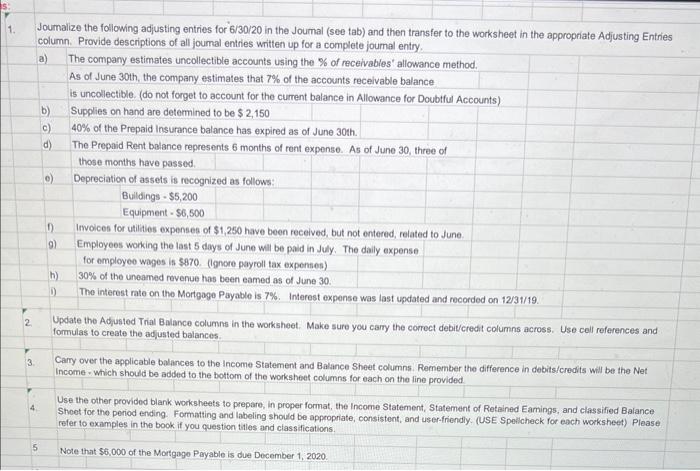

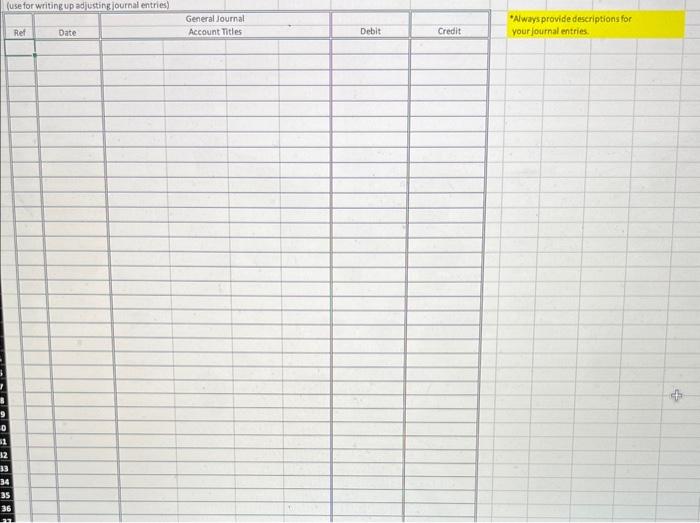

1. Joumalize the following adjusting entries for 6/30/20 in the Joumal (see tab) and then transfer to the worksheet in the appropriate Adjusting Entries column. Provide descriptions of all joumal entries written up for a complete joumal entry. a) The company estimates uncollectible accounts using the \% of receivables' allowance method. As of June 30 th, the company estimates that 7% of the accounts receivable balance is uncollectible. (do not forget to account for the current balance in Allowance for Doubtful Accounts) b) Supplies on hand are determined to be $2,150 c) 40% of the Prepaid insurance balance has expired as of June 30 th. d) The Prepaid Rent balance represents 6 months of rent expense. As of June 30 , three of those months have passed. 0) Depreciation of assets is recognized as follows: Buldings-$5,200Equipment-$6,500 f) Invoices for utilities expenses of \$1,250 have been received, but not entered, related to June. 9) Employees working the last 5 days of June will be paid in July. The daily expense for omployeo wages is $870. (lgnore payroll tax expenses) h) 30% of the uneamed revenue has been eamed as of June 30 . 1) The interest nate on the Mortgage Payable is 7%. Interest expense was last upctated and rocorded on 12/31/19. 2. Update the Adpusted Trial Balance columns in the worksheet. Make sure you cary the correct debiecredi columns across. Use cell references and formulas to create the adiusted balances. 3. Cary over the applicable balinces to the Income Statement and Balance Sheet columns. Remember the difference in debits/credits will be the Net Income - which should be added to the bottom of the worksheet columns for each on the line provided. Use the other provided blank worksheets to prepare, in proper format, the Income Statement, Statement of Retained Eamings, and classified Balance Shoet for the period ending. Formatting and labeling should be appropriate, consistent, and user-friendly. (USE Spellicheck for each worksheet) Please refer to examples in the book if you question tiles and classifications. 5 Note that $6,000 of the Mortgago Payable is due December 1,2020. 1. Joumalize the following adjusting entries for 6/30/20 in the Joumal (see tab) and then transfer to the worksheet in the appropriate Adjusting Entries column. Provide descriptions of all joumal entries written up for a complete joumal entry. a) The company estimates uncollectible accounts using the \% of receivables' allowance method. As of June 30 th, the company estimates that 7% of the accounts receivable balance is uncollectible. (do not forget to account for the current balance in Allowance for Doubtful Accounts) b) Supplies on hand are determined to be $2,150 c) 40% of the Prepaid insurance balance has expired as of June 30 th. d) The Prepaid Rent balance represents 6 months of rent expense. As of June 30 , three of those months have passed. 0) Depreciation of assets is recognized as follows: Buldings-$5,200Equipment-$6,500 f) Invoices for utilities expenses of \$1,250 have been received, but not entered, related to June. 9) Employees working the last 5 days of June will be paid in July. The daily expense for omployeo wages is $870. (lgnore payroll tax expenses) h) 30% of the uneamed revenue has been eamed as of June 30 . 1) The interest nate on the Mortgage Payable is 7%. Interest expense was last upctated and rocorded on 12/31/19. 2. Update the Adpusted Trial Balance columns in the worksheet. Make sure you cary the correct debiecredi columns across. Use cell references and formulas to create the adiusted balances. 3. Cary over the applicable balinces to the Income Statement and Balance Sheet columns. Remember the difference in debits/credits will be the Net Income - which should be added to the bottom of the worksheet columns for each on the line provided. Use the other provided blank worksheets to prepare, in proper format, the Income Statement, Statement of Retained Eamings, and classified Balance Shoet for the period ending. Formatting and labeling should be appropriate, consistent, and user-friendly. (USE Spellicheck for each worksheet) Please refer to examples in the book if you question tiles and classifications. 5 Note that $6,000 of the Mortgago Payable is due December 1,2020