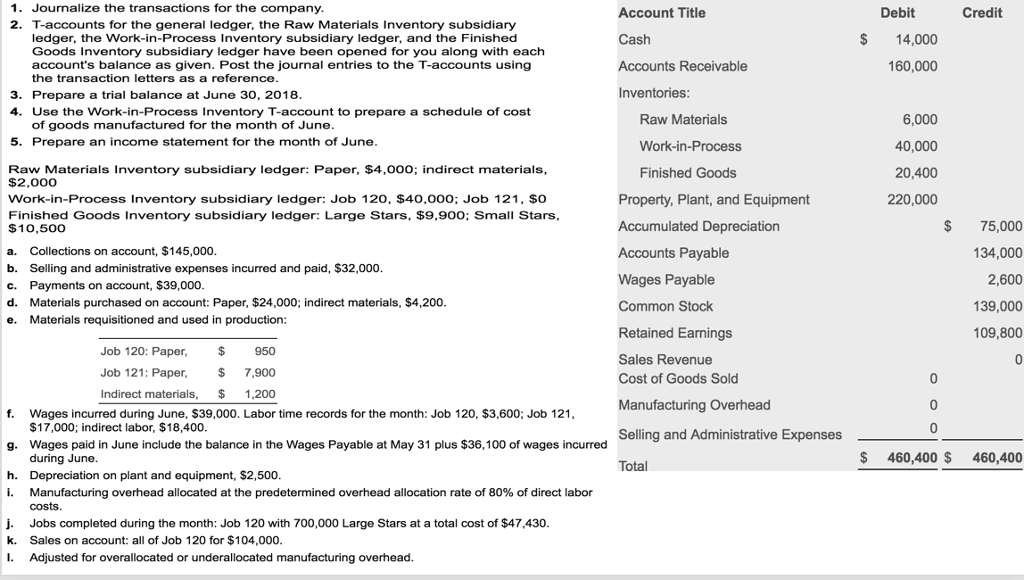

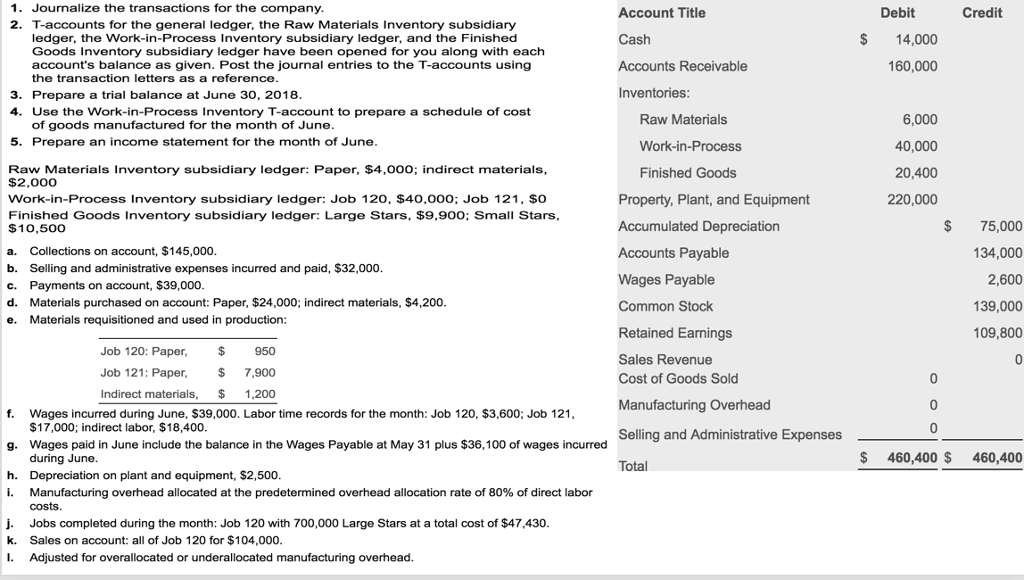

1. Journalize the transactions for the company, 2. T-accounts for the general ledger, the Raw Materials Inventory subsidiary Account Title Cash Accounts Receivable Inventories Debit Credit $14,000 ledger, the Work-in-Process Inventory subsidiary ledger, and the Finished Goods Inventory subsidiary ledger have been opened for you along with each account's balance as given. Post the journal entries to the T-accounts using the transaction letters as a reference 160,000 3. Prepare a trial balance at June 30, 2018 4. Use the Work-in-Process Inventory T-account to prepare a schedule of cost Raw Materials 6,000 40,000 20,400 220,000 of goods manufactured for the month of June 5. Prepare an income statement for the month of June Work-in-Process Raw Materials Inventory subsidiary ledger: Paper, $4,000; indirect materials $2,000 Work-in-Process Inventory subsidiary ledger: Job 120, $40,000; Job 121, $O Finished Goods Inventory subsidiary ledger: Large Stars, $9,900: Small Stars $10,500o a. Collections on account, $145,000 b. Selling and administrative expenses incurred and paid, $32,000 c. Payments on account, $39,000 d. Materials purchased on account: Paper, $24,000; indirect materials, $4,200 e. Materials requisitioned and used in production: Finished Goods Property, Plant, and Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Manufacturing Overhead Selling and Administrative Expenses Total $ 75,000 134,000 2,600 139,000 109,800 Job 120: Paper, $950 Job 121: Paper7,900 Indirect materials, 1,200 0 f. Wages incurred during June, $39,000. Labor time records for the month: Job 120, $3,600; Job 121, $17,000; indirect labor, $18,400 g. Wages paid in June include the balance in the Wages Payable at May 31 plus $36,100 of wages incurred $ 460,400 $ 460,400 h. i. during June. Depreciation on plant and equipment, $2,500 Manufacturing overhead allocated at the predetermined overhead allocation rate of 80% of direct labor costs. j Jobs completed during the month: Job 120 with 700,000 Large Stars at a total cost of $47,430 k. Sales on account: all of Job 120 for $104,000 I Adjusted for overallocated or underallocated manufacturing overhead