure? 1. INCOME STATEMENT AND ANALYSIS Assume LM Farmer has an accounting period running from way to December 31. Use the following information obtained for the calendar year 2007 counting period to complete an income statement for LM. Then complete the calculations on the last two pages Inventory Values Crops Livestock Jan. 1.2007 $32.850 $18.600 Dec 31, 2007 $25.440 $31.500 Revenue and Expenses 28 900 21.200 3.400 Depreciation Feed Purchased Property Taxes Misc. Expenses Market Livestock Sold Repairs Fertilizer Exp. Supplies Labor Hired Fuel Expense Gain on mach. sale Change in interest payable 5,800 91.660 12.100 9.400 4,800 22,600 5,800 11,100 (2,400) Crops Sold S189,600 Insurance 3,800 Interest Paid 33.400 Feeder Livestock Purch. 46,500 Seed Purchased 6,410 Vet. & Health Expense 4,800 Income from Custom Work 4,700 Gain on Sale of Breeding Stock 7,600 Gov't payment income 8,890 Chemical exp. 9,780 Change in acct. payable +1.400 Other Information $785,000 Average Asset Value (2007) Opportunity Cost of Operator Labor Opportunity Cost of Operator Management 24,000 Family Living Expenses $38,000 Income Tax Paid in 2007 10,700 Owner's Equity (12/31/07) S402,000 Average Equity Value (2007) $375,675 12,000 9% Opportunity Cost of Capital Assume that Total Assets are equal to Average Asset Value 6-1 IV. DEPRECIATION RECORDS I.M. Farmer lost all depreciation records from past years and needs help reconstructing a depreciation schedule through 2010. From the following information, calculate the depreciation for each item for each appropriate year. For items purchased during the year, only a prorated part of the first year's depreciation ean be taken. Use the attached form and complete all columns including the totals. Watch the purchase dates and begin depreciation in the year of the purchase, not before. For convenience, round everything to the nearest whole dollar. Purchase Date Item Depree. Method Useful Life Salvage Value Cost 1) Jan. 1. 2007 Truck S/L $32,420 $8,800 Combine DDB $131,000 $25.000 2) July 1, 2007 3) Sept. 1, 2007 Tractor $86,840 $15.000 150% Declining Balance 4) Jan 1, 2008 Planter SOYD $28,335 $6,500 5) Jan. 1. 2008 Pickup DDB and S.L. $17.955 $4,800 *Use DDB for 2008 and 2009, then switch to S.L. for 2010 Sonyai MC Crane ME DOUBLE DECLININOBA Now Calculate annual depreciation on this machinery using double declining balance. Be careful not to exceed the salvage value. If the salvage value is er wicht i ght line is the year when straight-line yields higher depreciation. (Use the remaining value as the starting point when you change.) Tractor 10.000 -OXZ Tractor B Combine Year C00.000 Year 2 Year 3 Year 4 Year 5 Year 6 Useful life Dep expene - Chistical cost-Qum valed Deplay Meras Sony Mccrane Tane TRAIGHT LINE DEPRECIATION The next two problems provide a closer look Sigher Depreciation in these problem a chinery is bought De D a the list of the year nce Machine 1) Tractor A Sabunge Value 20,000 Life 50,000 0.000 3) Combine 84.000 Assume you own the machinery above. Calculate anual depreciation using the right-line method Tractor A Conf Tractor .ca Combine Your Year 2 Year 3 V1000 20,000 Year 4 Year 5 -Go 60000 = 12000 14:00 - 12000 6.000 12000 12.000 6.000 12000 12000 6.000 12000 12000 6,000 12000 12000 6,000 12000 12000 Straight line marbelle Dep expenses historical cost - Sai vaige valve useful life 4-2 Year 6 Year 7 UUTIC 1. ASSET VALUATION AND DEPRECIATION EXERCISES Assets can be valued using either a cost-based valuation system or a market-based valuation system. For each asset listed, plase a " in the blank under the most appropriate valuation method to use for that asset when using a cost system. Place an "M" in the blank under the valuation method that should be used under a market based valuation system Valuation Methods Farm eduction ASSET Cost less Depreciation Market Value Cost Cost Tractor Grain sorghum in storage Purchased Feeder cattle Purchased beef breeding cows Raised beef breeding cows Wheat crop growing in field Land Hay barn 4-1 Cost Salvage Value DEPRECIATION SCHEDULE - LM. FARMER 2007 Method Life Depre. Book Value year 2008 Depre. this Book Value Depre. Book Depre. Value TOTALS 4-5 Analysis of Income Statement SHOW WORK WHERE NEEDED 1. What was Net Farm Income from Operations? farm eirenses - Farm income 2. What was Net Farm Income? 3. Compute Return to Management 4. Compute Return to Labor: 5. Compute Return on Assets: (%) NU COM + irrerit opens -owners window DIXUS + assets What is Return on Equity (in %)? Ivet income from operations-owners wirdraws equity requiry 7. What is the Operating Profit Margin Ratio? Compute the Asset Turnover Ratio which is Total Revenue divided by Total Assets. What does this value mean? How do you interpret it? 9. How much did I. M. Farmer's equity increase or decrease during 2007? 10. What was I. M.'s equity on January 1. 2007? II. Value of Farm Production is a concept defined as Total Revenue minus livestock purchased minus feed purchased. What was I M's Value of Farm Production for 2007? 12. What does Value of Farm Production Measure