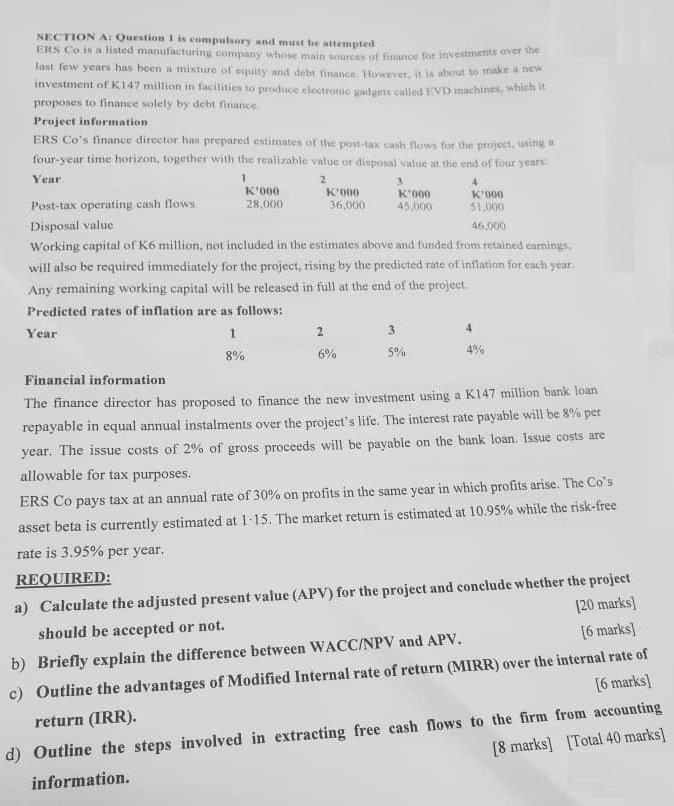

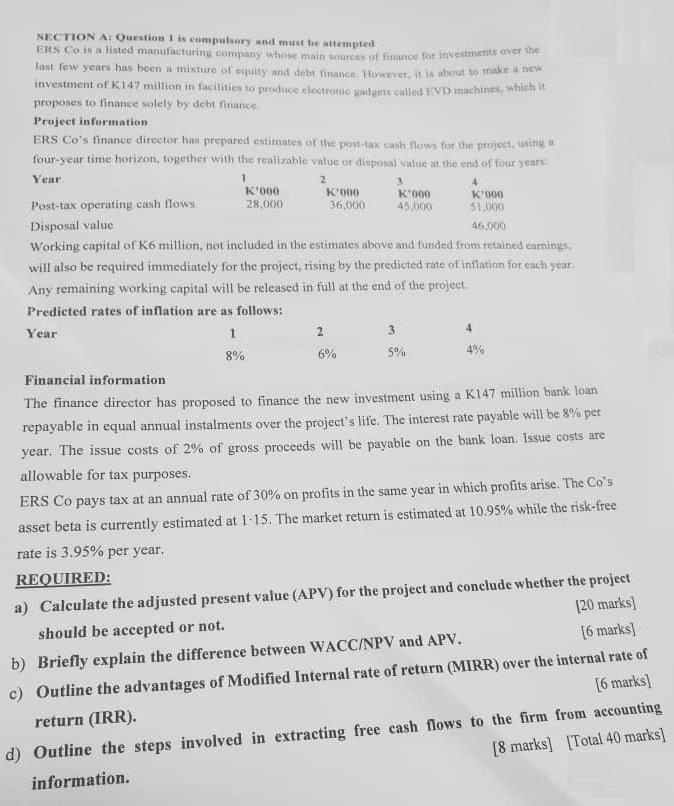

1 K'000 3 4 K 000 4 49% SECTION A: Question 1 is compulsory and must be attempted Erts Co is a lined manufacturing company with ances of finance to investments over the fost few years has been a mixture of equity and debt finance Kowever, it is about to make a new investment of K147 million in the liter to produce electronic mungete culled EVD machines, which is proposes to finance solely by debt finance Project information ERS Co's finance director han prepared estimates of the post-tax cash flows for the project any four-year time horizon, together with the realizable value or disposal value at the end of four years Year K'ono Post-tax operating cash flows K 000 28.000 36,000 45,000 $1.000 Disposal value 46,000 Working capital of K6 million, not included in the estimates above and funded from retained eaming, will also be required immediately for the project, rising by the predicted rate of inflation for each year Any remaining working capital will be released in full at the end of the project Predicted rates of inflation are as follows: Year 1 2 3 8% 5% Financial information The finance director has proposed to finance the new investment using a K147 million bank loan repayable in equal annual instalments over the project's life. The interest rate payable will be 8% pet year. The issue costs of 2% of gross proceeds will be payable on the bank loan. Issue costs are allowable for tax purposes. ERS Co pays tax at an annual rate of 30% on profits in the same year in which profits arise. The Co's asset beta is currently estimated at 1-15. The market return is estimated at 10.95% while the risk-free rate is 3.95% per year. REQUIRED: a) Calculate the adjusted present value (APV) for the project and conclude whether the project 120 marks) should be accepted or not. b) Briefly explain the difference between WACC/NPV and APV. c) Outline the advantages of Modified Internal rate of return (MIRR) over the internal rate of return (IRR). 16 marks) 16 marks) d) Outline the steps involved in extracting free cash flows to the firm from accounting information. [8 marks] [Total 40 marks] 1 K'000 3 4 K 000 4 49% SECTION A: Question 1 is compulsory and must be attempted Erts Co is a lined manufacturing company with ances of finance to investments over the fost few years has been a mixture of equity and debt finance Kowever, it is about to make a new investment of K147 million in the liter to produce electronic mungete culled EVD machines, which is proposes to finance solely by debt finance Project information ERS Co's finance director han prepared estimates of the post-tax cash flows for the project any four-year time horizon, together with the realizable value or disposal value at the end of four years Year K'ono Post-tax operating cash flows K 000 28.000 36,000 45,000 $1.000 Disposal value 46,000 Working capital of K6 million, not included in the estimates above and funded from retained eaming, will also be required immediately for the project, rising by the predicted rate of inflation for each year Any remaining working capital will be released in full at the end of the project Predicted rates of inflation are as follows: Year 1 2 3 8% 5% Financial information The finance director has proposed to finance the new investment using a K147 million bank loan repayable in equal annual instalments over the project's life. The interest rate payable will be 8% pet year. The issue costs of 2% of gross proceeds will be payable on the bank loan. Issue costs are allowable for tax purposes. ERS Co pays tax at an annual rate of 30% on profits in the same year in which profits arise. The Co's asset beta is currently estimated at 1-15. The market return is estimated at 10.95% while the risk-free rate is 3.95% per year. REQUIRED: a) Calculate the adjusted present value (APV) for the project and conclude whether the project 120 marks) should be accepted or not. b) Briefly explain the difference between WACC/NPV and APV. c) Outline the advantages of Modified Internal rate of return (MIRR) over the internal rate of return (IRR). 16 marks) 16 marks) d) Outline the steps involved in extracting free cash flows to the firm from accounting information. [8 marks] [Total 40 marks]