Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bob and Susan Menzel are planning to open a food service operation and have heard about operating leverage. They are forecasting annual sales and

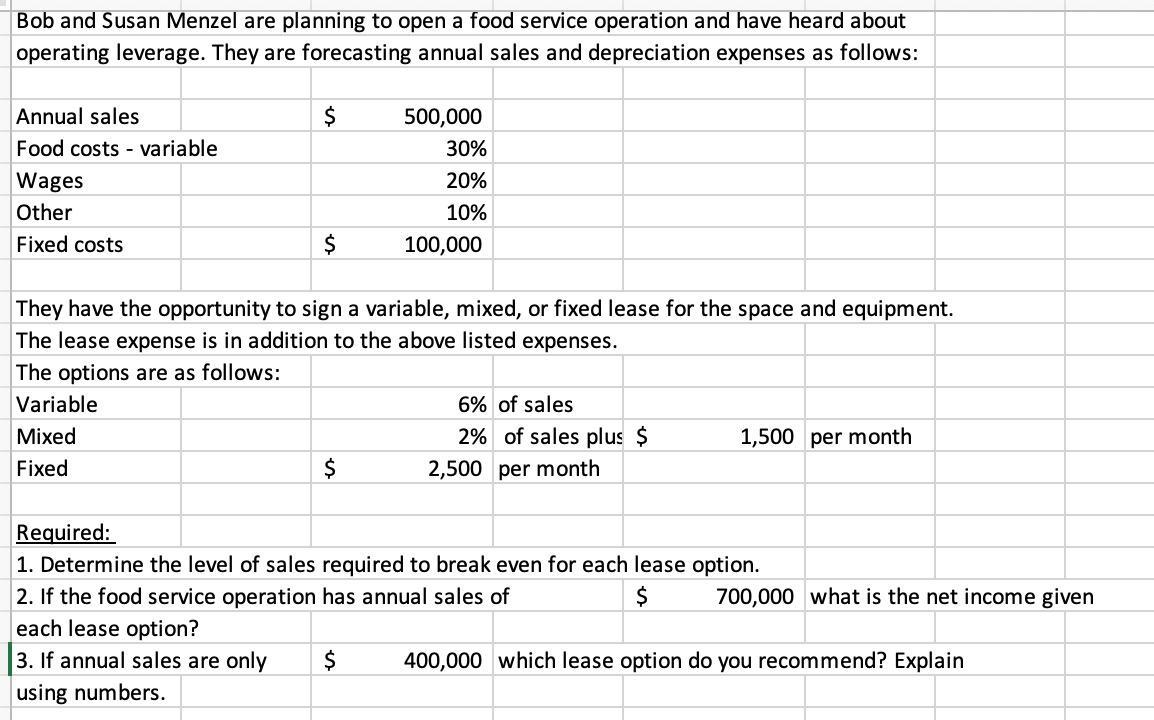

Bob and Susan Menzel are planning to open a food service operation and have heard about operating leverage. They are forecasting annual sales and depreciation expenses as follows: Annual sales Food costs variable Wages Other Fixed costs $ 500,000 30% 20% 10% $ 100,000 They have the opportunity to sign a variable, mixed, or fixed lease for the space and equipment. The lease expense is in addition to the above listed expenses. The options are as follows: Variable Mixed Fixed 6% of sales $ 2% of sales plus $ 2,500 per month 1,500 per month Required: 1. Determine the level of sales required to break even for each lease option. 2. If the food service operation has annual sales of each lease option? 3. If annual sales are only $ using numbers. $ 700,000 what is the net income given 400,000 which lease option do you recommend? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Breakeven Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started