Answered step by step

Verified Expert Solution

Question

1 Approved Answer

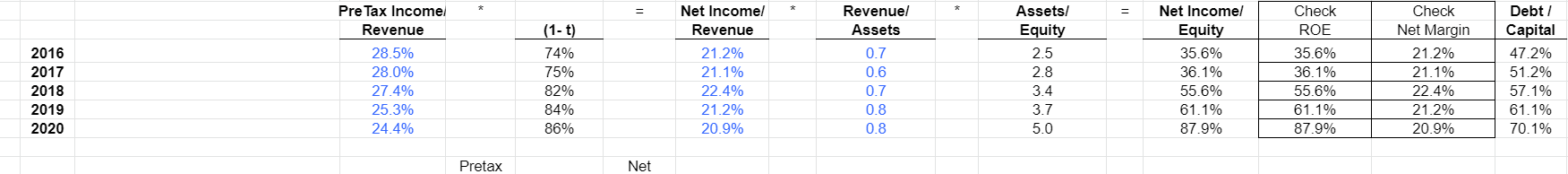

1. Is the trend in the Company's ROE over the last 5 years favorable or unfavorable? 2. Which factor (or factors) has driven the ROE

1. Is the trend in the Company's ROE over the last 5 years favorable or unfavorable?

1. Is the trend in the Company's ROE over the last 5 years favorable or unfavorable?

2. Which factor (or factors) has driven the ROE trend?

3. Do you believe the company has room for future increases in ROE? If so or not, which ROE components would drive these increases and why

= 2016 2017 2018 2019 2020 Pre Tax Income Revenue 28.5% 28.0% 27.4% 25.3% 24.4% (1-t) 74% 75% 82% 84% 86% Net Income! Revenue 21.2% 21.1% 22.4% 21.2% 20.9% Revenue! Assets 0.7 0.6 0.7 0.8 0.8 Assets/ Equity 2.5 2.8 3.4 3.7 5.0 Net Incomel Equity 35.6% 36.1% 55.6% 61.1% 87.9% Check ROE 35.6% 36.1% 55.6% 61.1% 87.9% Check Net Margin 21.2% 21.1% 22.4% 21.2% 20.9% Debt / Capital 47.2% 51.2% 57.1% 61.1% 70.1% Pretax NetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started