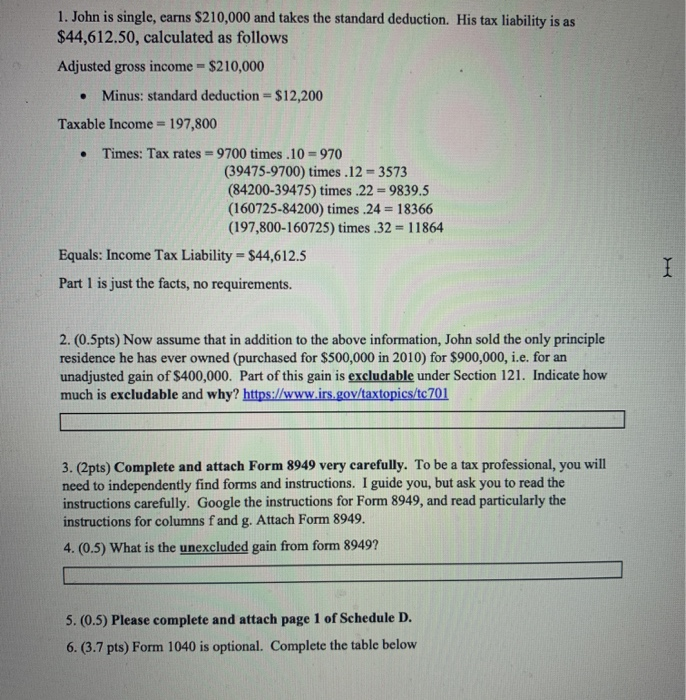

. 1. John is single, earns $210,000 and takes the standard deduction. His tax liability is as $44,612.50, calculated as follows Adjusted gross income - $210,000 Minus: standard deduction = $12,200 Taxable Income 197,800 Times: Tax rates = 9700 times.10 = 970 (39475-9700) times.12 - 3573 (84200-39475) times .22 = 9839.5 (160725-84200) times.24 = 18366 (197,800-160725) times .32 = 11864 Equals: Income Tax Liability = $44,612.5 Part 1 is just the facts, no requirements. . I 2. (0.5pts) Now assume that in addition to the above information, John sold the only principle residence he has ever owned (purchased for $500,000 in 2010) for $900,000, i.e. for an unadjusted gain of $400,000. Part of this gain is excludable under Section 121. Indicate how much is excludable and why? https://www.irs.gov/taxtopics/tc701 3. (2pts) Complete and attach Form 8949 very carefully. To be a tax professional, you will need to independently find forms and instructions. I guide you, but ask you to read the instructions carefully. Google the instructions for Form 8949, and read particularly the instructions for columns f and g. Attach Form 8949. 4. (0.5) What is the unexcluded gain from form 8949? 5. (0.5) Please complete and attach page 1 of Schedule D. 6. (3.7 pts) Form 1040 is optional. Complete the table below . 1. John is single, earns $210,000 and takes the standard deduction. His tax liability is as $44,612.50, calculated as follows Adjusted gross income - $210,000 Minus: standard deduction = $12,200 Taxable Income 197,800 Times: Tax rates = 9700 times.10 = 970 (39475-9700) times.12 - 3573 (84200-39475) times .22 = 9839.5 (160725-84200) times.24 = 18366 (197,800-160725) times .32 = 11864 Equals: Income Tax Liability = $44,612.5 Part 1 is just the facts, no requirements. . I 2. (0.5pts) Now assume that in addition to the above information, John sold the only principle residence he has ever owned (purchased for $500,000 in 2010) for $900,000, i.e. for an unadjusted gain of $400,000. Part of this gain is excludable under Section 121. Indicate how much is excludable and why? https://www.irs.gov/taxtopics/tc701 3. (2pts) Complete and attach Form 8949 very carefully. To be a tax professional, you will need to independently find forms and instructions. I guide you, but ask you to read the instructions carefully. Google the instructions for Form 8949, and read particularly the instructions for columns f and g. Attach Form 8949. 4. (0.5) What is the unexcluded gain from form 8949? 5. (0.5) Please complete and attach page 1 of Schedule D. 6. (3.7 pts) Form 1040 is optional. Complete the table below