Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Inventory 2. Accounts Receivable 3. Accounts payable 4. Sales 5. Purchases 6. Net Income ASAP please Use the following information to answer the next

1. Inventory 2. Accounts Receivable 3. Accounts payable 4. Sales 5. Purchases 6. Net Income

ASAP please

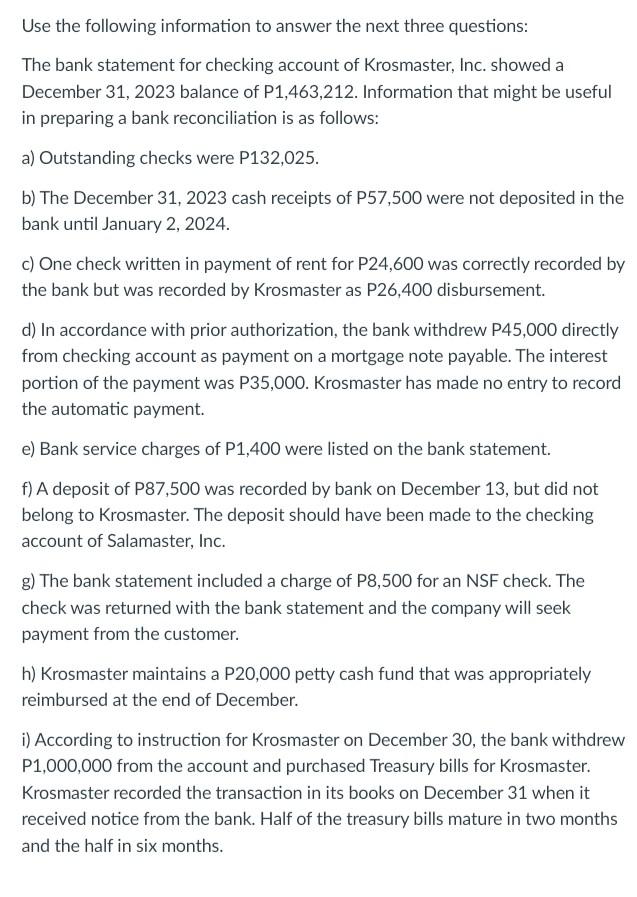

Use the following information to answer the next three questions: The bank statement for checking account of Krosmaster, Inc. showed a December 31, 2023 balance of P1,463,212. Information that might be useful in preparing a bank reconciliation is as follows: a) Outstanding checks were P132,025. b) The December 31, 2023 cash receipts of P57,500 were not deposited in the bank until January 2, 2024. c) One check written in payment of rent for P24,600 was correctly recorded by the bank but was recorded by Krosmaster as P26,400 disbursement. d) In accordance with prior authorization, the bank withdrew P45,000 directly from checking account as payment on a mortgage note payable. The interest portion of the payment was P35,000. Krosmaster has made no entry to record the automatic payment. e) Bank service charges of P1,400 were listed on the bank statement. f) A deposit of P87,500 was recorded by bank on December 13, but did not belong to Krosmaster. The deposit should have been made to the checking account of Salamaster, Inc. g) The bank statement included a charge of P8,500 for an NSF check. The check was returned with the bank statement and the company will seek payment from the customer. h) Krosmaster maintains a P20,000 petty cash fund that was appropriately reimbursed at the end of December. i) According to instruction for Krosmaster on December 30, the bank withdrew P1,000,000 from the account and purchased Treasury bills for Krosmaster. Krosmaster recorded the transaction in its books on December 31 when it received notice from the bank. Half of the treasury bills mature in two months and the half in six months. Use the following information to answer the next three questions: The bank statement for checking account of Krosmaster, Inc. showed a December 31, 2023 balance of P1,463,212. Information that might be useful in preparing a bank reconciliation is as follows: a) Outstanding checks were P132,025. b) The December 31, 2023 cash receipts of P57,500 were not deposited in the bank until January 2, 2024. c) One check written in payment of rent for P24,600 was correctly recorded by the bank but was recorded by Krosmaster as P26,400 disbursement. d) In accordance with prior authorization, the bank withdrew P45,000 directly from checking account as payment on a mortgage note payable. The interest portion of the payment was P35,000. Krosmaster has made no entry to record the automatic payment. e) Bank service charges of P1,400 were listed on the bank statement. f) A deposit of P87,500 was recorded by bank on December 13, but did not belong to Krosmaster. The deposit should have been made to the checking account of Salamaster, Inc. g) The bank statement included a charge of P8,500 for an NSF check. The check was returned with the bank statement and the company will seek payment from the customer. h) Krosmaster maintains a P20,000 petty cash fund that was appropriately reimbursed at the end of December. i) According to instruction for Krosmaster on December 30, the bank withdrew P1,000,000 from the account and purchased Treasury bills for Krosmaster. Krosmaster recorded the transaction in its books on December 31 when it received notice from the bank. Half of the treasury bills mature in two months and the half in six monthsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started