Answered step by step

Verified Expert Solution

Question

1 Approved Answer

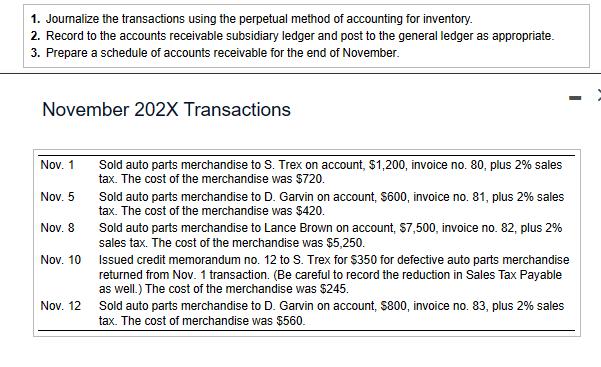

1. Journalize the transactions using the perpetual method of accounting for inventory. 2. Record to the accounts receivable subsidiary ledger and post to the

1. Journalize the transactions using the perpetual method of accounting for inventory. 2. Record to the accounts receivable subsidiary ledger and post to the general ledger as appropriate. 3. Prepare a schedule of accounts receivable for the end of November. November 202X Transactions Nov. 1 Nov. 5 Nov. 8 Nov. 10 Nov. 12 Sold auto parts merchandise to S. Trex on account, $1,200, invoice no. 80, plus 2% sales tax. The cost of the merchandise was $720. Sold auto parts merchandise to D. Garvin on account, $600, invoice no. 81, plus 2% sales tax. The cost of the merchandise was $420. Sold auto parts merchandise to Lance Brown on account, $7,500, invoice no. 82, plus 2% sales tax. The cost of the merchandise was $5,250. Issued credit memorandum no. 12 to S. Trex for $350 for defective auto parts merchandise returned from Nov. 1 transaction. (Be careful to record the reduction in Sales Tax Payable as well.) The cost of the merchandise was $245. Sold auto parts merchandise to D. Garvin on account, $800, invoice no. 83, plus 2% sales tax. The cost of merchandise was $560.

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries to record the transactions November 1 Sales 1200 Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started