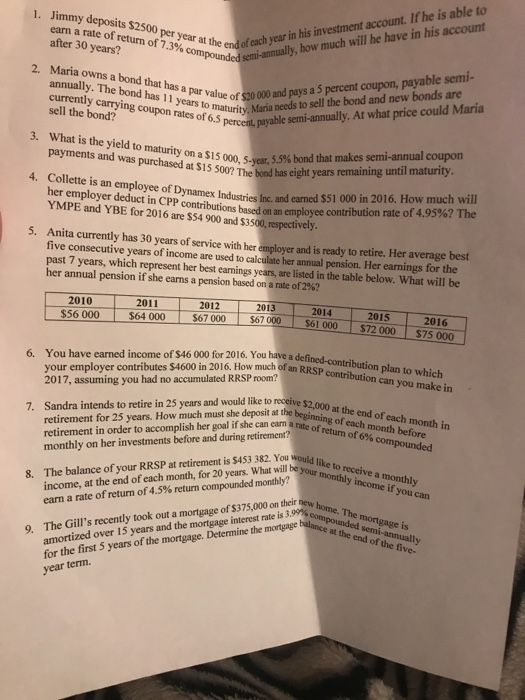

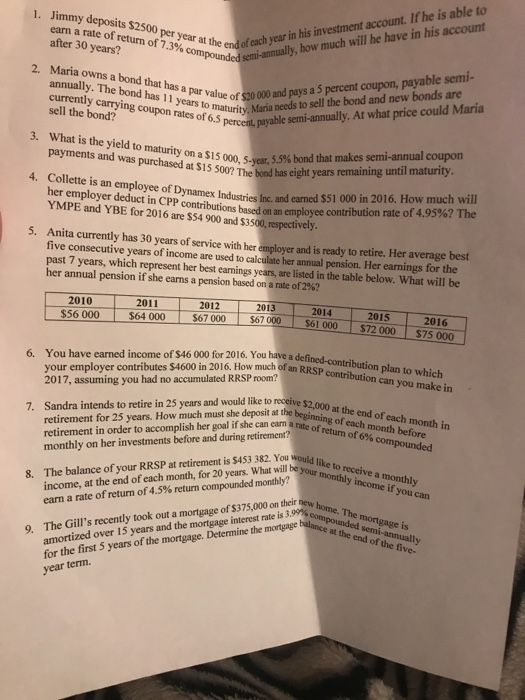

1. Jimmy deposits $2500 per year at the e earn a rate of return of 7.3% after 30 years? in his investment account. If he is able to in the end of each year pounded semi-annually, how much will he have in his account 2. Maria owns a bond that has a par par v sell the bocafrying cou ll Jears to alueof s2000and pas a 5 percent coupon, payable semi- n rates ofo maturity, Maria needs to sell the bond and new bonds are sell the bond? 0.5 percent, payable semi-annually. At what price could Maria payments and was purchased at $15 500? The bond has eight years untyon a$15 000, 5 year, 55% bond that makes semi-annual coupon ette is an employee of Dynamex Industries Inc and earned $51 000 in 2016. How much will her employer deduct in CPP contributions based on an employee contn YMPE and YBE for 2016 are $54 900 and $3500, respectively bution rate of 4.95%? The 5. Anita currently has 30 years of service with her employer and is ready to retire. Her average best five consecutive years of income are used to calculate her annual pension. Her earnings for the past 7 years, which represent her best eamings years, are listed in the table below. What will be her annual pension if she earns a pension based on a rate of2%? 2010 $56 000 2011 $64 000 2012 2013 2014 2015 2016 S67 000 $67000 $61 000 $72 000 $75 000 You have earned income of your employer contributes $4600 in 2016. How much of an RRSbutn plan to 2017, assuming you had no accumulated RRSP room? 6. P contribution can you make in retirement for 25 years. How much must she deposit at the b:000 at retirement in order to accomplish her goal if she can eama raeg ofac ofeach monthly on her investments before and during retirement? of tum of s month bfoonth in 7. Sandra intends to retire in 25 years and would like to receive $200 t 6% ed income, at the end of each month, for 20 years. What will be yod like to earn a rate of return of4.5% return compounded monthly? "montheceive a 8. The balance of your RRSP at retirement is $453 382. You would iu amortized over 15 years and the mortgage interest rate is 3.99% h for the first 5 years of the mortgage. Determine the mortgage balan Ponde mortg year term. ce at the end of the five- is 9. The Gill's recently took out a mortgage of $375,000 on their new ho