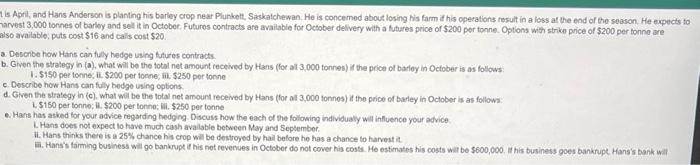

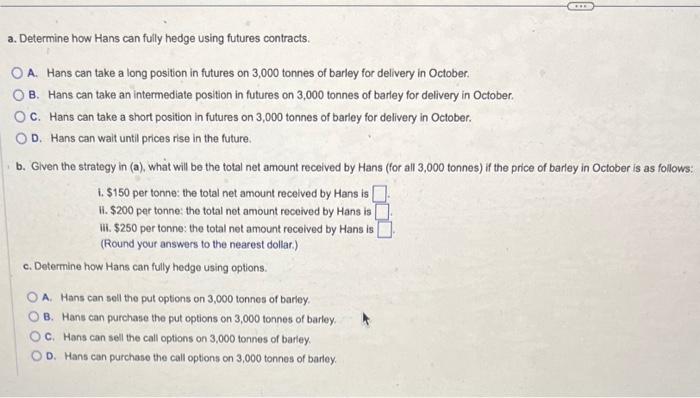

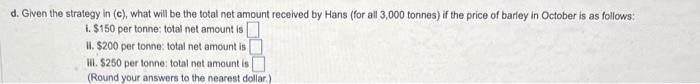

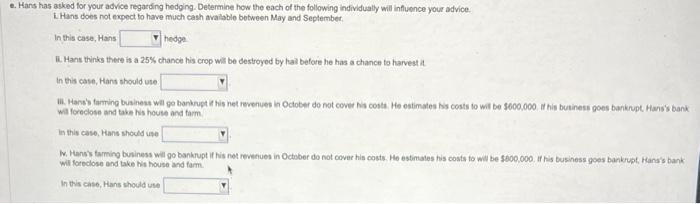

1 is Aorit, and Hans Anderson is planting his barley crop near Plurbolt. Saxkatchewan. He is concemed about losing his farm if his operations rosult in a less at the end of the season. He expects to narvest 3,000 tonnes of barloy and sel it in Octobee. Futures contracts are availabie for October delivery with a tutures price of $200 per tonne Options with strike price of $200 per tonne are also available: puts cost $16 and calis cost $20. a. Describe how Hars can fuly hedge using futures contracts. b. Given the strategy in (a), what will be the total net amount received by Hans (for al3,000 tonnes) it the price of barley in October is as follows: 1. $150 per tonne, ii. $200 per toene, iil. $250 per tonne e. Describe how Hans can fully bedge using eptions. d. Given the strategy in (c), what wel be the total net amount received by Hans (for al 3,000 tonnes) if the price of baley in October is as follows: L. \$150 per tonne; 11.$200 per tonne; ill. $250 per tonne e. Hars has asked for your advice regarding hedging Discuss how the each of the following individualy will influence your advice L. Hans does not expect to have much cash avalable between May and september. ii. Hans thinks there is a 25\%, chance his crop will be destroyed by hal before he has a chance to harvest a nan. Hans's farming business will go bankrupt it his net revenues in Oetober do not cover his costs. He estimates his costs wir be $600, 000. It his business goes bankfupt Hans's bank will a. Determine how Hans can fully hedge using futures contracts. A. Hans can take a long position in futures on 3,000 tonnes of barley for delivery in October. B. Hans can take an intermediate position in futures on 3,000 tonnes of barley for delivery in October. C. Hans can take a short position in futures on 3,000 tonnes of barley for delivery in October. D. Hans can wait until prices rise in the future. b. Given the strategy in (a), what will be the total net amount received by Hans (for all 3.000 tonnes) if the price of barley in October is as follows: i. $150 per tonne: the total net amount received by Hans is 1i. $200 per tonne: the total net amount received by Hans is iii. $250 per tonne: the total net amount received by Hans is (Round your answers to the nearest dollar.) c. Determine how Hans can fully hedge using options. A. Hans can sell the put options on 3,000 tonnes of barley. B. Hans can purchase the put options on 3,000 tonnes of barley. C. Hans can sell the call options on 3.000 tonnes of barley. D. Hans can purchase the call options on 3,000 tonnes of barley. d. Given the strategy in (c), what will be the total net amount received by Hans (for all 3,000 tonnes) if the price of barley in October is as follows: i. $150 per tonne: total net amount is ii. $200 per tonne: total net amount is iii. $250 per tonne: total net amount is (Round your answers to the nearest dollar.) e. Hans has asked for your advice regarding hedging. Determine how the each of the following individuatly will influence your advice. i. Hans does not expect to have much cash avaiable between May and September. In this case, Hans hedge. Ii. Hans thinks there is a 25% chance his crop wis be destroyod by lai before he has a chance to harvest it. In this case, Hans thould use willoreclose and take his house and farm. In this case, Hans should une W. Hars's tarming butiness will go bankrupt if his net revenues in October do not cover his costs. He estimales his cosis to wil be sa00,000. If his business goes bankrupt, Hans's bank? will foreclose and take his house and fam. In this case, Hans should use