Answered step by step

Verified Expert Solution

Question

1 Approved Answer

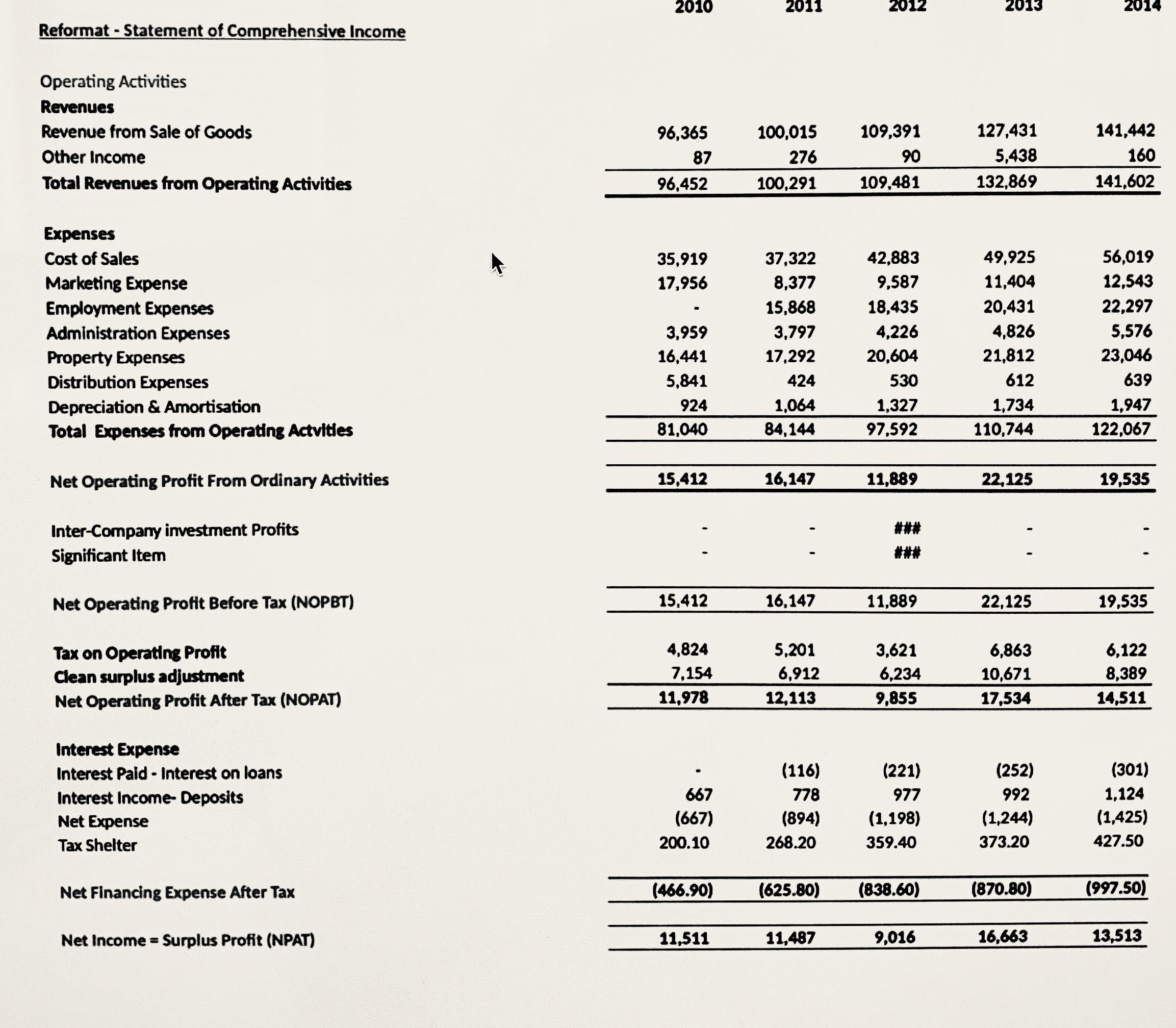

Calculate Clean Surplus adjustments and Tax Shelter in the reformatted financial statement: Reformat-Statement of Comprehensive Income Operating Activities Revenues Revenue from Sale of Goods Other

Calculate Clean Surplus adjustments and Tax Shelter in the reformatted financial statement:

Reformat-Statement of Comprehensive Income Operating Activities Revenues Revenue from Sale of Goods Other Income Total Revenues from Operating Activities Expenses Cost of Sales Marketing Expense Employment Expenses Administration Expenses Property Expenses Distribution Expenses Depreciation & Amortisation Total Expenses from Operating Actvities Net Operating Profit From Ordinary Activities Inter-Company investment Profits Significant Item Net Operating Profit Before Tax (NOPBT) Tax on Operating Profit Clean surplus adjustment Net Operating Profit After Tax (NOPAT) Interest Expense Interest Paid Interest on loans Interest Income-Deposits Net Expense Tax Shelter Net Financing Expense After Tax Net Income = Surplus Profit (NPAT) 2010 96,365 87 96,452 35,919 17,956 3,959 16,441 5,841 924 81,040 15,412 15,412 4,824 7,154 11,978 667 (667) 200.10 (466.90) 11,511 2011 100,015 276 100,291 37,322 8,377 15,868 3,797 17,292 424 1,064 84,144 16,147 16,147 5,201 6,912 12,113 (116) 778 (894) 268.20 2012 11,487 109,391 90 109,481 42,883 9,587 18,435 4,226 20,604 530 1,327 97,592 11,889 11,889 3,621 6,234 9,855 (221) 977 (1,198) 359.40 (625.80) (838.60) 9,016 2013 127,431 5,438 132,869 49,925 11,404 20,431 4,826 21,812 612 1,734 110,744 22,125 22,125 6,863 10,671 17,534 (252) 992 (1,244) 373.20 (870.80) 16,663 2014 141,442 160 141,602 56,019 12,543 22,297 5,576 23,046 639 1,947 122,067 19,535 19,535 6,122 8,389 14,511 (301) 1,124 (1,425) 427.50 (997.50) 13,513

Step by Step Solution

★★★★★

3.27 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Clean Surplus Adjustments and Tax Shelter in the Reformatted Financial Statement To calculate Clean Surplus adjustments and Tax Shelter in the reforma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started