Question

1. Journal entry 1: The company has paid the monthly interest fee for 30 June 2022, 7 days after it was due on 7 July

1. Journal entry 1: The company has paid the monthly interest fee for 30 June 2022, 7 days after it was due on 7 July 2022. The value of the payment was $1,500.

Required:

a. What is the journal entry to account for the interest expense accrued on 30 June?

b. What is the journal entry on the interest payment day (7 July)?

2. Journal entry 2: The company leases one of their offices to a local contractor. On 1 July 2022, the company received a $12,000 payment of rental income for 12 months in advance rent. The value of the monthly rent is $1,000.

Required:

a. What is the journal entry for the $12,000 unearned rental income?

b. What is the journal entry on 1 August when the rental income for the first month should be recorded?

3. Journal Entry 3: On 1 October 2022, the company decided to write off a $250 bad debt they knew they would not be able to collect.

Required:

What is the $250 bad debt journal entry against accounts receivable?

4. Journal Entry 4: On 30th June 2022, you are required to adjust the ledger accounts for inventory. The total cost of inventory, drawn from last year's ending inventory, is $750,000. After reviewing the physical inventory, you find out that the actual value of the inventory is $780,000.

Required:

What is the journal entry to adjust inventory?

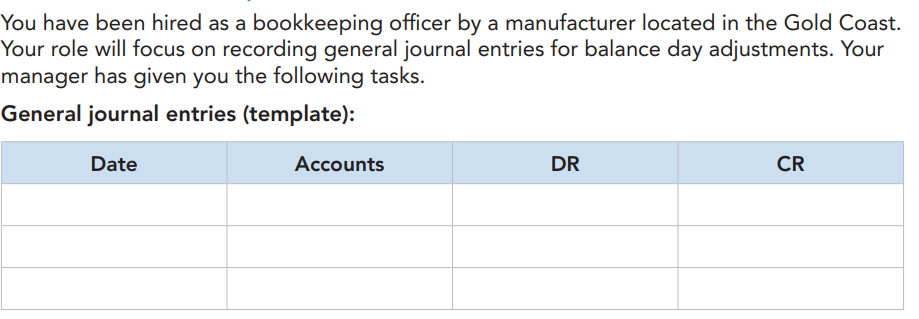

You have been hired as a bookkeeping officer by a manufacturer located in the Gold Coast. Your role will focus on recording general journal entries for balance day adjustments. Your manager has given you the following tasks. General journal entries (template): Date Accounts DR CR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started