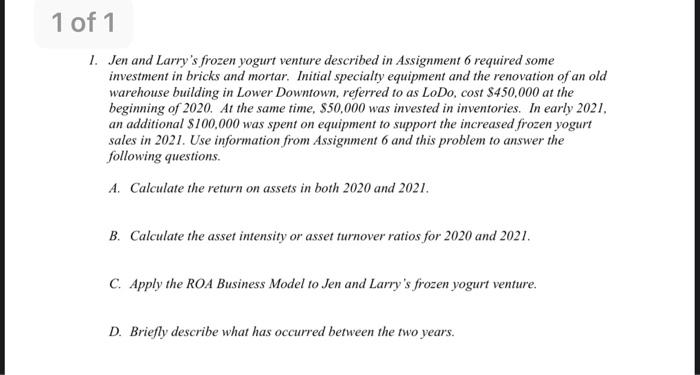

1. Jen and Larrys frozen yogurt venture described in Assignment 6 required some investment in bricks and mortar. Initial specialty equipment and the renovation of an old warehouse building in Lower Downtown, referred to as LoDo, cost $450,000 at the beginning of 2020. At the same time, $50,000 was invested in inventories. In early 2021, an additional $100,000 was spent on equipment to support the increased frozen yogurt sales in 2021. Use information from Assignment 6 and this problem to answer the following questions.

A. Calculate the return on assets in both 2020 and 2021.

B. Calculate the asset intensity or asset turnover ratios for 2020 and 2021.

C. Apply the ROA Business Model to Jen and Larrys frozen yogurt venture.

D. Briefly describe what has occurred between the two years.

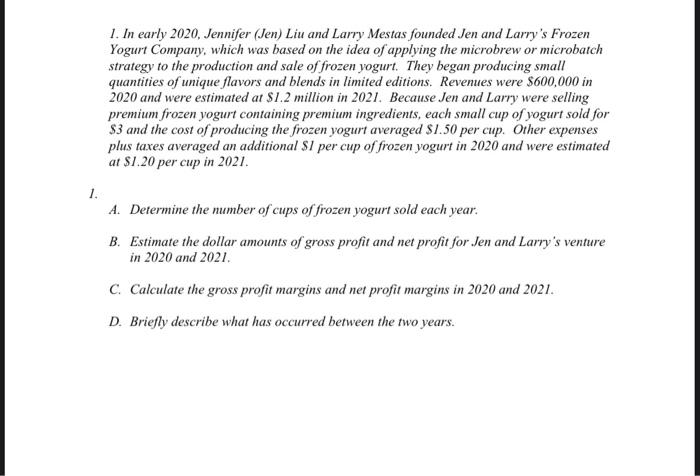

1. In early 2020. Jennifer (Jen) Liu and Larry Mestas founded Jen and Larry's Frozen Yogurt Company, which was based on the idea of applying the microbrew or microbatch strategy to the production and sale of frozen yogurt . They began producing small quantities of unique flavors and blends in limited editions. Revenues were $600,000 in 2020 and were estimated at $1.2 million in 2021. Because Jen and Larry were selling premium frozen yogurt containing premium ingredients, each small cup of yogurt sold for $3 and the cost of producing the frozen yogurt averaged $1.50 per cup. Other expenses plus taxes averaged an additional $1 per cup of frozen yogurt in 2020 and were estimated at $1.20 per cup in 2021. 1. A. Determine the number of cups of frozen yogurt sold each year. B. Estimate the dollar amounts of gross profit and net profit for Jen and Larry's venture in 2020 and 2021 C. Calculate the gross profit margins and net profit margins in 2020 and 2021. D. Briefly describe what has occurred between the two years. 1 of 1 1. Jen and Larry's frozen yogurt venture described in Assignment 6 required some investment in bricks and mortar. Initial specialty equipment and the renovation of an old warehouse building in Lower Downtown, referred to as LoDo, cost $450,000 at the beginning of 2020. At the same time, $50,000 was invested in inventories. In early 2021, an additional $100,000 was spent on equipment to support the increased frozen yogurt sales in 2021. Use information from Assignment 6 and this problem to answer the following questions. 1. Calculate the return on assets in both 2020 and 2021. B. Calculate the asset intensity or asset turnover ratios for 2020 and 2021. C. Apply the ROA Business Model to Jen and Larry's frozen yogurt venture. D. Briefly describe what has occurred between the two years. 1. In early 2020. Jennifer (Jen) Liu and Larry Mestas founded Jen and Larry's Frozen Yogurt Company, which was based on the idea of applying the microbrew or microbatch strategy to the production and sale of frozen yogurt . They began producing small quantities of unique flavors and blends in limited editions. Revenues were $600,000 in 2020 and were estimated at $1.2 million in 2021. Because Jen and Larry were selling premium frozen yogurt containing premium ingredients, each small cup of yogurt sold for $3 and the cost of producing the frozen yogurt averaged $1.50 per cup. Other expenses plus taxes averaged an additional $1 per cup of frozen yogurt in 2020 and were estimated at $1.20 per cup in 2021. 1. A. Determine the number of cups of frozen yogurt sold each year. B. Estimate the dollar amounts of gross profit and net profit for Jen and Larry's venture in 2020 and 2021 C. Calculate the gross profit margins and net profit margins in 2020 and 2021. D. Briefly describe what has occurred between the two years. 1 of 1 1. Jen and Larry's frozen yogurt venture described in Assignment 6 required some investment in bricks and mortar. Initial specialty equipment and the renovation of an old warehouse building in Lower Downtown, referred to as LoDo, cost $450,000 at the beginning of 2020. At the same time, $50,000 was invested in inventories. In early 2021, an additional $100,000 was spent on equipment to support the increased frozen yogurt sales in 2021. Use information from Assignment 6 and this problem to answer the following questions. 1. Calculate the return on assets in both 2020 and 2021. B. Calculate the asset intensity or asset turnover ratios for 2020 and 2021. C. Apply the ROA Business Model to Jen and Larry's frozen yogurt venture. D. Briefly describe what has occurred between the two years