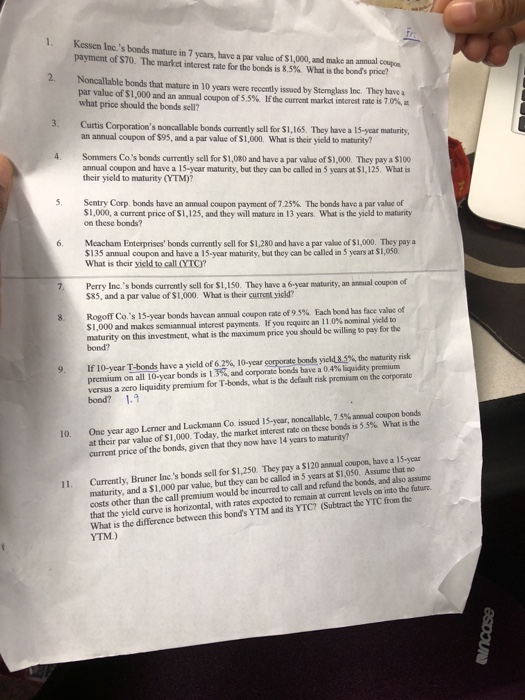

1. Kessen Inc.'s bonds mature in 7 years, have a par valuc of $1,000, and make an annual coupo payment of S70. The market interest rate for the bonds is 8.5% What is the bonds price? 2. Noncallable bonds that mature in 10 years were recently issud by Sternglass Inc. They have a par value of $1,000 and an annual coup on of 55% what pri should the bonds sell? lft e cunot mark interest me is 705. 3. Curtis Corporation's noncallable bonds currently sell for $1,165. They have a 15-year maturity an annual coupon of $95, and a par value of $1,000. What is their yicld to maturity 4. Sommers Co's bonds currently sell for $1,080 and have a par value of $1,000. They pay a $100 annual coupon and have a 15-year maturity, but they can be called in 5 years at $1,125. What is their yield to maturity YTM)? 5, Sentry Corp bonds have an annual coupon payment of 725% The bonds have a par value of $1,000, a current price of S1,125, and they will mature in 13 years. What is the yicld to maturity on these bonds? Meacham Enterprises' bonds currently sell for $1,280 and have a par valoe of $1,000. They pay a $135 annual coupon and have a 15 year maturity, but they can be called in 5 years at $1,050 What is their yield to call (YTC)? 6. 7. Perry Inc.'s bonds currently sell for S1,150. They have a 6ryear maturity, an aneual coupon of $85, and a par valuc of S1,000. What is their current yicld? 8. Rogoff Co.'s 15-year bonds havean annual $1,000 and makes semiannual interest coupon rate of 95% Eachbondhastce value of payments. If you require an 1 1.0% nominal yeld to maturity on this investment, what is the maximum price you should be willing to pay for the bond? If 10-year T-bonds have a yield of6 2%, 10-year corporate bonds yelL5% thc maturity risk premium on all 10-year bonds is13%, and corporate bonds have a 04%!quidity premium versus a zero liquidity premium for T-boeds, what is the defaualt risk premium on the corporate 9, bond? 1.9 One year ago ,emd rand Lack mann Co issued 15 year noncallable,75% anual cop on beads at their par value of SI,000 Today, the market interest rate on these bonds is 55% What is the 10 current price of the bonds, given that they now have 14 years to maturity? Currently, Bruner Ine's bonds sell for $1,250 They pay a $ 120 annual coupon, have a 15-year maturity, and a $1,000 par value, but they can be callod in 5 years at $1,0S0. Assume that no costs other than the call premium would be incurred to call and refund the bonds, and also assume that the yield curve is horizontal, with rates expected to remain at current levels on into the future What is the difference between this bond's YTM and its YTC? (Subtract the YTC from the YTM.) 1 1