Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Jada B invested $800,000 in cash to start up his company. 2. A building was purchased for $350,000 with a down payment of

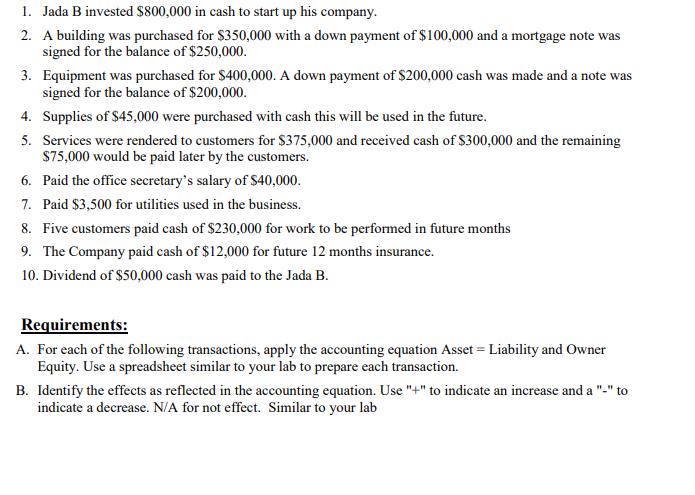

1. Jada B invested $800,000 in cash to start up his company. 2. A building was purchased for $350,000 with a down payment of $100,000 and a mortgage note was signed for the balance of $250,000. 3. Equipment was purchased for $400,000. A down payment of $200,000 cash was made and a note was signed for the balance of $200,000. 4. Supplies of $45,000 were purchased with cash this will be used in the future. 5. Services were rendered to customers for $375,000 and received cash of $300,000 and the remaining S75,000 would be paid later by the customers. 6. Paid the office secretary's salary of $40,000. 7. Paid $3,500 for utilities used in the business. 8. Five customers paid cash of $230,000 for work to be performed in future months 9. The Company paid cash of $12,000 for future 12 months insurance. 10. Dividend of $50,000 cash was paid to the Jada B. Requirements: A. For each of the following transactions, apply the accounting equation Asset = Liability and Owner Equity. Use a spreadsheet similar to your lab to prepare each transaction. B. Identify the effects as reflected in the accounting equation. Use "+" to indicate an increase and a "-" to indicate a decrease. N/A for not effect. Similar to your lab

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Explanation 1 Accounting Equation Accounting Equation is calculated using following equation Assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started