Answered step by step

Verified Expert Solution

Question

1 Approved Answer

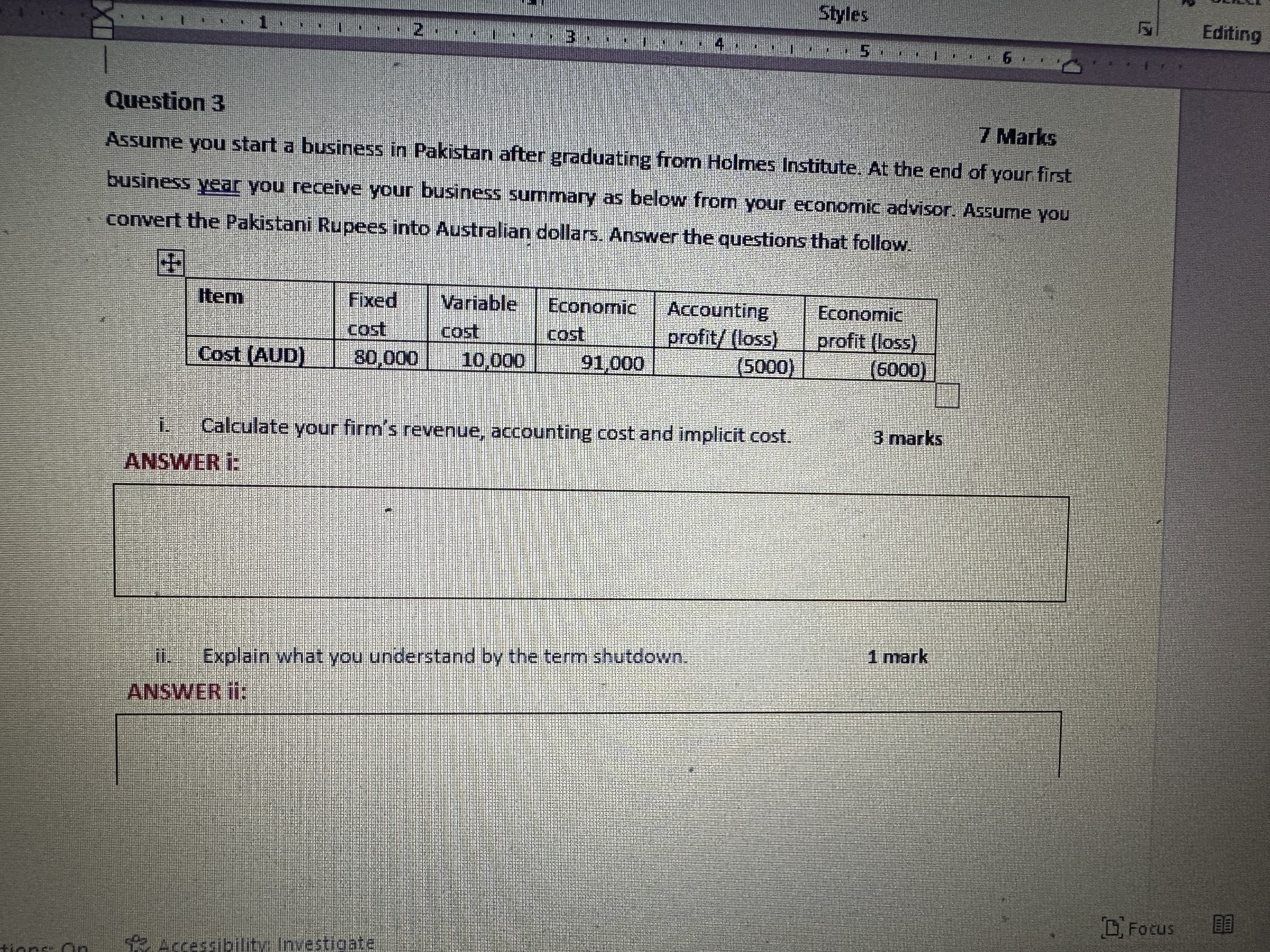

1 Item Question 3 7 Marks Assume you start a business in Pakistan after graduating from Holmes Institute. At the end of your first

1 Item Question 3 7 Marks Assume you start a business in Pakistan after graduating from Holmes Institute. At the end of your first business year you receive your business summary as below from your economic advisor. Assume you convert the Pakistani Rupees into Australian dollars. Answer the questions that follow. Fixed cost Cost (AUD) 80,000 10.000 . ANSWER I: Variable cost Economic Accounting cost profit/ (loss) (5000) Calculate your firm's revenue, accounting cost and implicit cost. Accessibility Investigate 91,000 ii. Explain what you understand by the term shutdown. ANSWER 11: Styles ..5:* Economic profit (loss) (6000) 3 marks 6 1 mark F Focus Editing EEEE Would you shut down your business. Explain you answer. ANSWER iii: 1 mark iv. Examine the market entry barriers that deter other firms from entering the market structure for distribution of consumer goods and services in Pakistan. 2 marks ANSWER iv:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer i Calculation Firms Revenue The firms revenue can be calculated by adding the accounting profit or subtracting the accounting loss to the econo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started