Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Johnny is the president and only shareholder of a corporation, Rosebud Motel Group. The IRS is investigating Johnny and demands he produce his

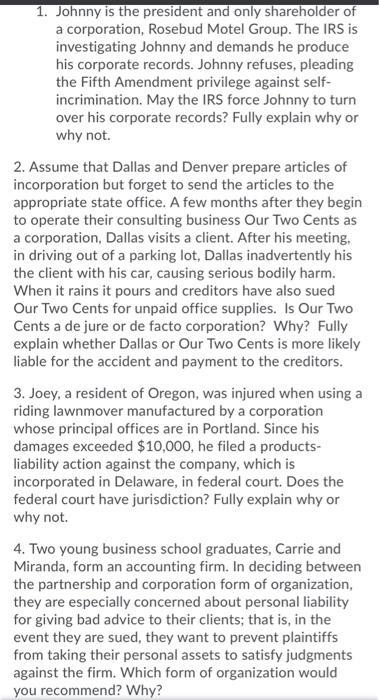

1. Johnny is the president and only shareholder of a corporation, Rosebud Motel Group. The IRS is investigating Johnny and demands he produce his corporate records. Johnny refuses, pleading the Fifth Amendment privilege against self- incrimination. May the IRS force Johnny to turn over his corporate records? Fully explain why or why not. 2. Assume that Dallas and Denver prepare articles of incorporation but forget to send the articles to the appropriate state office. A few months after they begin to operate their consulting business Our Two Cents as a corporation, Dallas visits a client. After his meeting. in driving out of a parking lot, Dallas inadvertently his the client with his car, causing serious bodily harm. When it rains it pours and creditors have also sued Our Two Cents for unpaid office supplies. Is Our Two Cents a de jure or de facto corporation? Why? Fully explain whether Dallas or Our Two Cents is more likely liable for the accident and payment to the creditors. 3. Joey, a resident of Oregon, was injured when using a riding lawnmover manufactured by a corporation whose principal offices are in Portland. Since his damages exceeded $10,000, he filed a products- liability action against the company, which is incorporated in Delaware, in federal court. Does the federal court have jurisdiction? Fully explain why or why not. 4. Two young business school graduates, Carrie and Miranda, form an accounting firm. In deciding between the partnership and corporation form of organization, they are especially concerned about personal liability for giving bad advice to their clients; that is, in the event they are sued, they want to prevent plaintiffs from taking their personal assets to satisfy judgments against the firm. Which form of organization would you recommend? Why?

Step by Step Solution

★★★★★

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started