Question

1. Installment Notes Zavala Drilling Co. purchased machinery on December 31, 2018, paying $100,000 down and agreeing to pay the balance in four equal installments

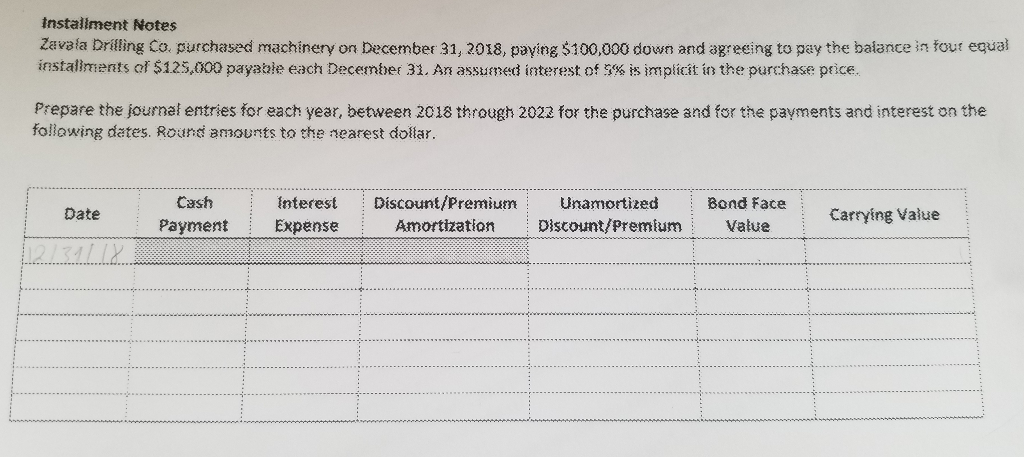

1. Installment Notes Zavala Drilling Co. purchased machinery on December 31, 2018, paying $100,000 down and agreeing to pay the balance in four equal installments of $125,000 payable each December 31. An assumed interest of 5% is implicit in the purchase price. Prepare the journal entries for each year, between 2018 through 2022 for the purchase and for the payments and interest on the following dates. Round amounts to the nearest dollar.

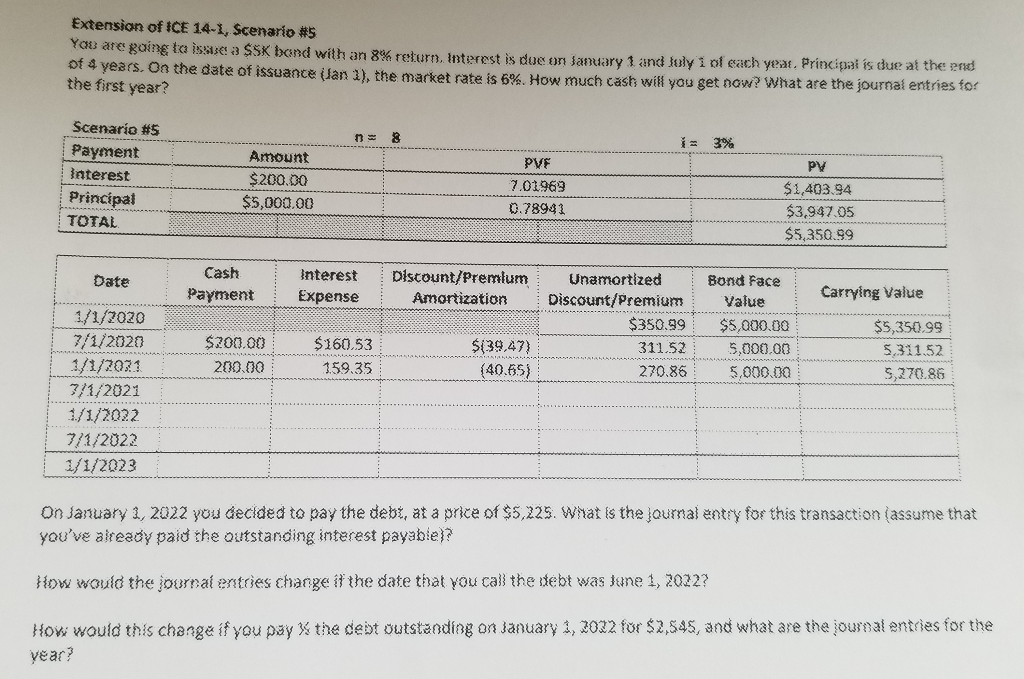

2. You are going to issue a $5K bond with an 8% return. Interest is due on January 1 and July 1 of each year. Principal is due at the end of 4 years. On the date of issuance (Jan 1), the market rate is 6%. How much cash will you get now? What are the journal entries for the first year?

On January 1, 2022 you decided to pay the debt, at a price of $5,225. What is the journal entry for this transaction (assume that youve already paid the outstanding interest payable)? How would the journal entries change if the date that you call the debt was June 1, 2022? How would this change if you pay the debt outstanding on January 1, 2022 for $2,545, and what are the journal entries for the year?

Installment Notes Zavala Drilling Co. purchased machinery on December 31, 2018, paying $100,000 down and agreeing to pay the balance in tour equal installments of $125,000 payable each December 31. An assumed interest of 5% is implicit in the purchase price. Prepare the journal entries for each year, between 2018 through 2022 For the purchase and for the payments and interest on the following dates. Round amounts to the nearest dollar. Date Cash Payment Discount/Premium Amortization Unamortized Discount/Premium Bond Face Value Carrying Value Expense Extension of ICE 14-1, Scenario #5 You are going to issue a $SK bond with an 8% return. Interest is due on January 1 and lely i of each year. Principal is due at the end of 4 years. On the date of issuance Jan 3), the market rate is 6% How much cash will you get now? What are the journal entries for the first year? 8 3% PVF Scenario #5 Payment interest Principal TOTAL Amount $200.00 $5,000.00 7.01969 0.78941 PV $1,403.94 $3.947.05 $5,350.99 Date Cash Payment Interest Expense Discount Premium Amortization Carrying Value 1/1/2020 7/1/2020 Unamortized Discount/Premium $350.99 311.52 Bond Face Value $5,000.00 5,000.00 5,000.00 $200.00 200.00 $160.53 159.35 $(39,47) (40.65) $5,350.99 5.311.52 9,270.86 270.86 3/1/2021 1/1/2022 7/1/2022 1/1/2023 On January 1, 2022 you decided to pay the debt, at a price of $5,229. What is the loumal entry for this transaction (assume that you've already paid the outstanding interest payable)? How would the journal entries change if the date that you cal the debt was tane 1, 2022? How would this change if you pay 3 the debt outstanding on January 1, 2022 for $2.545, and what are the journal entries for the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started