Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Is Will able to claim R.J. as a qualifying child for the earned income credit (EIC)? A. Yes, because his income is below the

1. Is Will able to claim R.J. as a qualifying child for the earned income credit (EIC)?

A. Yes, because his income is below the threshold for claiming EIC

B. Yes, because R.J. has a Social Security number.

C. No, because Will has an ITIN.

D. Both A and B - this choice is wrong

2. Will may claim R.J. as a dependent on his tax return.

A. True

B. Fasle

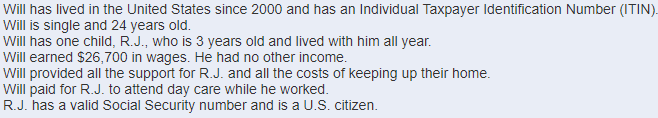

has an Individual Taxpayer Identification Number (TIN) is single and 24 years old Will has one child, R.J., who is 3 years old and lived with him all year Will earned $26,700 in wages. He had no other income Will provided all the support for R.J. and all the costs of keeping up their home. Will paid for R.J. to attend day care while he worked R.J. has a valid Social Security number and is a U.S. citizen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started