Answered step by step

Verified Expert Solution

Question

1 Approved Answer

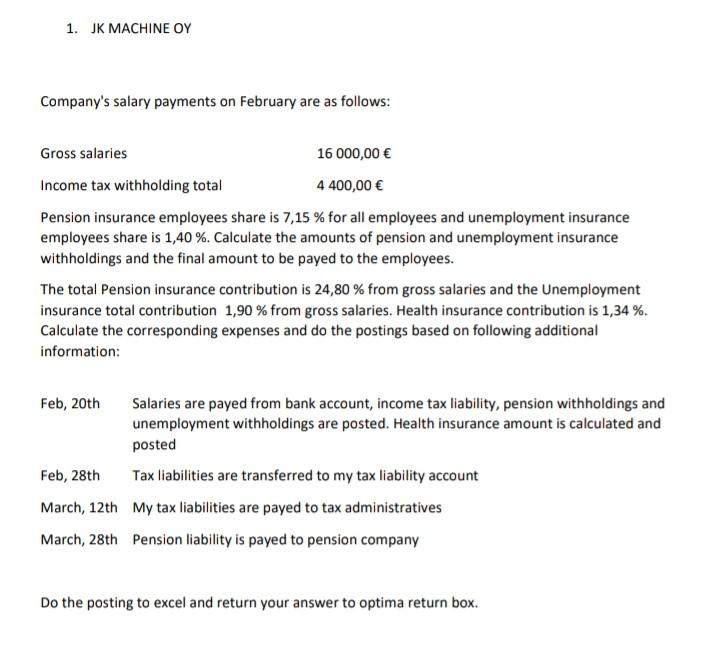

1. JK MACHINE OY Company's salary payments on February are as follows: Gross salaries 16 000,00 Income tax withholding total 4 400,00 Pension insurance employees

1. JK MACHINE OY Company's salary payments on February are as follows: Gross salaries 16 000,00 Income tax withholding total 4 400,00 Pension insurance employees share is 7,15 % for all employees and unemployment insurance employees share is 1,40 %. Calculate the amounts of pension and unemployment insurance withholdings and the final amount to be payed to the employees. The total Pension insurance contribution is 24,80 % from gross salaries and the Unemployment insurance total contribution 1,90 % from gross salaries. Health insurance contribution is 1,34 %. Calculate the corresponding expenses and do the postings based on following additional information: Feb, 20th Salaries are payed from bank account, income tax liability, pension withholdings and unemployment withholdings are posted. Health insurance amount is calculated and posted Feb, 28th Tax liabilities are transferred to my tax liability account March, 12th My tax liabilities are payed to tax administratives March, 28th Pension liability is payed to pension company Do the posting to excel and return your answer to optima return box

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started