Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 JUULUU PPUSSIDIU January 1, Detroit Gold Exchange paid cash of $32.400 for computers that are expected to remain useful for three years. At the

1

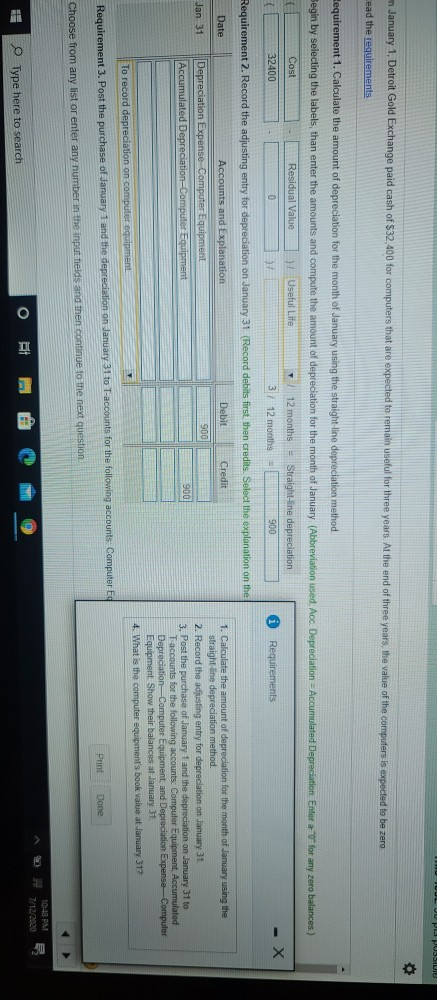

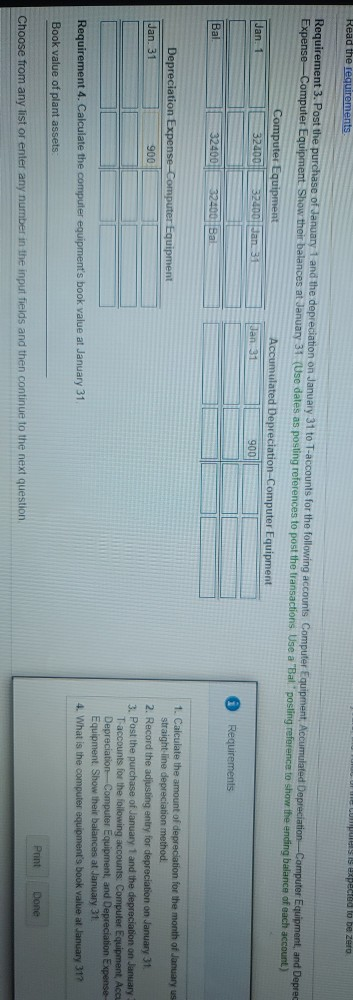

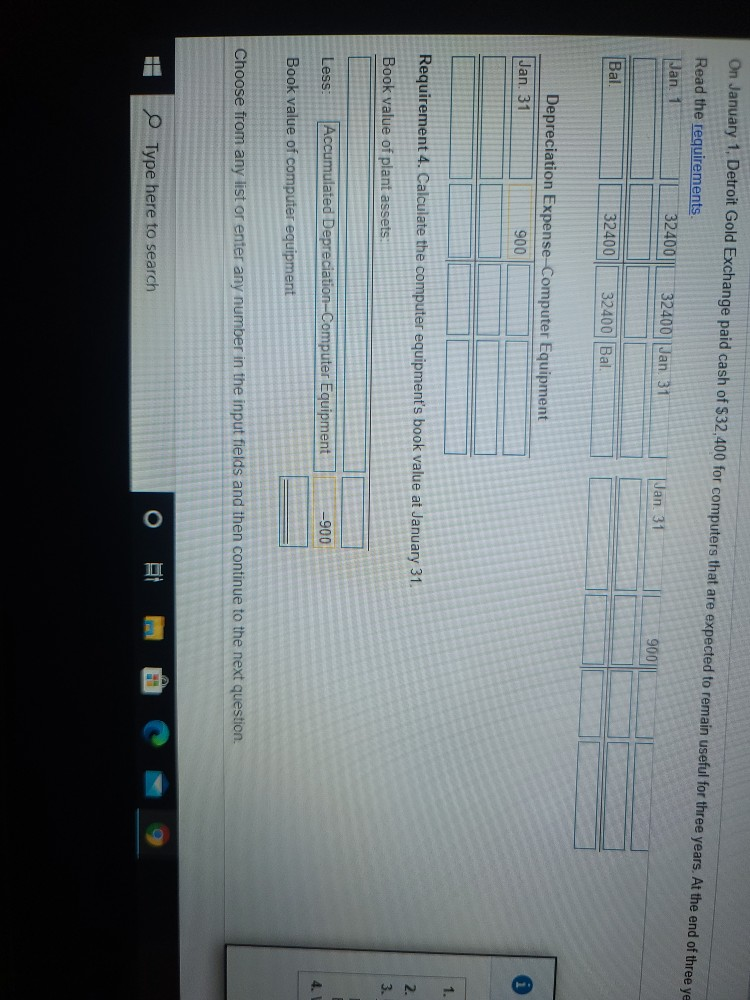

JUULUU PPUSSIDIU January 1, Detroit Gold Exchange paid cash of $32.400 for computers that are expected to remain useful for three years. At the end of three years, the value of the computers is expected to be zero Lead the requirements Requirement 1. Calculate the amount of depreciation for the month of January using the straight line depreciation method. Begin by selecting the labels, than enter the amounts and compute the amount of depreciation for the month of January (Abbreviation used, Acc. Depreciation Accumulated Depreciation Enter for any zero balances.) Cost Residual Value 37 Useful Life 12 months Straight-ine depreciation 37 12 months 900 0 Requirements - X 32400 Credit Requirement 2. Record the adjusting entry for depreciation on January 31 (Record debits first, then credits. Select the explanation on the Date Accounts and Explanation Debit Jan 31 Depreciation Expense Computer Equipment 900 Accumulated Depreciation-Computer Equipment 900 1. Calculate the amount of depreciation for the month of January using the straight-line depreciation method 2. Record the adjusting entry for depreciation on January 31 e following accounts: Computer Equipment, Accumulated Depreciation ---Computer Equipment and Depreciation Expense Computer Equipment Show their balances at January 31 4. What is the computer equipment's book value at January 31? Taccounts for the of January 1 and the depreciation on January 31 se To record depreciation on computer equipment Requirement 3. Post the purchase of January 1 and the depreciation on January 31 to 1-accounts for the following accounts Computer Es Print Done Choose from any list or enter any number in the input fields and then continue to the next question 10:48 PM 7/12/2020 Type here to search Read the requirements As expected to be zero Requirement 3. Post the purchase of January 1 and the depreciation on January 31 to T-accounts for the following accounts Computer Equipment, Accumulated Depreciation - Computer Equipment, and Deprec Expense -Computer Equipment Show their balances at January 31 (Use dates as posting references to post the transactions. Use a "Bal" posling reference to show the ending balance of each account) Computer Equipment Accumulated Depreciation-Computer Equipment Jan. 1 32400 324001 Jan 31 Jan 31 900 Requirements Bal 32400 32400 Bai Depreciation Expense-Computer Equipment Jan. 31 900 1. Calculate the amount of depreciation for the month of January us straight line depreciation method. 2. Record the adjusting entry for depreciation on January 31 3. Post the purchase of January 1 and the depreciation on January Taccounts for the following accounts: Computer Equipment, Accu Depreciation Computer Equipment, and Depreciation Expense Equipment Show their balances at January 31 4. What is the computer equipment's book value at January 31? Requirement 4. Calculate the computer equipment's book value at January 31 Book value of plant assets Print Done Choose from any list or enter any number in the input fields and then continue to the next question On January 1, Detroit Gold Exchange paid cash of $32,400 for computers that are expected to remain useful for three years. At the end of three ye Read the requirements 32400 Jan 1 32400||Jan 31 Jan 31 9002 Bal. 32400 32400 Bal Depreciation Expense-Computer Equipment Jan. 31 900 1. Requirement 4. Calculate the computer equipment's book value at January 31 2. Book value of plant assets 3. Less Accumulated Depreciation-Computer Equipment -900 Book value of computer equipment Choose from any list or enter any number in the input fields and then continue to the next question Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started