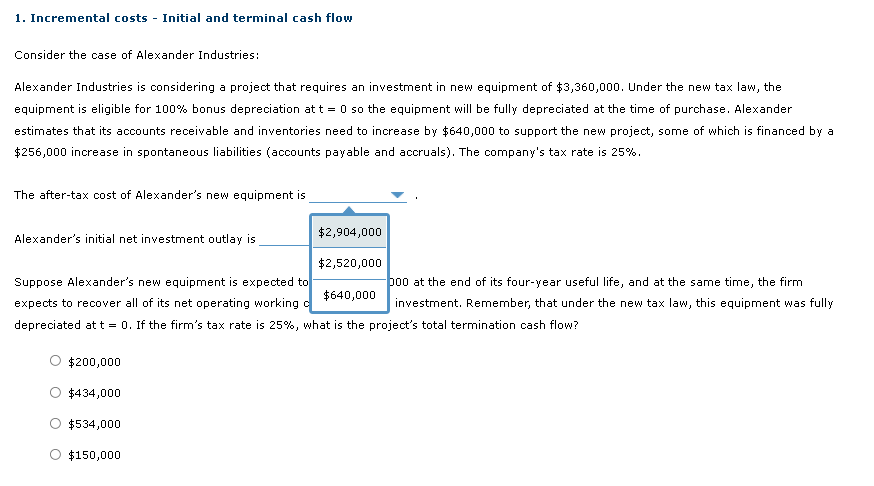

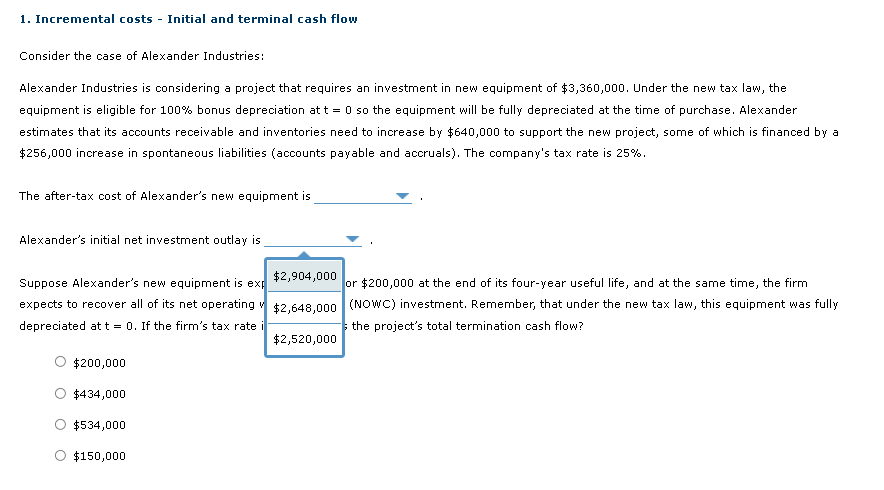

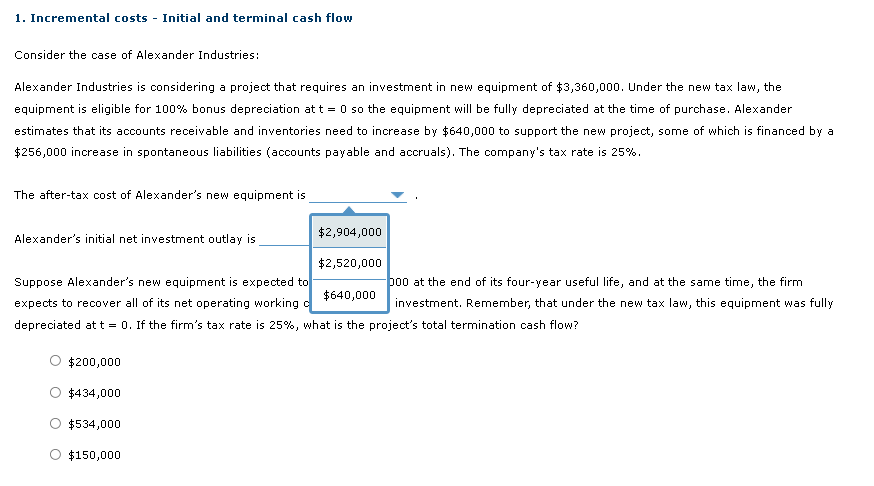

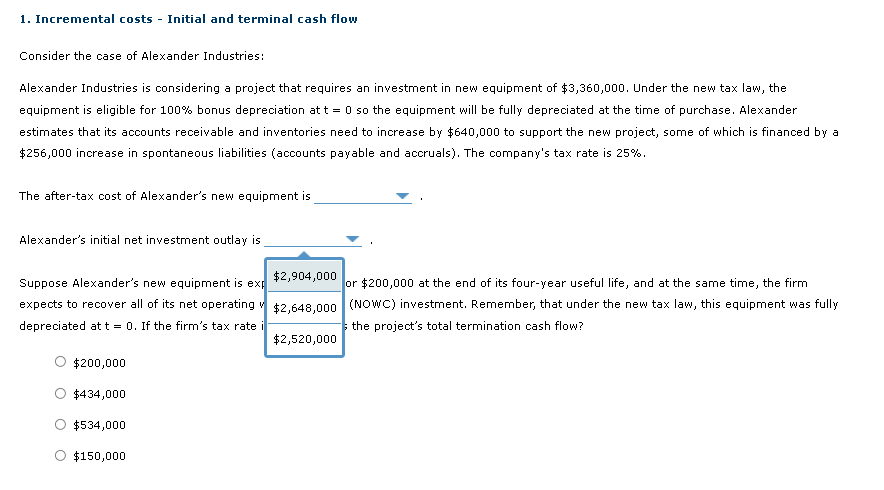

1. Incremental costs - Initial and terminal cash flow Consider the case of Alexander Industries: Alexander Industries is considering a project that requires an investment in new equipment of $3,360,000. Under the new tax law, the equipment is eligible for 100% bonus depreciation at t = 0 so the equipment will be fully depreciated at the time of purchase. Alexander estimates that its accounts receivable and inventories need to increase by $640,000 to support the new project, some of which is financed by a $256,000 increase in spontaneous liabilities (accounts payable and accruals). The company's tax rate is 25%. The after-tax cost of Alexander's new equipment is Alexander's initial net investment outlay is $2,904,000 $2,520,000 Suppose Alexander's new equipment is expected to poo at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net operating working $640,000 investment. Remember, that under the new tax law, this equipment was fully depreciated at t = 0. If the firm's tax rate is 25%, what is the project's total termination cash flow? $200,000 $434,000 $534,000 $150,000 1. Incremental costs - Initial and terminal cash flow Consider the case of Alexander Industries: Alexander Industries is considering a project that requires an investment in new equipment of $3,360,000. Under the new tax law, the equipment is eligible for 100% bonus depreciation at t = 0 so the equipment will be fully depreciated at the time of purchase. Alexander estimates that its accounts receivable and inventories need to increase by $640,000 to support the new project, some of which is financed by a $256,000 increase in spontaneous liabilities (accounts payable and accruals). The company's tax rate is 25%. The after-tax cost of Alexander's new equipment is Alexander's initial net investment outlay is Suppose Alexander's new equipment is ex $2,904,000 or $200,000 at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net operating $2,648,000 (NOWC) investment. Remember, that under the new tax law, this equipment was fully depreciated at t -0. If the firm's tax rate the project's total termination cash flow? $2,520,000 $200,000 $434,000 $534,000 $150,000