Question: 1) Jane has a margin account and deposits $80,000 into it. Assume that the prevailing margin requirement is 50%, interest and commissions are ignored and

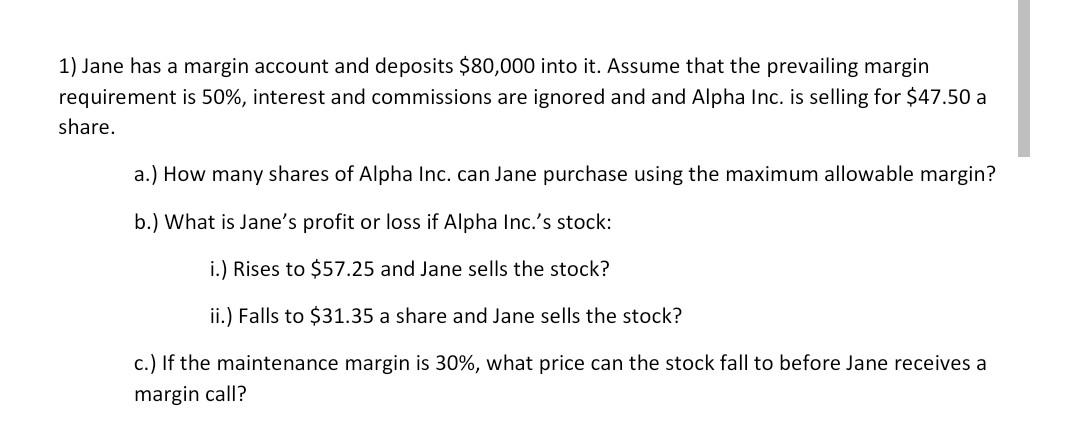

1) Jane has a margin account and deposits $80,000 into it. Assume that the prevailing margin requirement is 50%, interest and commissions are ignored and and Alpha Inc. is selling for $47.50a share. a.) How many shares of Alpha Inc. can Jane purchase using the maximum allowable margin? b.) What is Jane's profit or loss if Alpha Inc.'s stock: i.) Rises to $57.25 and Jane sells the stock? ii.) Falls to $31.35 a share and Jane sells the stock? c.) If the maintenance margin is 30%, what price can the stock fall to before Jane receives a margin call

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock