Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Joe's Coffee Ltd. needs to raise money to open a second location and is considering two options: - Option A is to borrow $100,000

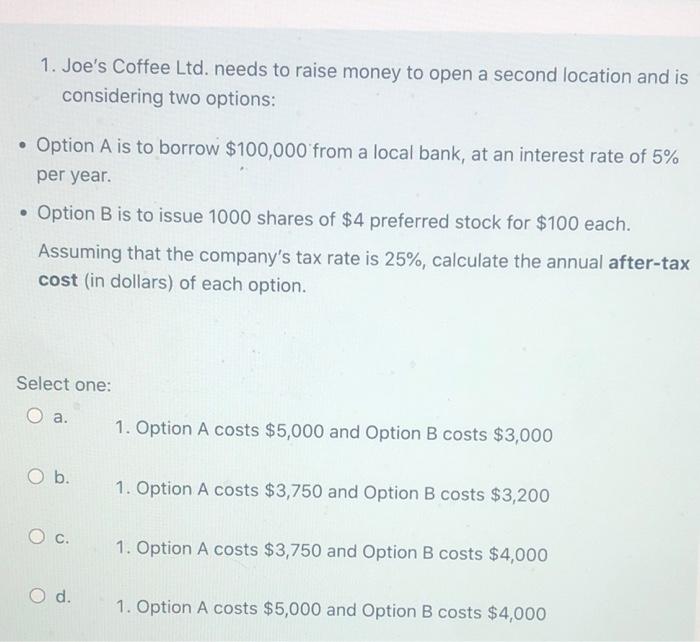

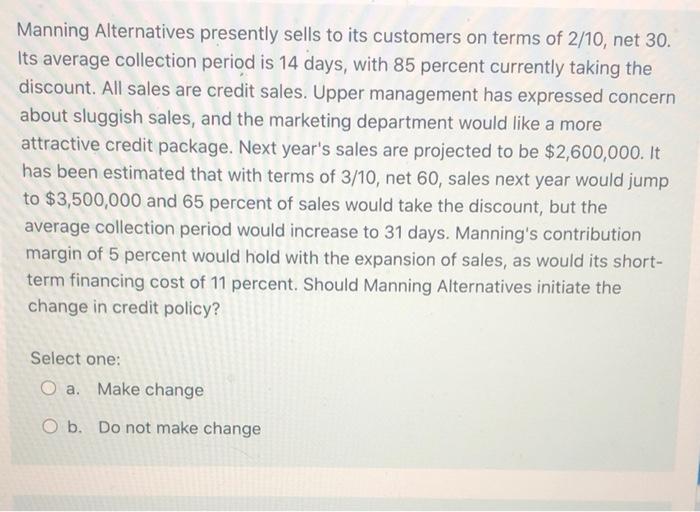

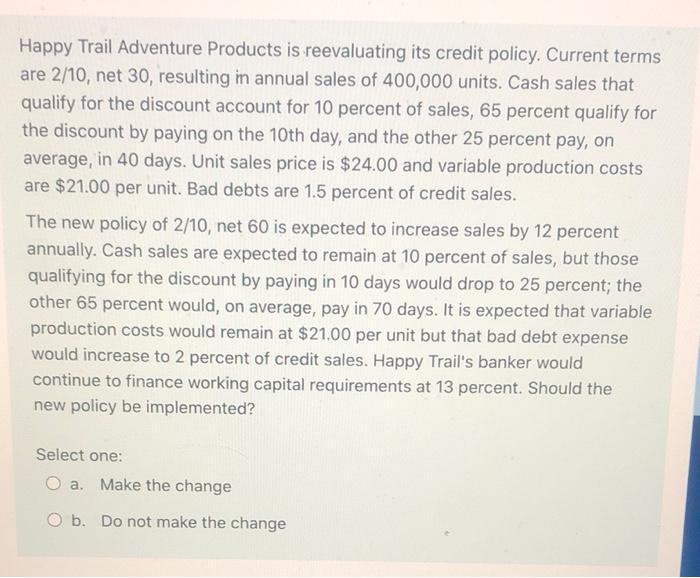

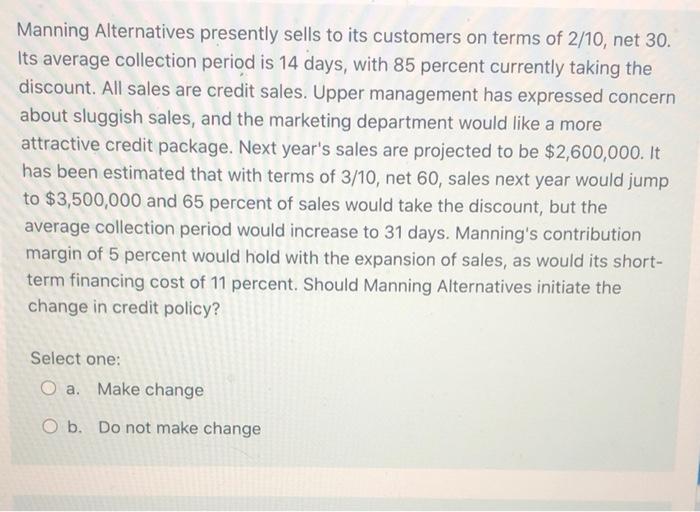

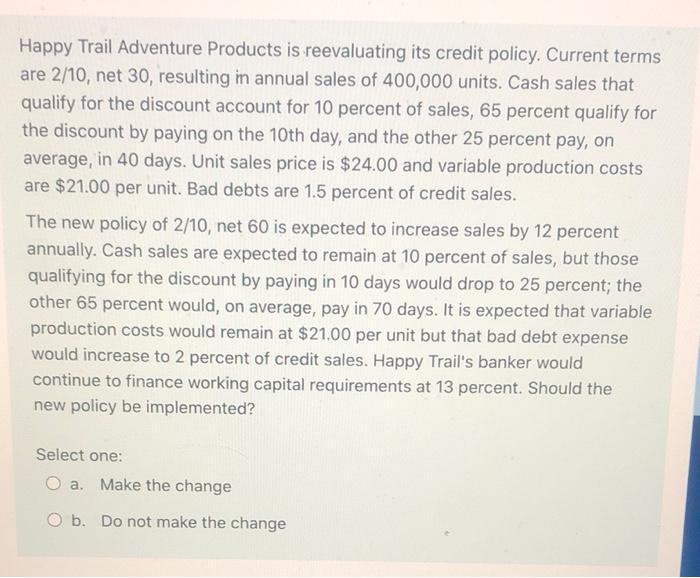

1. Joe's Coffee Ltd. needs to raise money to open a second location and is considering two options: - Option A is to borrow $100,000 from a local bank, at an interest rate of 5% per year. - Option B is to issue 1000 shares of $4 preferred stock for $100 each. Assuming that the company's tax rate is 25%, calculate the annual after-tax cost (in dollars) of each option. Select one: a. 1. Option A costs $5,000 and Option B costs $3,000 b. 1. Option A costs $3,750 and Option B costs $3,200 c. 1. Option A costs $3,750 and Option B costs $4,000 d. 1. Option A costs $5,000 and Option B costs $4,000 Manning Alternatives presently sells to its customers on terms of 2/10, net 30 . Its average collection period is 14 days, with 85 percent currently taking the discount. All sales are credit sales. Upper management has expressed concern about sluggish sales, and the marketing department would like a more attractive credit package. Next year's sales are projected to be $2,600,000. It has been estimated that with terms of 3/10, net 60 , sales next year would jump to $3,500,000 and 65 percent of sales would take the discount, but the average collection period would increase to 31 days. Manning's contribution margin of 5 percent would hold with the expansion of sales, as would its shortterm financing cost of 11 percent. Should Manning Alternatives initiate the change in credit policy? Select one: a. Make change b. Do not make change Happy Trail Adventure Products is reevaluating its credit policy. Current terms are 2/10, net 30 , resulting in annual sales of 400,000 units. Cash sales that qualify for the discount account for 10 percent of sales, 65 percent qualify for the discount by paying on the 10th day, and the other 25 percent pay, on average, in 40 days. Unit sales price is $24.00 and variable production costs are $21.00 per unit. Bad debts are 1.5 percent of credit sales. The new policy of 2/10, net 60 is expected to increase sales by 12 percent annually. Cash sales are expected to remain at 10 percent of sales, but those qualifying for the discount by paying in 10 days would drop to 25 percent; the other 65 percent would, on average, pay in 70 days. It is expected that variable production costs would remain at $21.00 per unit but that bad debt expense would increase to 2 percent of credit sales. Happy Trail's banker would continue to finance working capital requirements at 13 percent. Should the new policy be implemented? Select one: a. Make the change b. Do not make the change

1. Joe's Coffee Ltd. needs to raise money to open a second location and is considering two options: - Option A is to borrow $100,000 from a local bank, at an interest rate of 5% per year. - Option B is to issue 1000 shares of $4 preferred stock for $100 each. Assuming that the company's tax rate is 25%, calculate the annual after-tax cost (in dollars) of each option. Select one: a. 1. Option A costs $5,000 and Option B costs $3,000 b. 1. Option A costs $3,750 and Option B costs $3,200 c. 1. Option A costs $3,750 and Option B costs $4,000 d. 1. Option A costs $5,000 and Option B costs $4,000 Manning Alternatives presently sells to its customers on terms of 2/10, net 30 . Its average collection period is 14 days, with 85 percent currently taking the discount. All sales are credit sales. Upper management has expressed concern about sluggish sales, and the marketing department would like a more attractive credit package. Next year's sales are projected to be $2,600,000. It has been estimated that with terms of 3/10, net 60 , sales next year would jump to $3,500,000 and 65 percent of sales would take the discount, but the average collection period would increase to 31 days. Manning's contribution margin of 5 percent would hold with the expansion of sales, as would its shortterm financing cost of 11 percent. Should Manning Alternatives initiate the change in credit policy? Select one: a. Make change b. Do not make change Happy Trail Adventure Products is reevaluating its credit policy. Current terms are 2/10, net 30 , resulting in annual sales of 400,000 units. Cash sales that qualify for the discount account for 10 percent of sales, 65 percent qualify for the discount by paying on the 10th day, and the other 25 percent pay, on average, in 40 days. Unit sales price is $24.00 and variable production costs are $21.00 per unit. Bad debts are 1.5 percent of credit sales. The new policy of 2/10, net 60 is expected to increase sales by 12 percent annually. Cash sales are expected to remain at 10 percent of sales, but those qualifying for the discount by paying in 10 days would drop to 25 percent; the other 65 percent would, on average, pay in 70 days. It is expected that variable production costs would remain at $21.00 per unit but that bad debt expense would increase to 2 percent of credit sales. Happy Trail's banker would continue to finance working capital requirements at 13 percent. Should the new policy be implemented? Select one: a. Make the change b. Do not make the change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started