Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just been appointed President of Holy Shoe Company. You are studying the key past financial statistics and credit rating data of your

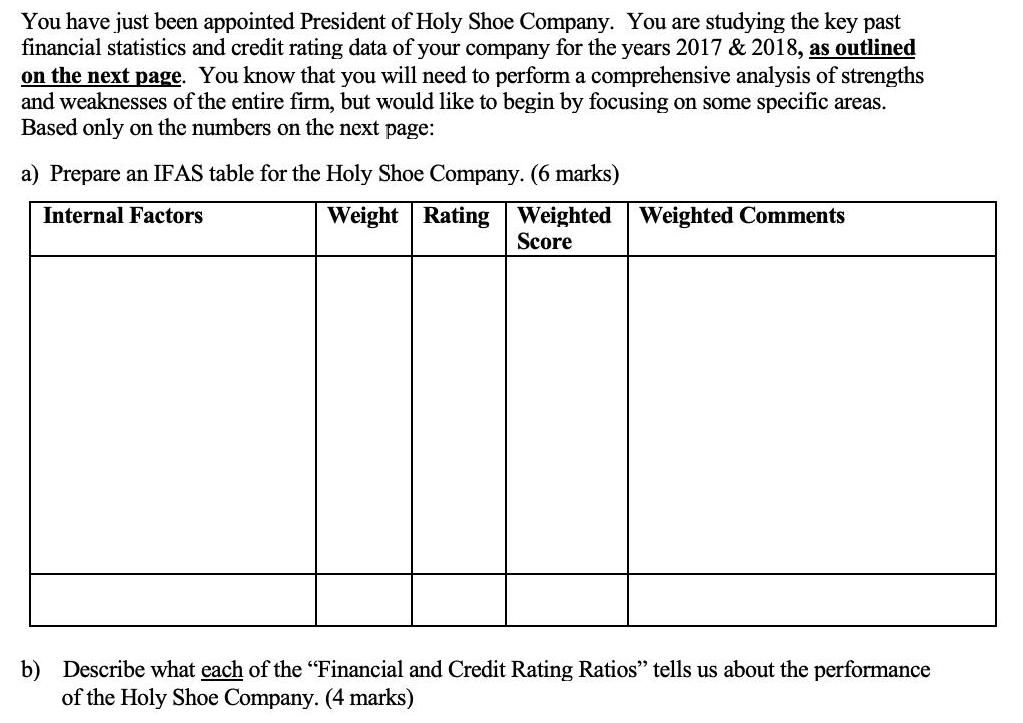

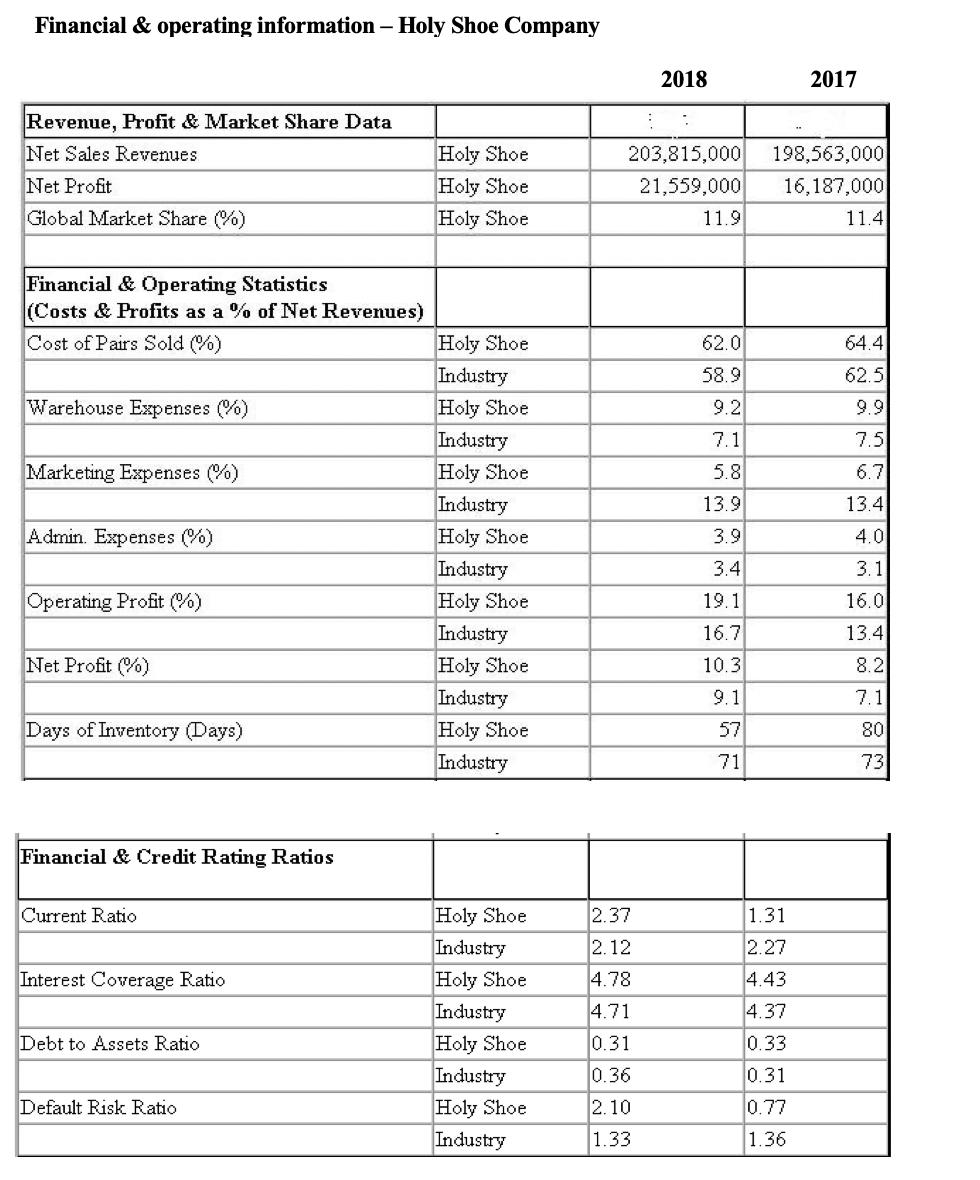

You have just been appointed President of Holy Shoe Company. You are studying the key past financial statistics and credit rating data of your company for the years 2017 & 2018, as outlined on the next page. You know that you will need to perform a comprehensive analysis of strengths and weaknesses of the entire firm, but would like to begin by focusing on some specific areas. Based only on the numbers on the next page: a) Prepare an IFAS table for the Holy Shoe Company. (6 marks) Weight Rating Weighted Weighted Comments Score Internal Factors b) Describe what each of the "Financial and Credit Rating Ratios" tells us about the performance of the Holy Shoe Company. (4 marks) Financial & operating information Holy Shoe Company 2018 2017 Revenue, Profit & Market Share Data Net Sales Revenues Holy Shoe Holy Shoe Holy Shoe 203,815,000 198,563,000 Net Profit 21,559,000 16,187,000 Global Market Share (%) 11.9 11.4 Financial & Operating Statistics (Costs & Profits as a % of Net Revenues) Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Cost of Pairs Sold (%) 62.0 64.4 58.9 62.5 Warehouse Expenses (%) 9.2 9.9 7.1 7.5 Marketing Expenses (%) 5.8 6.7 13.9 13.4 Admin. Expenses (%) 3.9 4.0 3.4 3.1 Operating Profit (%) 19.1 16.0 16.7 13.4 Net Profit (%) 10.3 8.2 9.1 7.1 Days of Inventory (Days) 57 80 71 73 Financial & Credit Rating Ratios Current Ratio Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry 2.37 1.31 2.12 2.27 Interest Coverage Ratio 4.78 4.43 4.71 4.37 Debt to Assets Ratio 0.31 0.33 0.36 0.31 Default Risk Ratio Holy Shoe 2.10 0.77 Industry 1.33 1.36 You have just been appointed President of Holy Shoe Company. You are studying the key past financial statistics and credit rating data of your company for the years 2017 & 2018, as outlined on the next page. You know that you will need to perform a comprehensive analysis of strengths and weaknesses of the entire firm, but would like to begin by focusing on some specific areas. Based only on the numbers on the next page: a) Prepare an IFAS table for the Holy Shoe Company. (6 marks) Weight Rating Weighted Weighted Comments Score Internal Factors b) Describe what each of the "Financial and Credit Rating Ratios" tells us about the performance of the Holy Shoe Company. (4 marks) Financial & operating information Holy Shoe Company 2018 2017 Revenue, Profit & Market Share Data Net Sales Revenues Holy Shoe Holy Shoe Holy Shoe 203,815,000 198,563,000 Net Profit 21,559,000 16,187,000 Global Market Share (%) 11.9 11.4 Financial & Operating Statistics (Costs & Profits as a % of Net Revenues) Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry Cost of Pairs Sold (%) 62.0 64.4 58.9 62.5 Warehouse Expenses (%) 9.2 9.9 7.1 7.5 Marketing Expenses (%) 5.8 6.7 13.9 13.4 Admin. Expenses (%) 3.9 4.0 3.4 3.1 Operating Profit (%) 19.1 16.0 16.7 13.4 Net Profit (%) 10.3 8.2 9.1 7.1 Days of Inventory (Days) 57 80 71 73 Financial & Credit Rating Ratios Current Ratio Holy Shoe Industry Holy Shoe Industry Holy Shoe Industry 2.37 1.31 2.12 2.27 Interest Coverage Ratio 4.78 4.43 4.71 4.37 Debt to Assets Ratio 0.31 0.33 0.36 0.31 Default Risk Ratio Holy Shoe 2.10 0.77 Industry 1.33 1.36

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a IFAS Table Internal Factors Weight Rating Weighted Score Weighted comments A Strengths 1 Significant share global market 015 3 045 More than 10 of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started