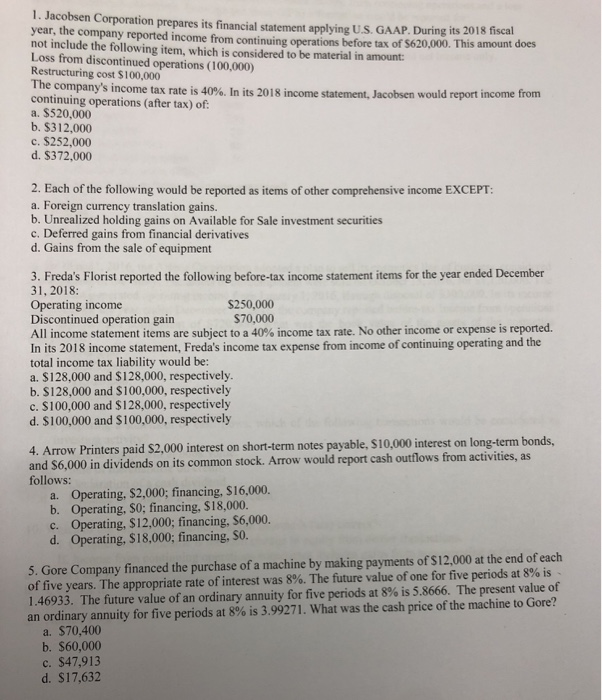

1. Jacobsen Corporation prepares its financial statement applying US GAAP. During its 2018 fiscal year, the company reported income from continuing operations hefore tax of 5620.000. This amount does not include the following item, which is considered to be material in amount: Loss from discontinued operations (100,000) Restructuring cost $100,000 The company's income tax rate is 40%. In its 2018 income statement. Jacobsen would report income from continuing operations (after tax) of: a. $520,000 b. $312,000 c. $252,000 d. $372,000 2. Each of the following would be reported as items of other comprehensive income EXCEPT: a. Foreign currency translation gains. b. Unrealized holding gains on Available for Sale investment securities c. Deferred gains from financial derivatives d. Gains from the sale of equipment 3. Freda's Florist reported the following before-tax income statement items for the year ended December 31, 2018: Operating income $250,000 Discontinued operation gain $70,000 All income statement items are subject to a 40% income tax rate. No other income or expense is reported. In its 2018 income statement, Freda's income tax expense from income of continuing operating and the total income tax liability would be: a. $128,000 and $128,000, respectively. b. S128,000 and $100,000, respectively c. $100,000 and $128,000, respectively d. $100,000 and $100,000, respectively 4. Arrow Printers paid $2,000 interest on short-term notes payable, $10,000 interest on long-term bonds, and $6,000 in dividends on its common stock. Arrow would report cash outflows from activities, as follows: a. Operating, $2,000; financing, $16,000. b. Operating, S0; financing. $18,000. c. Operating, $12,000; financing, S6,000. d. Operating. $18,000; financing, SO. 5. Gore Company financed the purchase of a machine by making payments of S12,000 at the end of each of five years. The appropriate rate of interest was 8%. The future value of one for five periods at 8% is 1.46933. The future value of an ordinary annuity for five periods at 8% is 5.8666. The present value of an ordinary annuity for five periods at 8% is 3.99271. What was the cash price of the machine to Gore? a. $70,400 b. $60,000 c. $47,913 d. $17,632